There is no Moore's Law for solar, batteries or wind.

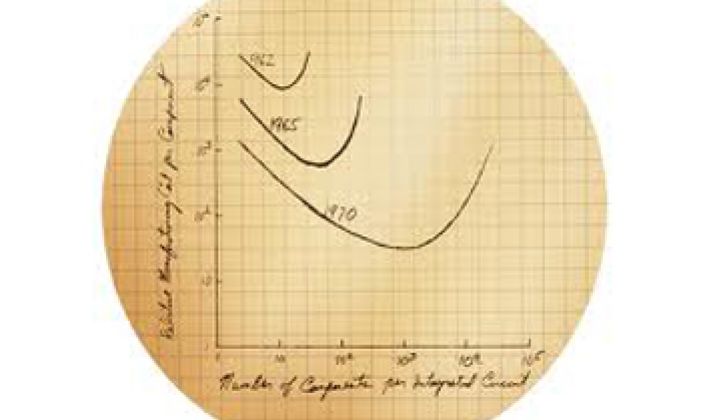

Moore's Law -- the observation that chips get cheaper and faster at the same time at a regular, rapid rate -- is a result of the ability of engineers to shrink the size of semiconductors. I once asked Gordon Moore why it worked so well. In part, we got lucky with silicon, he said.

Green technologies, however, do benefit from what we like to call Moore's Lite. That is, the performance of solar panels and batteries gets better over time and prices drop, but not nearly as fast and not nearly as predictably. Look at solar modules. Prices slid in 2008 because of a one-time economic cataclysm and an overabundance of silicon, not because of the work of engineers.

The question has been what to call this cost/performance continuum in a way that's memorable but doesn't oversell the benefits. Moore's Lite sounds like a beer -- a plus -- but it drives copyeditors nuts. Lindsay Leveen, a longtime chemical engineer and author, has suggested 'Demi Moore's Law.' 'Demi' means half in French, and of course you get that image in your head of the gravelly-voiced actress who still seems to occasionally pack them in at the cineplex. Does it work for you? Let us know. (The image shows the curve Moore -- Gordon, that is -- drew to explain his thoughts. It's the graph paper that launched 1,000 business plans.)

Elsewhere:

--General Electric Hitachi has signed a memorandum of understanding with Energoprojekt Warszawa to study the feasibility of nuclear reactors in the country. Poland is already examining two GEH reactors.

If all goes as planned, construction could begin in 2016 and the reactors could begin to deliver power in 2020.

In nuclear, however, almost nothing goes as planned. The budget for a plant in Finland being built by Areva, the French company that arguably leads the nuclear industry, has ballooned from $3 billion to $5 billion. It is set to open next year.

Nuclear companies have found ways to reduce their costs. In China, contractors have figured out ways to pour the foundation quicker and thus save money, Jacques Besnainou, CEO of Areva's U.S. group, told us earlier this year.

Still, labor, which tends to go up in price, accounts for 60 percent of the cost of nuclear plants in some areas. Safety concerns following Fukushima will also likely add years and costs to projects. Neighbor Germany put nuclear on hold recently.

--Masayoshi Son, the brash leader of investment firm SoftBank and Japan’s wealthiest individual, wants to move into solar. The idea is to start with 10 large solar plants and go from there. It is one of the principal topics of conversation in energy circles right now, says Alain Harrus, who recently returned from Japan.

The proposal has a lot going for it. Japan has strongly supported solar since 1974 with the Project Sunshine proposal. Local manufacturers like Sharp and Panasonic/Sanyo face stiff competition from Chinese manufacturers in Germany, U.S. and Italy. The Japanese public remains incredibly angry at Tokyo Electric Power. Although real estate will be a challenge, open land actually exists there. It will mostly be a matter of untangling leases and ownership rights.

Son also has a somewhat strong track record for disrupting local monopolies. Son and Softbank played the leading role in opening the Japanese telco market to competition. Softbank is now one of the leading cell carriers. Think of him as a Japanese version of Richard Branson -- but one that buttons his shirt.

--Finally, Efficient Drivetrains Inc., which makes components for hybrids and plug-ins, is engaged in a lawsuit with Toyota. EDI is the brainchild of UC Davis Professor Andy Frank, the man known as the Father (and Godfather) of the Plug-In. It operates with licensed technology from the University of California. (See video of Frank -- a heck of a guy -- here.)

Toyota popularized the hybrid, so this really is an unusual family squabble. Stay tuned.