Earlier this year Mosaic, a provider of residential solar loans and financing, closed a $200 million warehouse facility with DZ BANK (the fourth-largest bank in Germany) acting as "administrative agent and lead lender."

Well, the solar loan business must actually be pretty good, because Mosaic just announced another $220 million in equity financing, this time led by Warburg Pincus. Core Innovation Capital and Obvious Ventures also invested in the round. In related news, Vivint Solar just closed a new $313 million loan facility to support its solar lease and loan business.

Billy Parish, CEO at Mosaic, said in an earlier release, “With 40 percent consecutive monthly growth for over a year, we needed partners who could take us to the next level."

Mosaic "aims to originate $1 billion in home solar loans in the next year," and that's (very roughly) more than 200 megawatts' worth of solar loans.

Mosaic claims to provide "the simplest borrower experience in the industry. Customers are connected to top solar installers and can qualify instantly for no money down loans with fixed interest rates and multiple term options. For solar installers, Mosaic provides a streamlined financing platform to drive sales growth."

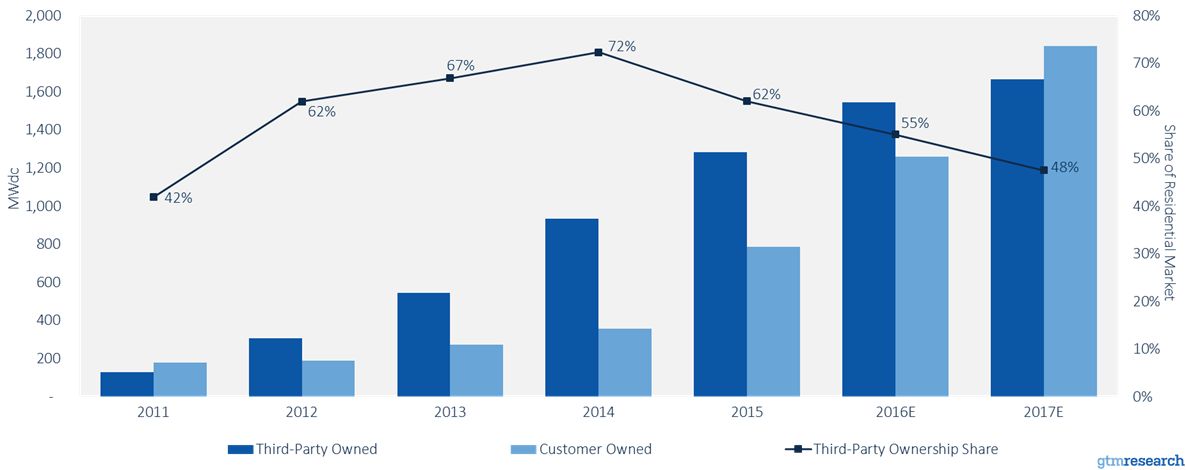

GTM Research has seen "a very quick shift away from leasing toward customer ownership over the past two years, and expects this trend to continue. This shift has been driven by the decreasing cost of solar and the increasing number of loan products available to customers. Local installers have especially taken advantage of these loans. The large national installers that account for more than half the market have not moved as quickly to loans, which is the main reason the third-party-ownership share is still over 50 percent."

Sungage, Sunlight, Spruce, SunPower, Sunrun, NRG, Sungevity and Dividend Solar are also involved in the solar loan business. As we've reported, around 60 percent of consumers would prefer to own a residential rooftop system rather than lease it, assuming savings and performance are similar, according to a 2014 survey of California homeowners conducted by Mosaic.

Sara Ross, the CEO of Sungage Financial, notes,"The large national platforms used to differentiate based on access to capital. The emergence of the solar loan all but removes that advantage, as this financing option is now accessible to installers large and small."