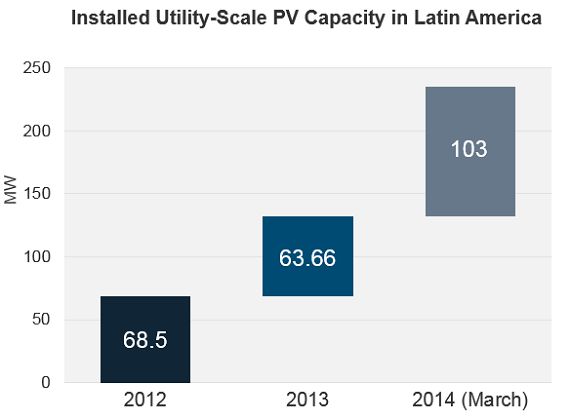

Large-scale solar in Latin America’s major markets has finally had a breakthrough year.

More than 140 megawatts were connected in the last twelve months, 70 percent of that in January alone. Around 200 megawatts more is expected to be installed between Mexico and Chile before 2014 is over, according to GTM Research's Latin America PV Playbook.

As the market goes from talk to reality, market participants should start looking over their experiences and distilling some lessons learned. Evaluating what strategies were used to overcome barriers in the market is an essential part of developing a model for future growth, particularly in sorting scalable approaches in early-market development. This discussion will focus on what’s happened with financing, offtakers, land acquisition, and permitting, and offer some insight into what to expect in the year ahead.

Source: GTM Research Latin America PV Playbook

Background

Investing in large-scale solar projects in Latin America is attractive due to rapidly growing demand, as well as high insolation levels and power prices. Even if the market doesn’t offer the same lucrative subsidies as are available in other parts of the world, many companies are interested. However, there have been serious challenges, including getting access to land; navigating the federal, state, and local permitting process; securing offtakers; and acquiring financing.

Of course, to some extent those problems were all exacerbated for the early players. Understanding the permitting structure for the first solar project is tough, from the point of view of the developers and the grid operators or regulators. Being the first bank to finance a project, or the first company to sign a long-term offtaker agreement is a particularly risky proposition, for example. Some of those difficulties do not yet have solutions, but the outlook on others will improve.

Financing: Then and now

Many of the first projects in Latin America were beneficiaries of development bank funding. The International Finance Corporation, Nacional Financiera and the Overseas Private Investment Corporation have all offered debt financing to utility-scale projects. The Chinese Development Bank, the Inter-American Development Bank, KfW/DEG, and the North American Development Bank have all expressed interest through funding smaller projects or backing developers.

Organizations such as these viewed the early investments in Latin America as a way to jump-start the market and help prove the value proposition by assuming some of that first-mover risk. After this, it was assumed that domestic commercial and international lenders would begin to step up.

Capital from development banks is likely to feature in future projects, particularly as the investment profile improves and banks like OPIC and CDB seek to support companies in their home countries. But what will definitely change is the kind of projects that are recipients in different countries.

Many of the first projects, including Aura I (30 megawatts), San Andres (50 megawatts) and Salvador (70 megawatts), were merchant projects depending on the spot market for their revenues. This market segment is unlikely to receive more development capital as a number of challenges emerge for power prices in key locations.

First, the influx of solar at certain transmission-constrained nodes may create supply bubbles where power prices are suppressed (this is particularly likely in Chile’s northern grid and the Baja Peninsula). Second, power prices on Mexico’s central grid have dropped due to rainfall. Third, energy reform legislation has thrown the viability of the vehicle for merchant solar in Mexico (i.e., the Small Power Producers Program) into question. Commercial banks may pick up the slack in this segment, but that outcome is by no means assured.

Instead, it is likely that development finance will go into projects with fixed-price PPAs; that more commercial banks will get into the mix going forward now that solar is better understood; and that projects will tap into funds made available by the Chilean and Mexican governments.

Offtakers

In Mexico, the primary offtaker has been the national utility CFE, because direct sales are illegal on a nationalized grid. A legal loophole does permit “self-supply” projects with multiple offtakers, so in addition to CFE, some companies and municipalities have banded together to buy solar power.

In Chile, several large mining companies have signed PPAs, and recently, distribution utilities have signed PPAs with Enel Green Power. The Brazilian state of Pernambuco recently auctioned off 120 megawatts' worth of solar PPAs. It is notable that with some of the CFE contracts, some of the mining contracts, and merchant projects in Chile, there is no fixed price for the energy, so the revenues of the projects are dictated by the market.

Will these offtakers be the exception or the rule? The answer differs by country.

In Mexico, “self-supply” projects, in which individual entities or consortiums of companies or municipalities purchase solar power for onsite consumption, are likely to grow in popularity as energy reform eliminates the need for legal gymnastics and retail power prices are expected to remain at steady levels for the key customer base. The future of the Mexico merchant market is questionable and will be dictated by the contours of the newly minted competitive wholesale market.

The Chilean market will likely take a turn toward fixed-price PPAs for distribution utilities and large consumers like mining companies, plus creatively structured PPAs (sometimes called “synthetic” PPAs) with more skeptical entities. As with Mexico, the future of the merchant market after the first wave is unclear -- at least until 2019 when new transmission is built.

In Brazil, expect more states to follow Pernambuco’s lead in securing capacity through solar auctions that offer competitive PPAs to large consumers and distribution utilities. The national auctions may follow suit.

Land and permitting

In Mexico, securing land for projects is very difficult -- and there is no end in sight for this issue. Local companies have purchased parcels of both land and permits, which are now being sold to foreign companies that are seeking to develop. In Chile, the government is auctioning off parcels of land specifically for nonconventional renewable energy in certain regions, which will be hugely helpful, and the permitting process there is very transparent and navigable. Brazil is somewhere in between these two countries, with a process that is easier to navigate than Mexico's, but which is not yet as streamlined or business-friendly as Chile's.

The outlook for 2014 is probably a holding pattern for land and permitting issues in Chile and Brazil, and hopefully the turn to privatized generation will provide an impetus to streamline land acquisition and permitting in Mexico.

****

Adam James is an analyst covering global downstream solar markets for GTM Research. For more on this topic, see the new Latin America PV Playbook, which provides quarterly coverage on the Latin America region and a detailed project tracker.