The U.S. International Trade Commission released a set of recommendations on the Section 201 solar trade case Tuesday that will soon make their way to President Trump for final consideration.

The proposed remedies are less severe than the tariff rates requested by petitioners Suniva and SolarWorld Americas, but stand to have a meaningful impact on the U.S. solar sector nonetheless.

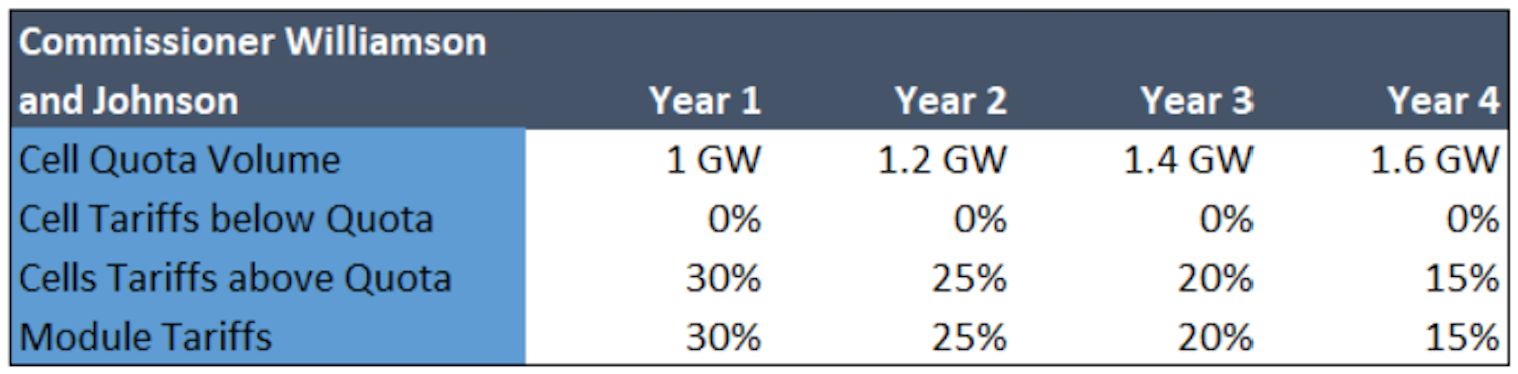

Commissioners Irving Williamson and David Johanson aligned on the proposal to place a 30 percent ad valorem tariff on imported crystalline silicon PV (CSPV) modules, to decline by 5 percentage points per year over four years.

For imported solar cells, the two commissioners agreed on four-year "tariff-rate quota" that would allow for up to 1 gigawatt of tariff-free cell imports. Any imports over 1 gigawatt would be subject to a 30 percent tariff. Each subsequent year, the tariff rate would decrease by 5 percentage points and the in-quota amount would increase by 0.2 gigawatts.

This proposal carries weight as the recommended remedy with the most commissioner support.

Source: GTM Research

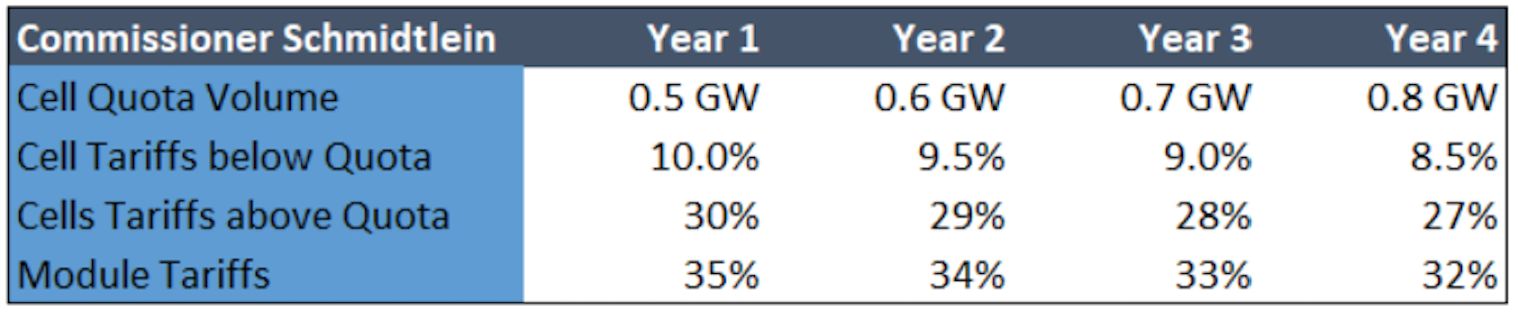

Chairman Rhonda Schmidtlein structured her proposal similarly, but with more stringent rates. For imported CSPV modules, she proposed the president implement a tariff starting at 35 percent, rather than the 30 percent her colleagues suggested. Like Williamson and Johanson, she recommended reducing the tariff incrementally over a four-year period, but by just 1 percentage point per year.

With respect to imported CSPV cells, Schmidtlein recommended a tariff-rate quota of 0.5 gigawatts, and that imports within quota be subject to a 10 percent tariff. Beyond the 0.5-gigawatt threshold, the 10 percent tariff would increase to 30 percent.

Schmidtlein recommended the tariff-rate quota on cells be implemented for four years, and that the in-quota level be incrementally raised and the tariff rate incrementally reduced over the course of the remedy period.

Source: GTM Research

The third proposal from Commissioner Meredith Broadbent was the least severe. She proposed an 8.9-gigawatt quota on CSPV module and cell imports, to increase by 1.4 gigawatts each year over four years.

