What’s it going to take to make the installed cost of battery storage fall as fast as solar's?

Over the past five years, solar panel prices have fallen fast, dropping to as low as 50 cents a watt. Of course, panels are just one component of the total cost of installed solar. As panel prices leveled out, it became clear that the remaining cost reductions were going to have to come from the rest of the PV system -- racks, inverters and wires, as well as soft costs like permitting, sales and logistics.

To address this issue, the eLab project of the Rocky Mountain Institute, the Colorado think tank led by energy guru Amory Lovins, convened a workshop in 2009 to look at all the cost elements of distributed solar.

“We looked at what could be done to lower the cost from the time it comes out of the plant to the time it goes on the roof,” said eLab manager Leia Guccione.

“We all came to an epiphany that the place we are making the least progress is soft costs” and non-panel hardware, known as the balance of system, or BOS, said Guccione.

From that epiphany came the SunShot Initiative, a DOE program launched under Secretary Steven Chu that has funded more than 350 projects since 2011 to drop those BOS costs. “We like to think we had a role in inspiring the DOE,” said Guccione.

Now RMI hopes to apply the same approach to batteries. It is kicking off a battery BOS project with a design charrette in the Bay Area on November 12-13. “If we start today, how much faster can we drive down costs for batteries?” asked Guccione.

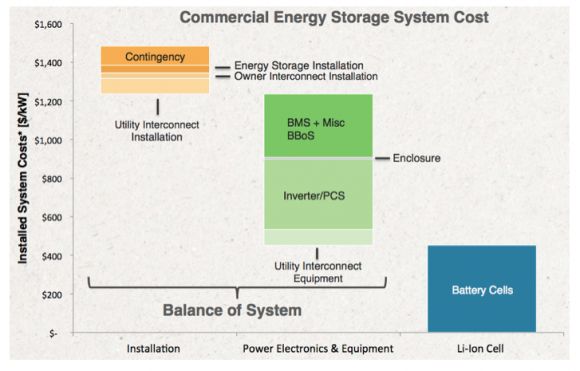

RMI estimates that battery cells account for about one-third of total system cost, with inverters and battery management systems making up the bulk of the BOS costs.

While it is too soon to say where the cost reductions will be found, Guccione looks to RMI's experience with solar. “The biggest reductions in solar BOS were in installation labor and customer acquisition,” she said. “Financing costs are coming down due to securitization. We can assume there will be parallels with batteries.”

GTM Research analyst Ravi Manghani thinks there are gains to be had in the domains of inverters and power conversion systems. “There are very few bidirectional inverters available off the shelf now, and even fewer with four quadrant operations," he said.

Manghani also said that the performance and features of battery management systems have improved greatly in the past few years, but have not seen significant price declines.

RMI is starting with a targeted cost decline rate of 5.8 percent per year, drawing from experience in the solar world. Manghani thinks battery cost declines could be even faster.

One opportunity for cost reductions may simply be in the configuration of the system. Speaking at the Energy Storage North America conference last month, SolarCity CTO Peter Rive said, “One of the cool things about storage is that if you're already installing a solar system, the incremental cost of also getting a storage system installed is low.” Rive sees this as being particularly true once storage systems are integrated into the same box as inverters.

In a February report on the economics of grid defection, RMI looked at how soon “utility-in-a-box” applications, which combine solar and batteries, would be competitive with grid power. It found there are already a few locations that are competitive now, such as commercial customers in Hawaii, with the potential to expand to other high-priced regions like New York and California as early as 2020.

Referencing forecasts from Bloomberg New Energy Finance, Navigant and EIA, RMI thinks that lithium-ion battery systems could drop from about $600 per kilowatt-hour today to less than half that by 2020. When announcing its new Giga factory, Tesla CEO Elon Musk said he expects to deliver battery cells at just under $200 per kilowatt-hour.

The U.S. Advanced Battery Consortium, a collaboration between the big three American car makers, has set a price goal of $100 per kilowatt-hour for cells and $125 per kilowatt-hour for systems by 2020.