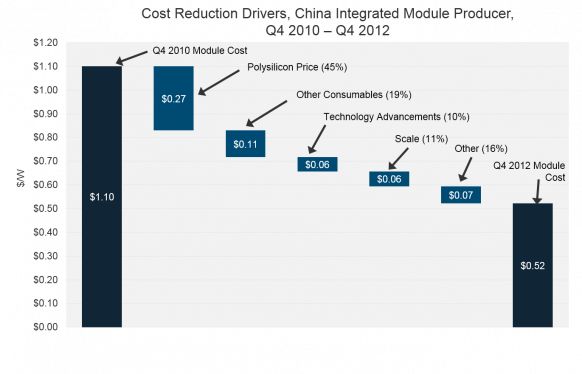

It’s no secret that the fall in PV module cost has played an important role in solar’s march toward grid-competitiveness in recent years. The numbers say it all: from 2009 to 2013, Chinese module manufacturing costs dropped by an incredible 70 percent, driving PV system cost reductions of roughly $1.60 per watt over that time in nominal terms.

A casual observer could be forgiven for attributing a drop of this magnitude to some kind of fundamental technological breakthrough. However, most of the heavy lifting in this case was carried out by plain old market forces: back-breaking levels of overcapacity across the PV supply chain leading to precipitous pricing declines for key consumables. Most prominent of these, of course, was polysilicon, but other important materials such as slurry, sawing wires, solar glass, EVA, and junction boxes also experienced significant pricing declines of their own, driving down polysilicon-to-module processing (non-silicon) costs for Chinese producers by 45 percent over the last four years.

Source: GTM Research PV Pulse, June 2014

Overcapacity-induced feedstock price crashes are not exactly a sustainable basis for continuing module cost reductions. Going forward, it is unrealistic in the extreme to expect consumables pricing to decline at anything close to recent historical levels. Already we have seen pricing for both polysilicon and silver paste used in cell processing increase notably over the course of 2014, and while economies of scale will help PV firms obtain volume purchase discounts from their suppliers, future declines are likely to be much more incremental in magnitude.

So where are tomorrow’s cost reductions going to come from? True, modules make up a much smaller proportion of the overall cost of PV power compared to the past, but even today, they are still the single largest contributor to the system cost structure. The dollar-a-watt DOE SunShot goal for system costs is unlikely to be achieved at current module manufacturing costs of around 50 cents per watt, so clearly there is some work to be done.

Below, we take a look at a few strategies that leading manufacturers have adopted that could serve as examples for the rest of the industry. In contrast with more ambitious and disruptive approaches that require significant capital investment and are less proven at scale (e.g., kerfless wafering, frameless modules, n-type cells), the methods listed here are relatively uncomplicated and carry minimal technological risk -- in other words, they represent the lowest-hanging fruit in terms of cost reduction techniques available to suppliers today.

Qualify New Materials Suppliers

Just as the number of firms involved in PV component manufacturing has expanded considerably in the last half-decade, the landscape of raw materials suppliers to PV producers is many times larger than it used to be. Wafer, cell and module producers now have a vast array of options in terms of vendors available to them for consumables such as silver paste, EVA, backsheets, frames and junction boxes, all occupying different positions on the price-to-performance spectrum. Where before the PV materials ecosystem was dominated by Western and Japanese names such as DuPont, Bekaert, Bridgestone and STR, recent years have seen a number of Asian firms enter the fray, including Xingda (sawing wire), Giga Solar (silver paste) and Hangzhou First PV Material (EVA). Consequently, PV manufacturers that have persisted with tried and true suppliers over the years may have the opportunity to reduce materials costs by qualifying new suppliers that offer comparable quality materials at lower price points than the status quo. Indeed, best-in-class firms have already taken the lead on doing so -- examples are First Solar (which recently ended its long-standing relationship with EVA supplier STR), REC and Hanwha SolarOne.

Optimize Module Bill of Materials by End Market

Does it make sense to design a PV module bound for the Middle East for hail resistance or snow load? Is it necessary that a module sold into the Chinese market meet Japan’s (perhaps overly) rigorous certification standards? In contrast to years prior, today’s PV modules are deployed across a wide range of geographical markets, each with its own certification requirements and environmental conditions. In such a scenario, cost savings can be achieved by optimizing the selection and characteristics of module materials for each major end market (i.e., the U.S., Japan, China, Europe) separately, assuming, of course, that performance and reliability are not impacted negatively. Industry cost leader JinkoSolar has already begun to take steps in this direction in recent months, and it is likely that other major global firms will follow in its wake.

Use Less Silver

PV cell producers have always had a love-hate relationship with silver. On one hand, it has the ideal combination of properties required for high-efficiency, reliable cell metallization (low resistance, inert chemical nature). But it is also expensive and notoriously price-volatile. While getting rid of silver entirely is an option (usually by replacing it with copper, as in the case of First Solar acquisition TetraSun), it is considered to be challenging from a technical and reliability perspective, and can add other costs to the cell production process. It's less disruptive simply to reduce the amount of silver used per cell, which can be made possible via a variety of techniques. While the two most obvious approaches -- narrower fingers and more efficient paste formulations -- have been thoroughly explored, driving silver usage down by 50 percent since 2010, best-in-class firms have begun to adopt more advanced measures such as increasing the number front of busbars, reducing or eliminating rear busbars, or using conductive adhesives.

Increase Automation

Traditionally, PV producers in China have adopted a far more labor-intensive approach to PV manufacturing than their Western and Japanese counterparts: a typical ingot-to-module plant in China employs almost three times as many line workers as an equivalent factory in Europe or Japan. While this tactic may have been an advantage in the past, steeply rising labor rates in China in recent years have made it increasingly unviable over time -- to the point where a more automated manufacturing model is now more cost-effective. Initial traction on this front is likely to be achieved in the areas of cell inspection, testing, stringing and tabbing, where using machines in place of human beings not only saves labor costs but can also drive improved manufacturing yields and more consistent product quality. A prominent recent example in this regard is Hanwha SolarOne, which is in the midst of a shift to completely automated module assembly by early 2015.

All data and analysis in this article are excerpted from PV Pulse, GTM Research's monthly global PV market tracker. For more on the Pulse, click here.