By now you might have heard that Vinod Khosla has raised his fourth general investment fund, coming in at a cool $1.05 billion. More than half of that total could be steered toward cleantech firms.

It's notable because: 1) It's Khosla Ventures; 2) It's a billion dollars; and 3) It's a VC fund closed in a rather hostile VC-fundraising environment. Word on the street is that even established cleantech funds are having some challenges in meeting their fundraising targets.

Some VC firms are being forced to make major changes. As an illustration, put yourself in the shoes of a large investor in now-bankrupt Solyndra trying to make a case for why your LPs should continue to invest in your VC firm. One of those VC investors in Solyndra recently told me that their firm was realigning their priorities to be more in line with the goals of their LPs. Which I took to mean that their LPs expect CMEA to actually generate returns.

Dan Primack of Term Sheet fame notes that the Khosla fund "[W]as oversubscribed, with over 90 percent of commitments coming from existing LPs. Considering that former cornerstone backer CalPERS decided not to re-up, that means a lot of increased commitments." He added, "Almost all of Khosla's LPs are institutional investors. One notable exception is John Doerr, who has personally invested in both Funds III and IV."

At least two Khosla-backed greentech firms have been acquired: Areva bought solar thermal developer Ausra in 2010 and Regal Beloit bought motor and control firm Ramu earlier this year. Three biofuel firms in the Khosla Ventures portfolio have gone public in the last 12 months: Amyris, Kior, and Gevo. Mascoma, another biofuels firm, has filed to go public.

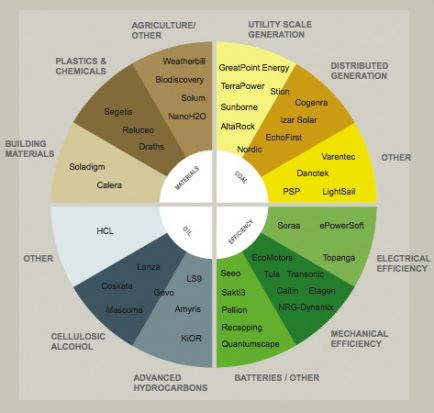

The Khosla portfolio includes some unique battery startups, some unique energy storage firms and 40 more firms searching for a black-swan moment.

Mr. Khosla often has a contrarian take on the greentech market and we've managed to get him on record in his not-so-rare moments of candor. He's also contributed a number of perspective pieces to Greentech Media that are well worth reading. Here are some of his greatest hits:

- Khosla on energy storage: A speech in which Khosla effectively alienates most of the energy storage industry. You had to be there.

- Khosla on innovation: "Only small companies do impressive things."

- Khosla on the smart grid: "Automating your meter reader is not the smart grid. The grid really equals smart power electronics. It's not even about the networks. We need a whole new class of devices and systems."

- Khosla on thin-film solar

- Khosla's biofuel primer

-

Khosla on investing in renewables and energy efficiency: “We’re in a crisis, and there is an opportunity to reinvent our energy infrastructure; it would be a folly to waste it.”

A quote which Mr. Khosla likes to cite: All progress depends on the unreasonable man. -- George Bernard Shaw

The Khosla Ventures cleantech portfolio: