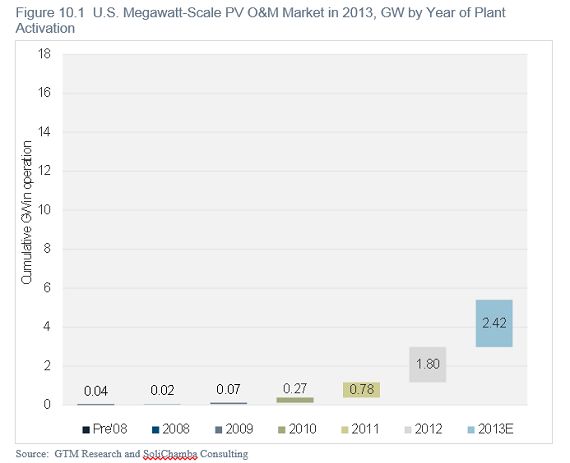

The U.S. megawatt-scale PV market, virtually nonexistent until 2010, has experienced solid growth since 2011. According to our recent report, Megawatt-Scale PV Plant Operations and Maintenance: Services, Markets and Competitors, 2013-2017, the total O&M addressable market is estimated to be 5.4 gigawatts by the end of 2017.

The U.S. megawatt-scale market is driven mostly by the renewable portfolio standards (RPSs) mandated by various states, as well as by federal tax benefits such as the 30 percent investment tax credit (ITC) and accelerated depreciation. The U.S. market is heavily concentrated with very large projects in a few states, predominantly California, Arizona and Nevada. However, a more distributed megawatt-scale market is emerging.

The following twelve trends and predictions for the U.S. market come straight from the recent report.

Key Trends

-- Many EPC companies in the U.S. are not interested in O&M and prefer to focus on their core business of building new plants, with the exception of large, vertically integrated firms (e.g., First Solar, SunEdison and SunPower); utilities and IPPs (e.g., EDF RE, NRG Energy); and local subsidiaries of European EPCs that consider O&M to be an important part of their business (Conergy, GES, juwi, etc.). This is likely due to the potential new growth opportunities within the U.S. market in the coming years.

-- There is already a market for pure-play independent O&M providers, subcontracting O&M for EPC firms (mostly during the warranty period), and signing up with owners after the end of the warranty period, or in scenarios where the original EPC firm is no longer in business or the investor is not satisfied with the service they have received. This is different from the situation both in Germany (where independent providers only appeared and grew recently in a very mature and declining PV market) and in Italy, where pure-play O&M firms are still small and their growth opportunity is strongly tied to a secondary market that doesn’t yet exist in the U.S.

-- Investors are more aware of the importance of O&M, and the discussion is switching from a pure budget allocation (“Here is the price I can afford; what services can you offer?”) to a greater focus on service needs (“Here are the O&M requirements; how much will you charge for it?”). Conversely, in the absence of clearly defined best practices in the PV O&M industry, this may lead to sub-optimal maintenance plans (whether due to a lack of or an excess of services).

-- Guarantees have become more prevalent in new O&M contracts, from response time service-level agreements to availability guarantees, and sometimes PR, yield or production guarantees. These higher levels of guarantees are mostly offered by vertically integrated firms that control a large part of the equipment supply chain (including the modules), as well as the quality of design and installation.

-- New insurance products are offered to back or supplement O&M guarantees. While investors are pushing to transfer risk to O&M vendors, O&M vendors may be able to pass this risk through to an underwriting firm. The success of this model is highly dependent on pricing models and the relative assessment of risk by PV investors and insurance professionals.

-- The operations aspect of O&M is gaining importance and will continue to do so. As very large PV systems are being built and the overall penetration of PV increases, grid operators frequently need to contract with operators with the ability to control the plant on an on-demand basis, to provide energy forecasts, and to cooperate with them on maintenance scheduling. This requirement may force smaller players that lack the necessary infrastructure to find partners able to provide these functions.

Future Outlook

-- Increased competition is likely to put more pressure on prices, especially after the end of the initial EPC warranty period of one to five years. Since price levels are already relatively low in the U.S. compared to most global markets, the amount of the drop will probably be limited unless service levels are revised as well. Scale will be a key factor to allow O&M providers to operate profitably in a more competitive environment.

-- More players are likely to enter the market, especially EPCs, when the pipeline for new projects dries out as the Investment Tax Credit drops from 30 percent to 10 percent at the end of 2016. Similarly to what is already happening in Germany as its new construction market slows down, in 2016/17 (or perhaps sooner), we are likely to see some EPCs in the U.S. going out of business, while others rush toward O&M -- unless policy changes ensure continued growth of the megawatt-scale PV industry beyond 2016.

-- O&M providers will take on more work as power plants age, warranties expire and failure rates increase. Since most O&M plans include fees for corrective maintenance work, this may actually increase the profitability of the O&M business. Providers offering full-wrap plans will experience higher costs and reduced margins, and those that did not properly assess the ongoing costs of out-of-warranty repairs will suffer losses.

-- Large EPC firms seeking contracts to manage third-party plants will separate their O&M business units so they can make decisions to engender the success of their O&M business, independently from EPC considerations. Utility and IPP firms in the U.S. are already structured this way (e.g., NRG Energy Services), as are a number of German EPC firms (e.g., Conergy Operations & Maintenance, SEAG Service).

-- The market will probably consolidate in 2016/17 as the construction of new plants slows down and O&M firms are forced to compete for an addressable market that is no longer growing at a fast pace. Larger players may acquire smaller ones (or their contract portfolios). Smaller players with a regional presence may merge with others in order to reach nationwide scale. Companies that do not reach critical scale and are unable to compete on pricing and service levels will disappear or get acquired.

-- More plants will be switched to new O&M providers as EPC warranties expire and investors seek to lower costs, increase service levels, or standardize with a single O&M vendor across their asset portfolio. The emergence of a secondary market where PV assets are sold to new investors (after the tax benefits are realized, for example) will add to this trend.

-- The megawatt-scale O&M market might split into two segments: service providers for plants of 1 megawatt to 20 megawatts and service providers for plants above 20 megawatts. Plants of more than 20 megawatts have specific requirements that usually do not apply to smaller PV systems (e.g., grid integration and controls, higher chance of being subject to NERC compliance, etc.).

***

The 231-page report contains in-depth market overviews, forecasts, pricing, service levels, and vendor profiles for the French, Italian, German, Spanish, U.K., and U.S. markets. Click here to learn more.