We recently published the first in a series on flow batteries as our inaugural Technology Squared column. We're looking to dive even deeper into the technology, finance and behavior of the energy sector than we do in our daily GTM news coverage. Here's the second and final piece in this survey (read Part 1 here).

***

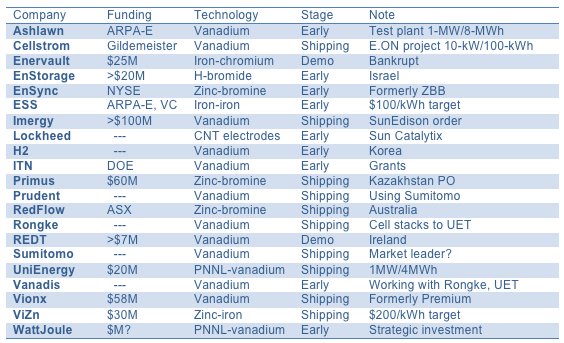

Flow battery system vendor profiles

EnStorage

The Israel-based startup has raised more than $20 million from Warburg Pincus, Greylock Partners, Canaan Partners, Siemens TTB, Wellington Partners, 83North and BIRD. The firm recently announced an R&D partnership with Areva and Schneider Electric using the company's hydrogen-bromide chemistry. EnStorage claims to have developed a 50-kilowatt flow battery prototype with a target price of $0.10 to $0.15 per kilowatt-hour.

EnSync Energy Systems

EnSync (NYSE MKT: ESNC), the former ZBB, is building zinc-bromine flow batteries, as well as providing energy management systems that allow "simple integration of all AC and DC system inputs." EnSync is also offering power-purchase agreements through Holu Energy, a project developer in Hawaii. EnSync has partnerships with South Korea’s Lotte Chemical and Solar Power, Inc.

EnSync's financials for the 12 months ending June 30, 2015:

- Total revenue decreased to $1.7 million as compared to $7.8 million in the previous year.

- Loss from operations was $13.5 million versus a loss of $8.8 million in the previous year.

- Backlog is approximately $2.9 million; cash on hand is approximately $35.9 million.

Dan Nordloh, EVP of business development for EnSync Energy, told GTM, “We realized a number of years ago that the perfect battery doesn't exist. There is no one chemistry that is the be-all, end-all holy grail of energy storage, and in fact, most behind-the-meter applications could benefit from both power and energy, which is best accomplished by hybridizing different types of batteries -- for example, flow batteries with lithium-ion.”

The flow battery, from EnSync's perspective, is a viable storage technology, but it's just one of the tools in the toolkit to help monetize the applications behind the meter. “It's the energy management system capability that's the real enabling technology,” said Nordloh.

“We'll continue to evolve the [flow battery] technology -- we're on generation four of our ZBr flow battery and it's a commercial product today. We were purely a flow-battery play for decades, but we realized that to get to a wider market and really control our own destiny, we had to be more of a system-level type of company.”

That would seem to position EnSync’s business as closer to storage system vendors such as Stem, Sunverge or Green Charge Networks.

“We just announced the ground-breaking for an energy management system on a 350+ unit condo building. It's a hybrid; it consists of a flow battery and lithium-ion for both power and energy. We can provide...frequency response and time-shifting. Whereas the Stems of the world, they're typically tied to a specific battery. They're using lithium-ion, they're using conventional inverter technology. If you deploy that type of solution, you've essentially pigeonholed that specific property or that site. You're limited to what that architecture and battery can do. When you deploy our technology, you future-proof that site...it’s modular, it's scalable, and we can integrate any type of battery you can imagine. Nobody can predict what's going to happen over the next 20 years with these 20-year assets.

“If anybody's trying to force-fit a flow battery into anything other than time-shifting of large utility applications, they're probably going to have an issue, because there are other types of storage that you can use to complement a flow battery and achieve a lot better results and get a lot better lifetime out of your storage.”

ESS

Energy Storage Systems of Portland, Oregon just closed a series A round of $3.2 million led by Pangaea Ventures, along with Element 8, with the aim of commercializing its "all-iron" flow battery. ESS has also been awarded $4.5 million in grants from ARPA-E and other sources.

The company claims its distinction and path to lower levelized cost of energy is the use of a low-cost and readily available electrolyte based on iron, salt and water. The initial product from ESS will be a 125-kilowatt, 1-megawatt-hour flow battery.

