China-based Jinko Solar withdrew its IPO plans earlier this year due to "poor market conditions." Jinko manufactures silicon solar wafers, cells, and modules, and had hoped to raise $100 million.

Late last week, the firm managed to go public on the NYSE, raising approximately $64 million in its maiden offering (here's a link to the prospectus). The company's 5.84 million American depository shares sold for $11 per share, which was at the low end of the $11-$13 range. Jinko had raised more than $30 million in venture funding from CIVC, Shenzhen Capital, Pitango Venture Capital, et al. in 2008.

Obviously, investors are a bit jittery about the solar industry in an environment where slim margins exist for commodity-level wafers and modules -- and where soon-to-be curtailed German subsidies might impact demand while the world waits for the U.S. and other markets to take off.

Jinko had sales of $80.4 million in the first quarter, a 20 percent drop from the fourth quarter of last year. Margins grew to 24 percent, from 16 percent in the fourth quarter. Jinko managed to make $12.5 million in profit in 2009.

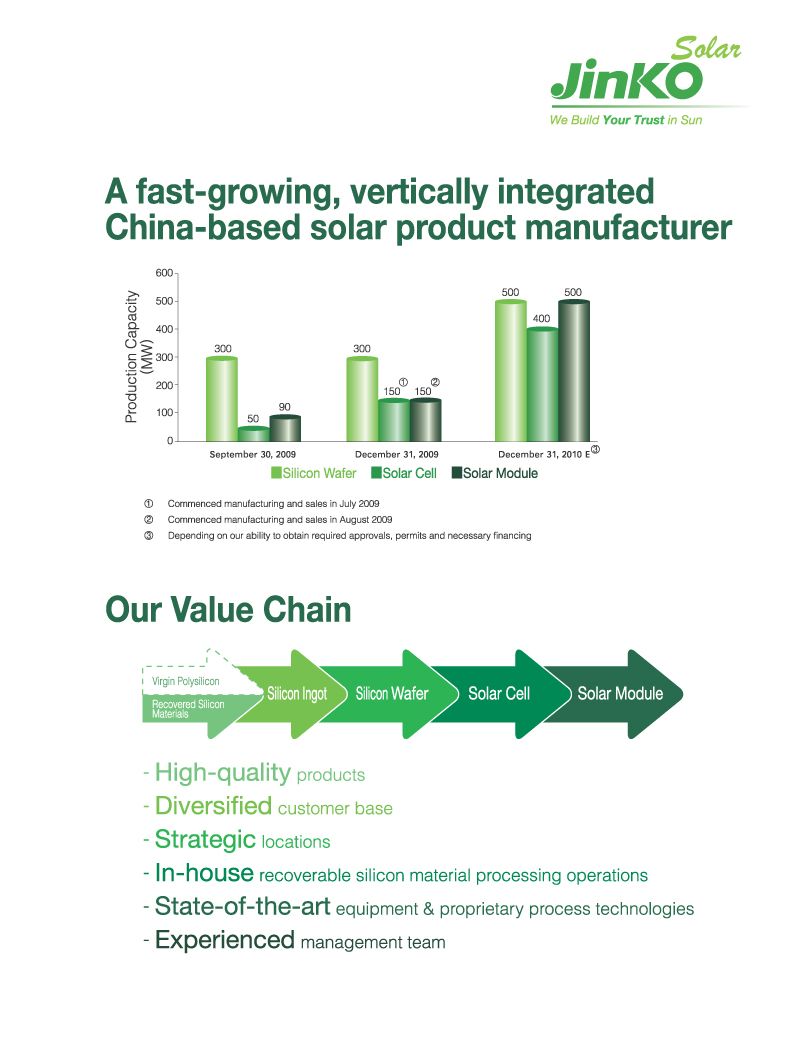

The vertically integrated firm has solar cell and module manufacturing capacities of about 200 megawatts with intentions to grow that capacity to 500 megawatts by year's end. This makes Jinko the smaller of the vertically integrated China-based solar firms like Yingli or Suntech. Jinko has more than 400 customers and a deep relationship with troubled feedstock aspirant Hoku. The prospectus is full of risk statements regarding Hoku's performance.

If a relatively profitable solar firm has such tepid results -- what are the prospects for an IPO aspirant like Solyndra?

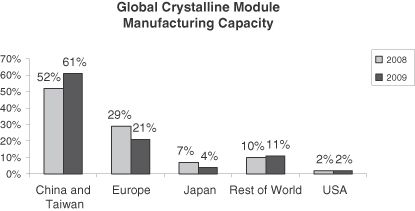

Charts from the Jinko prospectus: