But how do you measure the value of a power plant never built -- and how do you justify the uncertain returns on the hard costs of deploying the smart grid to make that happen (or, not happen)?

Those are questions that the smart grid industry -- and, importantly, state and federal regulators -- will have to answer if we’re to achieve the peak-shaving potential that the smart grid promises.

“What’s the value of that avoided cost?” John Chevrette, president of management consulting division at big utility technology services firm Black & Veatch, said during a Wednesday press breakfast in San Francisco. “It’s a very debatable point in the industry.”

Chevrette and other Black & Veatch execs were in town to discuss a new report on the global energy outlook and to cover the challenges facing the water and energy industries they serve.

In broad terms, the biggest news in the energy business is the super-cheap price of natural gas, and the expectations of cheap gas for years to come, of course. That’s a challenge to wind and solar power development, but a relief to an industry that can’t build new coal-fired power plants and finds nuclear plants way too expensive and unpopular to build, he noted.

In fact, Black & Veatch predicts that 61,000 megawatts of coal power plants are set to retire between now and 2020, he said. (The U.S. Energy Information Administration says 27 gigawatts, or 27,000 megawatts, will retire over the next five years.) Replacing that will be some solar and wind, but mostly natural gas, Chevrette said, given that nuclear power’s would-be renaissance has stalled amidst economic turmoil and blowback from Japan’s Fukushima disaster -- but there’s still a lot of lost power to make up for.

“The relief valve, in many respects, for these pressures, comes down to the customers,” he said. Pushing energy efficiency, demand response and other programs to get utility customers to use less power will be a critical part of making up for that shortfall.

There’s plenty of real-world evidence of smart grid technologies cutting peak power and improving overall energy efficiency -- and more often as not, it’s been done specifically to avoid building new power plants.

Take conservation voltage reduction (CVR) or volt/VAR optimization (VVO) deployments, which can lower overall voltage across the grid, both for overall efficiency and to shed load during peak demand times. That can push 4 percent to 6 percent efficiency gains, and save enough power to avoid building new power plants -- a key to meeting emissions targets.

Projects from the likes of ABB (and Ventyx), Schneider Electric (and Telvent), General Electric, S&C Electric Co., UtiliData and AEP Ohio, Entergy with ABB, Survalent and Elster, Avista and Efacec ACS, or Dominion Power with Lockheed Martin are proving themselves out now. Progress Energy is working with Telvent on a commercial-scale CVR/VVO project aimed at cutting 385 megawatts of peak load, the equivalent to one fair-sized coal-fired power plant.

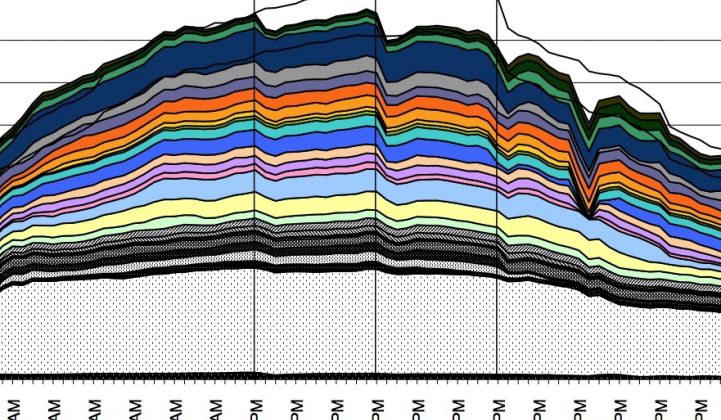

Then there’s demand response, the business of turning down power loads during times of peak demand, which already accounts for some 40,000 megawatts of peak reduction across the United States. The Federal Energy Regulatory Commission predicts that could grow to as much as 188,000 megawatts by the end of the decade, if technology can be aligned with the right policy and economic incentives.

That would add up to a lot of power plants deferred, which is the point of many smart grid-enabled demand response projects being rolled out around the world. Oklahoma Gas & Electric’s smart-meter-and-smart-thermostat demand response program with Silver Spring Networks and Energate is aimed at delivering 210 megawatts of load reduction over the next three years, again saving the need to build a new power plant.

But there are problems in measuring the benefits of projects like these, Chevrette noted. First of all, most utilities (with the exception of those in “decoupled” states like California) make money directly by selling power -- and that makes it hard to convince them to spend money to get their customers to buy less of it.

Even when utilities do come up with ways to make money on saving energy, they can run up against regulatory restraints. Duke Energy’s Save-a-Watt program, which seeks to ensure capital expense-style returns for investment in efficiency as well as for power lines and plants, has run into opposition in many of the states where Duke has proposed it, Chevrette noted.

Indeed, GTM Research’s Distribution Automation, 2012-2016: Technologies and Strategies for Grid Optimization report noted that conservation voltage reduction is “poised for an explosion of acceptance among utilities looking to reduce peak load and defer capital expenditures through CVR or increase control of voltage and reactive power levels on the distribution grid.” But that explosion will only happen if utilities are incentivized to shave peak load through decoupling or other methods that avoid losing money for selling less power.

At the same time, certain forms of energy efficiency can come into conflict with power generators themselves. Take demand response. FERC’s ruling to give “negawatts” of peak power reduction equal value with megawatts of generated power is facing a legal challenge from generator groups, saying that it could undercut the economics needed to justify real generation investments.

Then there’s the tricky question of how smart grid will compare against cheap natural gas as a solution to the peak power problem. For example, Southern California will likely rely on gas-fired backup power to get through a summer without the San Onofre nuclear power plant, which is offline for inspection, Dean Oskvig, president and CEO of Black & Veatch's energy business, said. Likewise, Japan is importing tons of natural gas and turbines to get through its post-Fukushima power crisis.

Solar and wind power, while useful, need to be more tightly integrated into both grid operations and power markets, Oskvig added. And while solar and wind’s growth is outpacing natural gas power projects, it still makes up only 6.6 percent of U.S. capacity in 2013, compared to 36 percent for natural gas. Over the next 25 years, Black & Veatch predicts that renewables will roughly double to 13.3 percent of the nation’s power mix, but that natural gas will make up more than half of it, or 55.4 percent, by that time.