Andrew Haughian, partner at Pangaea Ventures, told GTM, "We really think that the long-duration market is the huge opportunity in energy storage. We think that the short-duration markets that are going full-steam right now are just the tip of the iceberg."

Craig Evans is CEO of the company, and Julia Song is CTO. Both worked at former fuel-cell aspirant ClearEdge Power. The startup moved into a 23,000-square-foot factory in Portland earlier this year.

Bill Sproull, VP of sales at ESS, told GTM that opportunities for storage in California’s grid market would be more about transmission and distribution deferral rather than shifting large blocks of energy. California’s 1-megawatt cap on net energy metering would not spur long-duration battery applications, according to the VP.

But outside of California, in Hawaii or other Pacific islands with fragile grids or low NEM caps, Sproull sees an enormous market for long-duration storage sited at commercial and industrial facilities, where solar power produced between 10 a.m. and 2 p.m. is saved for later in the day.

Of course, the dream application of independent power producers “putting in renewables and/or storage to play in wholesale markets and looking like generation assets to the utility has to be four or six hours of capacity,” said Sproull.

Gildemeister

Germany’s Gildemeister is an established machine-tools maker with a large stake in Cellstrom, an Austrian-based maker of the CellCube vanadium flow battery. Gildemeister claims to have sold more than 50 of its systems, and has embarked on a project with German utility E.ON. It’s also working with related company and utility battery integrator Younicos to create “battery parks” to serve grid-balancing functions in Europe’s volatile energy markets.

H2

South Korea’s H2 installed a 50-kilowatt/100-kilowatt vanadium system in 2013 and a “grid-independent” 5-kilowatt/20-kilowatt-hour vanadium redox flow battery at Sejong City in combination with PV in 2014.

Imergy

Jack Stark, Imergy’s CFO, told GTM, "If there's a need for discharge duration in excess of two hours or for a relatively fast charge or multiple cycles, no other battery can do those things well, and it's in those markets that we will thrive."

Imergy, the former Deeya, has raised more than $100 million from Technology Partners, NEA, DFJ, BlueRun Ventures and SunEdison. The company pivoted from its original iron-chromium chemistry to a vanadium electrolyte in 2013. Imergy also moved from the sulfuric acid usually used with vanadium to another acid, which reduces the problem of hydrogen forming in the charged electrolyte.

Imergy is working with contract manufacturer Flextronics to build a 5-kilowatt/30-kilowatt-hour battery for cellular towers and remote applications. Larger formats are being designed, including a 30-kilowatt/120-kilowatt-hour containerized system for microgrids or building backup power.

SunEdison has agreed to buy up to 1,000 of Imergy's 30-kilowatt flow batteries over the next three years. They're destined for deployment in India, where they will store solar-generated electricity for off-grid consumers and businesses in rural areas. SunEdison is encountering its own challenges and has slowed down its storage efforts of late, potentially impacting the Imergy deal.

Bill Watkins is the relatively new CEO of this startup, who now has to deliver on one of the world's largest flow-battery orders. Watkins stresses that Imergy is differentiated by its energy density and its ability to use vanadium that hasn’t been refined to the same purity as required by other VRB vendors.

Imergy developed a process to use vanadium extracted from oil sludge or fly ash as its electrolyte. A small difference in purity comes with a big reduction in costs, according to the CEO. “We basically take the contaminants, and we can mask it with our formulation,” said Watkins. “We don’t have to go to the commodity vanadium markets around steel -- we can create our own markets.” This allows Imergy to cut its vanadium costs by a third, according to Watkins, and ensure an ongoing and consistent supply of the metal. Imergy still has to prove this process at scale, however.

Imergy is aiming to deliver its VRBs at $500 per kilowatt-hour with its current systems, and eventually to drop that to $300 per kilowatt-hour by using recycled vanadium for its electrolyte, according to the company. Imergy has around 160 units in the field. Once the battery does come to the end of its useful life -- after 20 to 30 years, according to Tim Hennessy, Imergy’s president -- its vanadium can be recovered and reused.

Hennessy sees opportunity in off-grid applications with microgrids and storage coupled with renewables offering a cheap alternative to full-scale electrification, while also replacing diesel.

“We sell a battery that's an asset -- you don’t lose money every time you discharge,” said Watkins.

