Market researchers predict that the ultracapacitor (a.k.a. supercapacitor or double-layer capacitor) market will grow rapidly in the coming years, reaching $500 million by 2011 or 2012. This growth will likely be driven by the automotive and transportation sector, as well as by applications in renewable energy, consumer electronics and industrial power management.

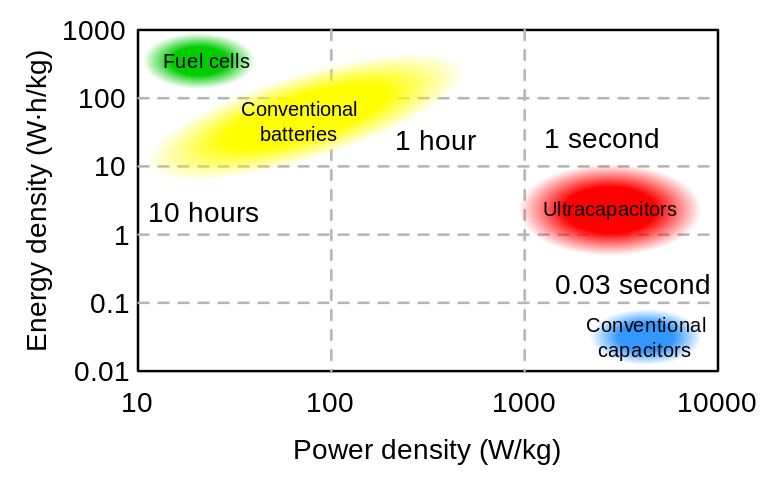

A battery is an energy device, while an ultracapacitor is a power device. Batteries are good for range, while the relatively new technology of ultracaps offers quick charging, discharging and acceleration for vehicles.

One of the promises of ultracapacitors is their potential to reduce the size -- and therefore the cost -- of hybrid vehicle batteries. The ultracap provides a way to extend the life of and quickly charge a hybrid vehicle's power unit. Ultracaps offer similar advantages for fuel cell vehicles. However, the tandem use of ultracapacitors and batteries does require additional power electronics, which can increase the cost of the vehicle.

Using ultracapacitors for regenerative braking improves fuel efficiency in urban driving conditions, as ultracapacitors capture and store electrical energy (generated by braking) and release it quickly for acceleration.

Compared to lithium-ion batteries, which gradually lose their capability to hold a charge after a few hundred thousand charge/discharge cycles, ultracapacitors can withstand hundreds of thousands of charge/discharge cycles. What's more, ultracaps work well at temperature extremes that hamper battery performance.

The quick energy jump from ultracapacitors is suited for peak power applications such as elevators, forklifts, consumer electronics and back-up power applications.

In the longer term, ultracaps might serve as alternatives to battery banks for utility-scale power grid applications -- providing a short-term electricity supply during power outages.

(Chart from Wikipedia commons)

I spoke with the CEO of Maxwell, David Schramm. Schramm comes out of General Motors and has been with Maxwell since 2007. As a public company, Maxwell breaks out their total revenue and their ultracapacitor revenue as follows:

- $57 million total revenue in 2007

- $82 million total revenue in 2008

- More than $100 million in 2009 of which about $40 million came from their ultracapacitor business.

A 3000 Farad ultracapacitor has an average selling price of $40, and Maxwell has sold millions of units over the years.

Other players in the market for ultracaps, large and small, are Panasonic, NEC TOKIN, Seiko Instruments, Cooper Bussmann, NESSCAP, Cap-XX, and LS Ultracapacitor. There are many others vying for this emerging market and lots of R&D by companies big and small.

Applications in Renewable Energy

Maxwell's ultracaps are used to power the pitch control adjustment in wind turbines. Rather than be faced with a tricky battery replacement process that must be carried out 500 feet above the ground, Enercon has opted to use Maxwell ultracaps in 2 megawatt- and 3 megawatt-size wind turbines.

Schramm estimated that there is $5000 worth of ultracaps in the typical windmill.

Applications in Vehicles -- $100 per car and $15,000 per bus

Ultracaps can also be used in a variety of vehicle applications.

Maxwell is in the process of installing and testing ultracaps in a Honda Civic, using them to start the engine and for electric power steering. Schramm wants to show that there is enough energy generated to start the car. The Toyota Prius uses a small (Panasonic) ultracap for their electric brakes. Maxwell sees each car using about $100 in ultracaps.

Capturing the energy from a braking event in a bus or car is a process measured in seconds, a perfect time-frame for ultracaps.

There is a lot of money to be made designing ultracaps into buses -- $15,000 per bus according to the CEO. California company ISE is on their 300th bus, while China has mandated that there will be 13,000 electric buses. That's 13 cities with 1000 electric buses in each city, all using lots of ultracaps. Maxwell is working with all-electric bus-builder Sanjiu to install fourteen 48-volt ultracap modules per bus. In this application, ultracaps will be used for acceleration, while batteries will be used for range.

EEStor, et al.

Of course, if you're discussing ultrcapacitors, the conversation eventually turns to the topic of EEStor, the mysterious ultracapacitor start-up that promises a disruptive leap in performance. Zenn Motors, B and Ed attest the claims are genuine. I asked Maxwell's CEO about EEStor and his comments were diplomatically limited to the following observation:

"I'd be more than happy to compare our data to theirs," but "I haven't seen a prototype." He added, "My experience with technology is - there are many things that are possible. The question is - can you make money, can you make a profit, can you make it work and will anybody buy it?"

EEStor has received funding from Kleiner Perkins, although Kleiner may have elected not to participate in their most recent funding round. Other VC-funded start-ups working in this field are EnerG2 and Graphene Energy.

More Info on Ultracapacitors

And be on the lookout for a new in-depth report on ultracapacitor technology and applications coming soon to a website near you, from GTM Research.