Another traditional power company has joined the growing list of utilities and electricity providers moving into residential solar.

Integrys Energy Services (IES), subsidiary of Fortune 1000 utility holding company Integrys Energy Group (TEG), which owns six regulated utilities and manages over $10 billion in assets, will make funds available to installers through Clean Power Finance’s CPF Market.

Neither partner would disclose the exact amount of the fund, but President Dan Verbanac said that IES plans to put approximately $40 million to $50 million into commercial and residential solar investments every year. IES is “eager to investigate and continue to invest in solar,” he added.

The move, Verbanac said, supports a growing trend toward distributed energy sources. “Significant cost reductions in recent years,” Verbanac said, “permit this type of energy source to compete with many of the traditional generation sources.”

IES presently holds investments in 50 megawatts of commercial-scale solar, but the new CPF Market fund is its first engagement in the residential space. The new fund, Verbanac said, “will be complementary to our continued investment in commercial solar projects. We expect our investment portfolio to be made up of both.”

CPF Market is an online platform designed to connect electric power companies with CPF’s national network of qualified solar professionals.

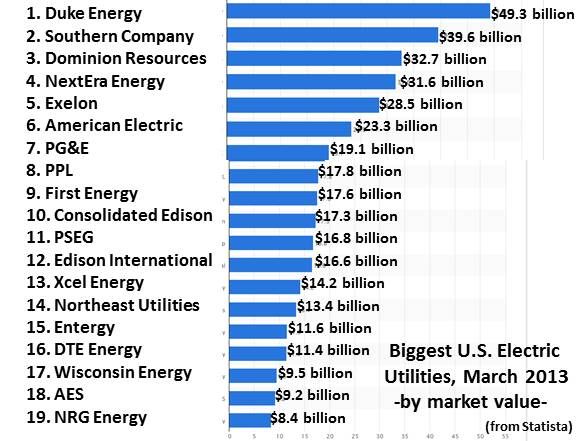

The IES fund follows CPF’s $37 million round of backing from last fall that included utility giants Edison International, Duke Energy, Dominion and the investment subsidiary of NextEra Energy.

According to Clean Power Finance president and CEO Nat Kreamer, the IES investment is another indication that “traditional power companies are increasingly interested in residential solar as the market moves in that direction.” It also indicates how substantial the third-party-ownership (TPO) marketplace has become. The creation of the NRG Residential Solutions subsidiary by NRG Energy (also among the top twenty electricity holding companies) to focus on the residential solar market is another indication of the trend, Kreamer said.

“Traditional U.S. power companies are increasingly interested in solar, particularly residential solar,” Kreamer noted. “The power company of the future will own both centralized and distributed generation, including residential solar.”

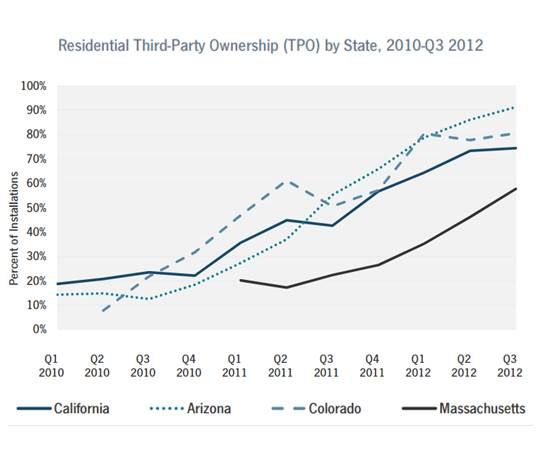

“There are more than ten companies offering residential solar leases or power purchase agreements (PPAs) in thirteen states,” according to GTM Research’s report U.S. Residential Solar PV Financing: The Vendor, Installer and Financier Landscape, 2013-2016. “In the more mature state markets such as California, Arizona and Colorado, TPO now comprises over 70 percent of all residential solar installations. And in a few states such as Arizona, the number has risen to over 90 percent.”

TPO financing draws capital funds to solar’s low-risk, steady returns. Through leases and PPAs, installers can offer businesses and homeowners solar systems with little or no upfront costs. Fund investors get the 30 percent federal investment tax credit and the federal accelerated depreciation as tax shelters. They can also get a portion of the lease or PPA payments as a revenue stream. Installers get the work because businesses and homes get solar electricity at below-utility-bill rates.

CPF “has quickly risen to become, in many minds, the fourth top-tier TPO vendor along with SolarCity (SCTY), Sunrun and SunPower (SPWR),” according to GTM Research.

Through CPF Market partners, IES will be able to expand its brand identity in solar beyond its Northeastern and Midwestern customer base. “We're starting in the California, Hawaii and New Jersey markets and plan to roll out later to New York, Maryland, and Massachusetts,” Verbanac said.

IES chose the CPF platform and CPF Tools after a year-long look at the residential solar TPO space “because of the flexibility” they offered, he said. “We're initially rolling out a PPA product and a PPA prepay product, followed shortly thereafter by a lease option.”

According to Verbanac, CPF's most appealing differentiator was its flexibility as a tool "to promote the Integrys Energy Services brand with customers. That fits our business [model], where we take an active role with our customers.”

Unlike other major TPO investment fund players like Sunrun and SolarCity, CPF connects solar installers with solar investors but allows the investor to retain full ownership, set fund parameters and promote its brand, Kreamer explained.

Sunrun and SolarCity market to homeowners, cultivate brand identity, oversee system installation, and provide operation and maintenance in-house, according to Kreamer. CPF provides a white-label software platform used by a wide range of independent solar installers.

“If ‘Joe's Solar’ uses the CPF Market to sell solar finance products to consumers, a homeowner will see ‘Joe's Solar’ on the system proposal, not ‘CPF,’” Kreamer said. “Brand recognition is much more important to ‘Joe's Solar.’ And if Joe sells more solar because customers recognize his brand, then CPF also wins, because we make transaction fees for every deal that crosses the CPF platform.”

Most fund investors using CPF don’t brand to consumers, Kreamer said. “But retail electric providers like Integrys Energy Services -- and utilities -- have spent decades building and refining their brands. They want to own consumer relationships. With CPF's white-label platform, they get to keep and monetize that customer relationship.”