ITN Energy Systems

ITN has won millions in funds from ARPA-E to develop a 2.5-kilowatt/10-kilowatt-hour vanadium flow battery. ITN's design looks to reduce overall system cost by increasing power density through a new stack model, as well as using cheaper membranes and alternative electrolytes. Spinoff firm Storion Energy aims to commercialize vanadium products while working to transition an organic electrolyte developed by the University of Southern California into a commercial product.

Primus

Primus has raised more than $60 million from Anglo American Platinum, Chrysalix Energy, DBL Investors, I2BF Global Ventures, KPCB, DOE, ARPA-E and the CEC.

Samruk-Energy, the electric utility owned by Kazakhstan’s sovereign wealth fund, has announced its intention to buy 25-megawatts/100-megawatt-hours' worth of Primus’ zinc-bromide-based, single-tank energy storage systems, or 1,250 units in all, to help it meet its “very significant renewable energy plans,” CEO Tom Stepien said.

Samruk-Energy has "agreed to get 1,250 of these,” he said, “which is huge. It's a $150 million type of [deal] for Primus at going prices for these batteries.” In light of Stepien's statement, perhaps it’s actually Primus that owns the world’s largest order for flow batteries.

Primus uses a single-loop flow battery design, plating zinc on titanium-based electrodes to perform the key energy exchange function, rather than running electrolyte through membranes, as most other flow batteries do.

With “other flow batteries, eventually you have to replace the stack,” he said. “Over a 25-year horizon, we win -- we don’t have to replace the membranes.” That brings down the levelized cost of energy for its systems, a critical step for batteries meant to stand for decades alongside grid infrastructure, solar arrays and wind farms.

Marine Corps Air Station Miramar recently installed Primus' 280-kilowatt systems as part of an integrated microgrid project being put together by defense contractor Raytheon.

“If you have spikes because of an elevator, you shouldn't use an energy battery, because it's a couple of spikes that you may need to take out a couple of times a day." On the other hand, Stepien described another scenario to which the technology is better suited: "You're making equipment, [and] you need to run the equipment every day, and you have a prolonged peak from 1 p.m. to 5 p.m.” In this case, 47 percent of a company’s $105,000 annual electric bill goes to SCE’s early-afternoon demand charges. “By using a battery with three to four hours in generation, they reduce the charges by 50 percent to 75 percent,” according to Stepien.

Over the course of five to six hours, Primus plates zinc on each of its titanium electrodes. Stepien said, “It’s about a 10-square-meter surface area, and we plate 1.25 millimeters of zinc. That stores energy. When we want energy from the battery, we will reverse the flow and erode the zinc, and electrons flow. We do that with a single tank. There's a very clear separation between the species. When you plate, bromide becomes bromine, and it's very thick, so we've got that 'oil-and-water' type of separation.”

Primus looks to ship its first batteries to Kazakhstan by the end of this year or early 2016.

RedFlow

RedFlow is an Australian flow battery firm working in the zinc bromide chemistry. Siobhan Leahy, marketing manager at RedFlow, emphasized the system's 100 percent depth-of-discharge capability. She noted, "Conventional batteries might have from 40 percent to 80 percent depth of discharge, depending on the technology.”

“We don't need any active cooling,” said Leahy, adding, “You can keep our batteries fully discharged, and they have an indefinite shelf life.”

“Telecommunications is probably our key focus market, because we've got a 48-volt DC battery, which is specifically the voltage used at base transceiver station sites."

Leahy said that the company has about 120 of its small-sized flow batteries in the field. RedFlow lost $12.3 million in the last year on revenue of $2.3 million.

Prudent

Prudent Energy, based in China, acquired all of the assets of Vancouver, B.C-based vanadium redox flow battery maker VRB Power in 2009. In 2011, Prudent raised $29.5 million from Japan’s Mitsui & Co., Kangoo Investment Partners, Idinvest Partners, and Asia Clean Energy Limited. Previous investors Draper Fisher Jurvetson, DT Capital Partners, Northern Light Venture Capital and CEL Partners, which invested $22 million in March 2010, also joined the round.

REDT

With millions in funding from AIB Seed Capital, Enterprise Ireland and the U.K. Department for Energy and Climate Change, REDT is building a 1.68-megawatt-hour vanadium-based demo storage system to be deployed on the Scottish island of Gigha. Applications include storage of nighttime wind power produced by the local 775-kilowatt wind farm, as well as "peak-shaving and power regulation, deferral of capital upgrades of over-utilized transmission assets, potential standby power for the island during network faults or power outages, and enabling an increase in wind generation with associated additional income for the island."

