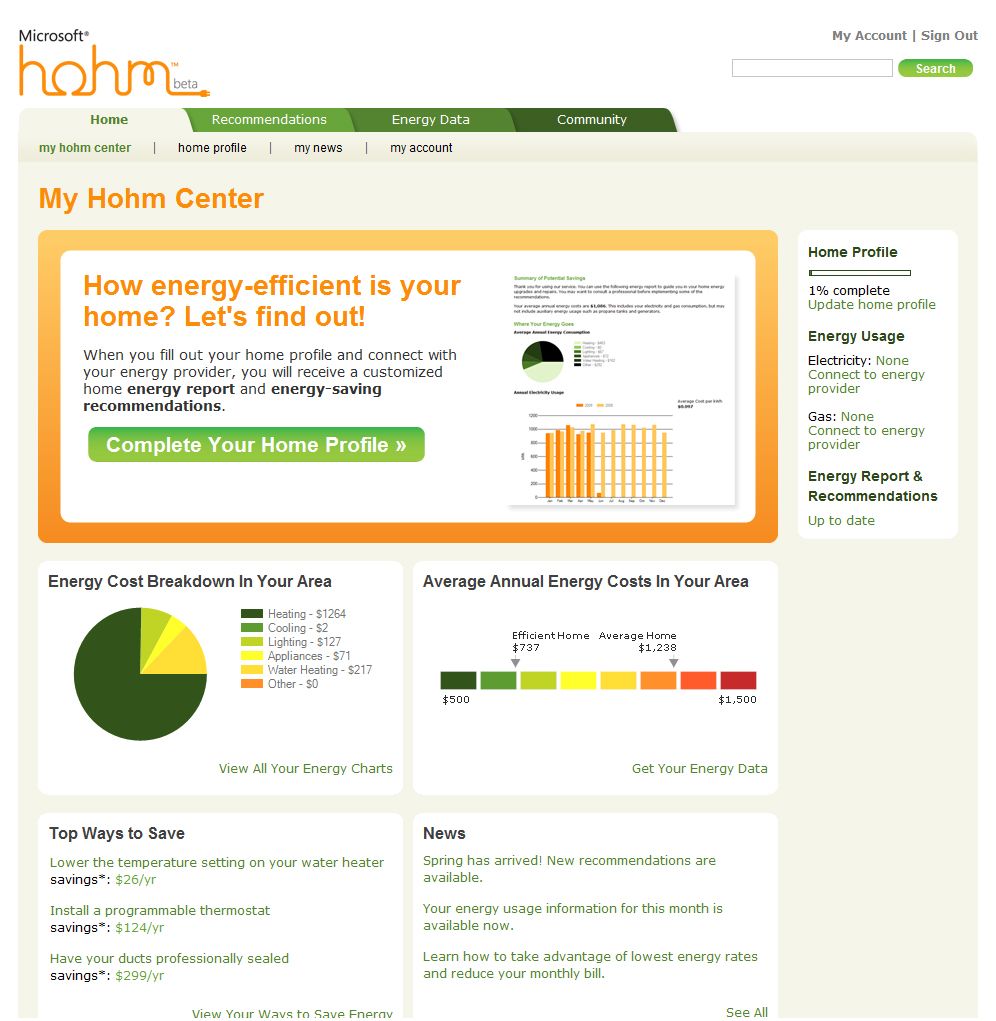

Microsoft has entered the home energy efficiency sector Wednesday with the launch of Microsoft Hohm – a free website that, like a host of others being developed by startups like Greenbox and giants like Google, allows homeowners to analyze and react to home energy usage data to save power and money.

But that's just the start of the software giant's plans for home energy. Eventually it envisions providing home energy management devices like smart thermostats and "smart plugs," all leading to a business in reducing home energy use to help utilities.

That's the vision Troy Batterberry, product unit manager for Microsoft energy management and home automation, laid out for the new site, which is expected to be available throughout the United States some time next week at www.microsoft-hohm.com.

Microsoft has signed up four utilities – Puget Sound Energy, Seattle City Light, Xcel Energy and the Sacramento Municipal Utility District – to provide customer energy data for the site, and is working on partnerships with about a half-dozen more, Batterberry said.

But Hohm can also be used without any utility link at all, he said, by allowing individuals to sign on, enter data for a host of questions about their home, then analyze it using algorithms developed by the Department of Energy and its Lawrence Berkeley National Laboratory, he said.

That differentiates the offering from many home energy management systems looking to utilities to provide data, including Google's PowerMeter (see The Smart Home, Part II).

Google has signed partnerships with eight utilities and smart meter maker Itron to develop ways to import customer energy data, but hasn't said it plans to offer the site without utility data as the basis for its analysis (see Lu's Google PowerMeter Update: Open APIs, More Partners Soon).

Microsoft also has partnerships with Itron and smart meter maker Landis+Gyr to integrate their data. But it also anticipates that many homeowners will make use of the site by typing in their own data, although Batterberry acknowledged that many might choose not to fill out all of the about 200 detailed questions the site asks to get a tighter handle on a home's energy profile.

"We did not want to say, only those that have a smart meter can play, or only those that have a utility that's partnered with Microsoft on data feeds can play," he said.

Whether or not that gains traction with homeowners is open to debate, however. Several sources noted that Microsoft's success or failure in the field will depend greatly on how much money and manpower it ends up dedicating to the effort.

Batterberry believes that the DOE algorithms, combined with lots and lots of historical data on typical home energy usage patterns, will also make Hohm useful for smaller utilities like rural cooperatives that lack the resources to do their own home energy analysis websites.

Microsoft may also look to partner with telecommunications companies interested in offering energy management services. Energy management is a growing field of interest for telecoms that see an opportunity to add them onto home entertainment or security systems (see Verizon to Add Energy Management to FiOS).

Hohm will also include natural gas, liquid propane and heating oil usage data, either provided by partner utilities or typed in by homeowners, and is working to integrate water usage data as well, he said.

But eventually, Microsoft envisions a lot more data coming into the system through the smart thermostats and smart plugs it expects to roll out in the next year, he said.

The company is working with "a variety of hardware makers" on the products, which will likely include a WiFi controlled thermostat, though he wouldn't specify which ones. Companies making such devices include Tendril, Comverge and a host of other companies (see The Smart Home, Part I).

As for how those devices will communicate, Microsoft is looking at a variety of potential wireless protocols including ZigBee, 6LoWPAN and WiFi, he said. But the company would remain "protocol-agnostic" as it looks to the market place to select an overall winner, he added.

Eventually, Microsoft envisions using those devices and the Hohm platform as the basis for an energy demand management business, he said.

While Battenberry wouldn't get into many details of how Microsoft sees that business model emerging, he said it most likely would be through utilities that provide price signals to home systems tuned to shut off certain appliances or turn down air conditioners when prices reach a certain level.

Still, there's a long road between Hohm's launch and a demand response business based on home energy control devices, he said. Deploying home energy monitoring and control devices on a mass scale is likely going to take a decade or more, he said.