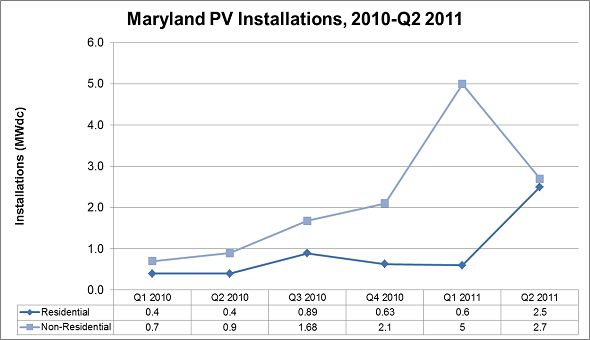

Total quarterly installed capacity in Maryland decreased 7 percent in the second quarter of 2011, according to GTM Research and the Solar Energy Industries Association's latest quarterly U.S. Solar Market Insight report, with installations falling from 5.6 megawatts in the first quarter to 5.2 megawatts in the second quarter.

Conversely, the state saw a ramp-up of the residential market in the second quarter. Residential installations in the state grew to 2.5 megawatts in the second quarter, up from 0.6 megawatts in the first quarter of this year. Growth in the residential segment can be attributed to the recent introduction of the residential solar lease throughout the state, as well as the continued availability of the Maryland Energy Administration residential rebates (homeowners receive $0.50 per watt for systems up to 20 kilowatts).

Source: GTM Research - Q2 U.S. Solar Market Insight Report

Though many developers see Maryland as a potential source of growth with the expected downturn of the New Jersey and Pennsylvania markets, it is a substantially more difficult environment to play in. Maryland exists primarily as a spot solar renewable energy credit (SREC) market, with prices currently around $300. Securing project financing is harder as banks will not lend against uncontracted SRECs. This results in developers and project hosts taking on SREC risk, leading to tighter returns for developers and higher PPA prices for consumers. However, despite difficult market conditions, participants remain optimistic. Come 2012, Maryland will no longer accept out-of-state SRECs, a change that will likely increase in-state demand.

Utility installations provide the primary risk to Maryland demand. In the next two years, three utility projects are expected to come online -- Constellation Energy’s Emmittsburg Solar, SunEdison’s installation for the Southern Maryland Electric Cooperative, and Competitive Power Ventures’ Piney Reach Solar Farm -- for a total capacity of nearly 40 megawatts. These projects could fulfill a considerable portion of the SREC requirement, leaving little room for new market growth.