Gigha’s population of about 160 people has “limited grid connection via an aging subsea cable.”

Rongke Power

Bolong Holding Group and the Dalian Research Institute of Chemical Physics founded Rongke in 2008. Rongke supplies stacks and capital to UET and also has a partnership with Vanadis.

Sumitomo Electric Industries

Sumitomo might be the world's most experienced vendor of flow-battery technology. Japan is the home of two of the largest flow-battery installations, both vanadium-based systems from SEI:

- The 1.5-megawatt/1.5-megawatt-hour system in the Sanyo Electric semiconductor fab installed by SEI for peak-shaving and emergency backup

- The 4-megawatt/6-megawatt-hour vanadium system installed by SEI in 2005 for J-Power at the Subaru Wind Farm in Hokkaido for wind energy storage and stabilization

SEI identifies its redox flow battery business as a key investment area, with revenue expectations of $825 million in 2020, according to Goldman Sachs.

UniEnergy Technologies

With more than $20 million in funding from China Bolong and others, UET claims that its third-generation system is differentiated by its Pacific Northwest National Laboratory-licensed vanadium electrolyte with "double the energy density, much broader temperature range, and 100 percent recyclability."

Recently, Avista Utilities took control of the largest capacity flow battery in North America -- a 1-megawatt, 4-megawatt-hour UET vanadium redox flow battery sited at the Turner Substation in Pullman, Wash. to support Washington State University’s smart campus operations. The battery will be used for load-shifting, frequency regulation, and voltage regulation.

The company stresses, "It's not a pilot -- it's a grid asset."

Russ Weed, VP of business development at UET, said that the company's battery works well in a microgrid, in commercial and industrial applications, and in utility applications. He added, "And we love [the Turner Substation] site, because it's all three."

Weed said that a typical installation will cost “somewhere between $700 and $800 per kilowatt-hour,” a figure that includes all the components needed to interconnect with the grid. “When we scale up to where we’re going, we’re going to be $500 per kilowatt-hour, all in,” he said.

For years, energy storage technology vendors have claimed the ability to perform time-shifting (an energy application) at the same time as frequency regulation (a power use case), Weed said. “We can do peak-shaving (or time-shifting)...and frequency regulation concurrently,” he noted. “We have test results proving we can do it.”

Weed added, “I would submit that we are the leading flow battery now, and we are working hard to scale up the channel. We have a pipeline of gigawatt-hours' worth of projects we’re working on.”

UET is partnering with electrical demand management firm Powerit Solutions to deploy a 500-kilowatt/2-megawatt-hour flow battery at Mission Produce, a global importer and processor of avocados in Oxnard, Calif. The installation is slated for the end of 2015. The flow battery/PV combination will allow Mission to run mostly off of solar power during peak hours and absorb spikes in energy demand through load and battery management.

One of UET’s investors, China's Bolong Industrial Investment, is also an investor in Rongke Power, a Chinese firm building vanadium flow batteries using an older type of electrolyte.

UET has deployed or has on-order 5-megawatts/15 megawatt-hours of its vanadium flow battery.

Vanadis Power

Founded in 2013, Vanadis aims to deliver a VRFB to Energiespeicher Nor, a JV of Robert Bosch and a citizen-owned wind park. The battery has a capacity of 1 megawatt-hour and a peak power of 325 kilowatts. Vanadis has a strategic partnership with Rongke Power to manufacture battery cells and systems, with Bolong New Materials to produce the vanadium electrolyte, and with UET, which is manufacturing its vanadium battery.

Vionx Energy

Boston-based Vionx Energy (formerly Premium Power) was founded in 2002 and recently raised about $58 million from VantagePoint and Starwood Energy. Bobby Kennedy Jr. is on the board.

Vionx adopted the vanadium flow technology developed by researchers at the United Technologies Corporation (UTC) after years of investigating zinc-bromine.

The company recently organized an "ecosystem" of firms to launch and commercialize its flow batteries. Six companies -- UTC, Starwood Energy Group, Siemens, 3M, Vantage Point Capital Partners and Jabil -- are looking to "license, finance, manufacture and deploy the energy storage system."

David Vieau, Vionx’s CEO (and former CEO of lithium-ion battery maker A123 Systems), said that UTC figured out a way to reduce the stack costs, the second-largest cost driver.

Vieau told GTM that when it comes to utility and power customers, "Everything they do is about 20 to 30 years, not five years."

ViZn

ViZn Energy has raised more than $35 million entirely from "high-net-worth individuals" for its alkaline electrolyte-based flow battery. Deployments include a project with BlueSky Energy for an Austrian microgrid project, a second system for the Montana-based utility Flathead Electric Cooperative, and a system that is part of a solar project for Virginia utility Dominion Resources.

CEO Ron Van Dell told GTM, "We are a zinc-iron electrochemical couple. We picked up this technology from eight years' worth of prior research done by Lockheed Martin and the DOE.”

Del Allison, VP of sales, notes, “We're actually the little company that most people haven't heard of, but we've been in business for about 15 years. The DOE funded ViZn for nine years, and we've spent the last six years in relative stealth mode, productizing, going through about eight major iterations of flow batteries to get it right, to make it reliable. We've also increased our energy output and density about 200 percent in the last five years.”

The CEO said the system is "very good at supporting both power and energy applications. We can do multi-hour discharge; we can also do very fast charge and discharge, and we can switch between charge and discharge as fast as the inverter can.” The VP added, “You can run it at 300 percent of its normal rate, until it's fully discharged. You can do that and it doesn't wear out the cell.”

The CEO claims, "We will be hands-down the lowest-cost solution in the battery space. I don't think that's typically what people say about flow batteries. We're not concocting a 20-hour-long discharge time that's going to make the economics look better on a dollars-per-kilowatt-hour basis by pumping up the hours. We know how to get below $200 per kilowatt-hour. We can do that by 2018, and we don't need blue-sky, leading-edge R&D to make that happen. All we have to do is basically scale up our business, which is happening rapidly right now."

Earlier this year, ViZn announced a financing deal with LFC Capital to offer customers leases for up to $5 million per project -- the same strategy used by battery-based storage providers Stem and Coda Energy to ease the upfront cost for C&I customers looking to deploy energy storage.

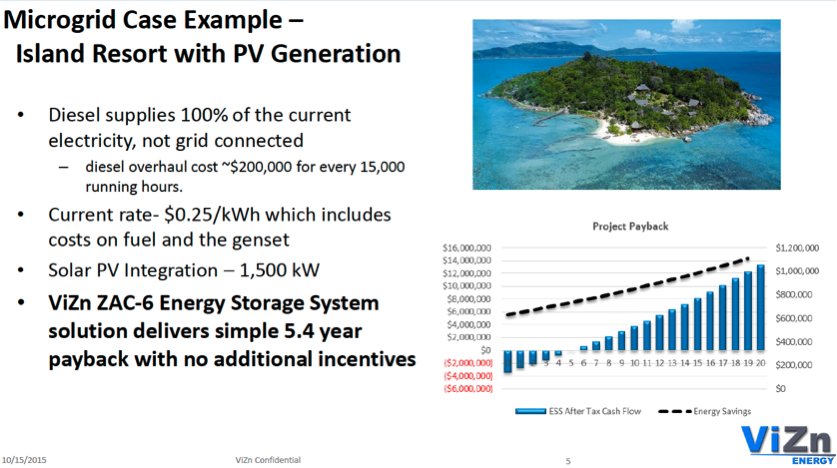

Allison pointed out a recent installation at an island resort microgrid, which provides a good return on investment without any incentives. “There's no ITC, there's no [Modified Accelerated Cost Recovery System]. This is a microgrid where diesel was supplying 100 percent of the grid” before the installation. He added, “Diesel [systems] require a major overhaul basically every 15,000 hours. The current rate just for diesel is 25 cents a kilowatt-hour.”

“We added about 1.5 megawatts of solar, and we put in one of our systems. With this simple analysis, the payback is about 5.4 years. We basically reduce diesel consumption. We improve the resiliency of the system, and of course, we were able to use the solar as part of the contributor to reducing cost.”

“The PV and the battery system cost together was about $3.3 million -- that was what it cost to implement the system. The annual benefit is about $634,000, so it's a pretty dramatic savings just from offsetting diesel and integrating solar into our system. No ITC, no MACRS, no rebates.”

Don’t rule out Li-ion or other formulations

While flow battery companies make small gains, the now-immense lithium-ion industry, led by Panasonic, Samsung and LG, continues to lower costs and improve cell performance. It’s being driven by the economies of scale of consumer electronics and EVs.

Today's lithium-ion technology is cost-effective compared to gas turbines up to about two hours, and it threatens to be cost-effective up to four hours by 2020. Lithium-ion’s cost leadership and bankability will present a barrier to entry for new, novel technologies.

Ravi Manghani, GTM Research's senior storage analyst, notes, “If there is any value in long-duration storage, flow batteries can deliver energy for up to six to 10 hours. Emerging battery technologies such as zinc-aqueous could also compete with flow batteries on a long-duration cost-per-kilowatt basis. Where flow batteries underperform is in efficiency, with an energy-in to energy-out ratio in the mid-70-percent range, compared to the mid-to-high 90-percent ranges for the best lithium-ion cells."

Chris Shelton, president of AES Energy Storage, notes that while most of his company’s nearly 200 megawatts of lithium-ion grid storage projects are serving short-duration power needs like frequency regulation, half of its roughly 1,000 megawatts of projects under development fall into the “long duration” category, capable of providing energy for two to four hours.

“We can do a two-hour product at less than $1,000 a kilowatt,” Shelton said. At that cost, “We’re less expensive than a gas-fired power plant.”

Goldman Sachs, Lux Research, reality

A recent note from Goldman Sachs struck a giddy tone over the market potential of energy storage, citing factors including Tesla’s Gigafactory, renewables integration on the grid, solar-plus-storage, utilities/IPPs, and Southern California Edison, NextEra, and AES moving forward with "initial forays into storage."

The firm’s analysis suggests a $100 billion to $150 billion total addressable market (TAM) for energy storage in the U.S., driven by peak-shaving, renewables integration, ancillary services and T&D deferral. That analysis sizes bulk storage’s TAM as between $5 billion and $7 billion.

The note referred to flow batteries as the “elephant in the room for Li-ion evangelicals,” suggesting that “its longevity could drive a much lower cost, based on LCOS, over its lifetime.”

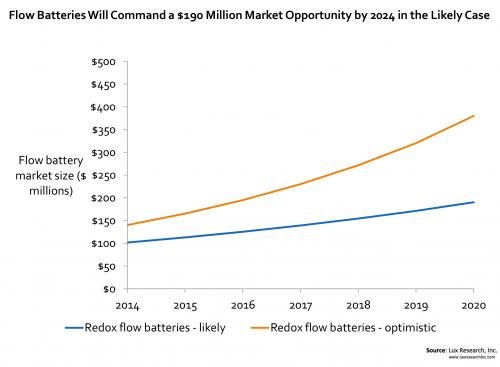

Lux Research has a less sanguine take. Flying in the face of all of these bold corporate pronouncements and funding rounds is this chart from Lux, which throws some cold water on the flow battery market.

Source: Lux Research

If the optimistic growth path for flow batteries is $380 million or 760 megawatt-hours in 2024, then this is not a market for VCs, which need high-growth, billion-dollar markets. If this is truly the size of the market, can it ever achieve the economies of scale needed to have a price breakout like those that silicon and lithium-ion have had?

The Goldman Sachs scenario doesn’t take into account the immense regulatory, scaling and economic headwinds in store for flow batteries and energy storage. For flow batteries, it doesn’t take into account the difficulty of establishing bankability for a novel product when lithium-ion is trusted and widely deployed.

Will the volumes promised by Imergy, UET, Primus, ViZn and Sumitomo materialize in the next few years? Keep an eye on these early deployment claims and watch the energy storage solutions selected by developers this year and next to get a reality check on flow battery deployment.

Further reading

- SEI: http://global-sei.com/technology/tr/bn73/pdf/73-01.pdf

- Sandia: http://www.sandia.gov/ess/publications/SAND2013-5131.pdf

- “A Stable Vanadium Redox-Flow Battery with High Energy Density for Large-Scale Energy Storage,” Li, L. et al. (2011). (Abstract at http://onlinelibrary.wiley.com/doi/10.1002/aenm.201100008/abstract)

- "Redox Flow Batteries for the Storage of Renewable Energy: A Review," Alotto, P. et al. (2015). (Full text at http://www.researchgate.net/publication/275015170_Renew._Redox_flow_batteries_for_the_storage_of_renewable_energy_A_review)

- Electrochemically Enabled Sustainability: Devices, Materials and Mechanisms, Chan, K. & Li, C., Eds. (2014).