"These recommended quantities are consistent with the market share held by imports in 2016, adjusted to reflect projected changes in demand for photovoltaic products over the next four years," she wrote. "Therefore, they are set at levels that will not disrupt expected growth in CSPV demand but will help address the serious injury to the domestic industry by preventing further surges in imports."

Broadbent noted that a major market disruption would adversely affect hundreds of thousands of U.S. solar workers. "I am firmly of the view that damaging the domestic consumers, installers, and manufacturers supporting CSPV deployment is not an effective way to save domestic producers of CSPV products," she added.

Broadbent also proposed that the president administer the quota by selling import licenses at public auction at a minimum price of 1 cent per watt. In other words, the importer of record would have to pay a penny per watt in order to come in under the 8.9-gigawatt restriction.

The sale of import licenses will likely generate revenue for the U.S. government of at least $89 million in the first year, to increase by at least $14 million each year thereafter. Broadbent recommended those funds be used to provide development assistance to domestic CSPV product manufacturers for the duration of the remedy period.

This proposal aligns closest with recommendations put forth by the Solar Energy Industries Association (SEIA), which is strongly opposed to imposing new tariffs.

Source: GTM Research

All four of the ITC commissioners recommended that their remedy proposals be applied to certain Free Trade Agreement (FTA) partners, including Mexico and South Korea. Chairman Schmidtlein also applied her proposals to Canada.

All Commissioners recommended that their remedy proposals exclude certain other FTA partners, including Australia, Colombia, Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, Israel, Jordan, Nicaragua, Panama, Peru and Singapore, as well as the beneficiaries of the Caribbean Basin Economic Recovery Act.

If these recommendations are adopted, it will be a major win for Singapre-based REC Group -- one of the few foreign CSPV product manufacturers to be exempt from tariffs.

Weak or intensely harmful?

U.S.-based manufacturers Suniva and SolarWorld brought the Section 201 case earlier this year, citing serious financial harm they claimed to have suffered due to imported solar products. Suniva filed for Chapter 11 bankruptcy protection this spring. Following a series of layoffs, SolarWorld Americas recently raised $6 million to keep its doors open and its factory operational while fighting the trade case. Both petitioners expressed disappointment in response to today's news.

"The ITC's remedy simply will not fix the problem the ITC itself identified, and with it, we'll see very shortly the extinction of what remains of this manufacturing sector and the jobs of American workers, as yet another high-tech manufacturing industry will have been destroyed because of an overt plan by China," according to a statement from Suniva.

The company called the ITC proposals "weak" and called on President Trump to take the "courageous steps necessary" to reinvigorate this sector. Juergen Stein, CEO and president of SolarWorld Americas, indicated he is also looking for a more favorable response from the White House.

"We are pleased that a bipartisan majority of the commission has recommended tariffs, tariff-rate quotas and funding for the domestic industry. This is a useful first step," he said. "The process will now move forward to the president, and we continue to believe that the remedies SolarWorld has recommended are the right ones for this industry at this time."

Last month, Suniva recommended a tariff of 25 cents per watt on CSPV cells -- down from its initial 40 cents per watt request -- and 32 cents per watt on CSPV modules. These rates would ramp down modestly over four years. The manufacturer also requested a floor price on all imported solar products of 74 cents per watt, down from the 78 cents per watt in the initial petition. The proposed floor price would also decline over time.

SolarWorld made the same tariff request for cells and modules -- starting at 25 cents and 32 cents per watt, respectively. But instead of a floor price, SolarWorld proposed an import quota starting at 0.22 gigawatts for cells and 5.7 gigawatts for modules. The quotas become somewhat less severe over the four-year period.

"It’s worth noting that in no case did a commissioner recommend anything close to what the petitioners asked for," said Abigail Ross Hopper, SEIA's president and CEO. "That being said, the proposed tariffs would be intensely harmful to our industry."

She said she is encouraged that three commissioners made reference to alternative funding mechanisms, including SEIA's own import license fee proposal. Commissioners Johanson, Williamson and Broadbent recommended the president seek some form assistance for domestic producers through funding and restructuring programs.

The solar trade group, with its broad coalition of supporters -- including political conservatives, progressives, free-market advocates and environmental groups -- will continue to impress upon the Trump administration "the need for an approach that will not inflate the cost of electricity for all Americans and harm workers, consumers and the U.S. economy," Ross Hopper said.

In a sign of the crosscutting nature of this case, Fox News host and Trump supporter Sean Hannity recently came out against the Section 201 petition. In a radio spot that's also been shared as a video, Hannity claims that Suniva and SolarWorld -- two foreign-backed companies -- are seeking to "manipulate U.S. trade laws" in order to get a "bailout" from President Trump.

The ITC will officially file its proposals with the president on November 13, at which point he will have 60 days to "take action.” According to Stoel Rives' Morten Lund, this could be an order or announcement for a remedy decision, or he could ask the ITC for additional information.

Any tariffs, tariff-rate quotas and quotas announced by the president will take effect within 15 days from the president’s announcement, unless he announces an intent to negotiate certain trade agreements, which can delay implementation for up to 90 days.

***

Join GTM Research’s team of analysts for a free webinar as they dissect the U.S. ITC’s vote and provide their immediate reactions to what the future of U.S. solar under recommended remedies might hold.

An earlier version of this story included a chart that incorrectly listed auction proceeds from Commissioner Broadbent's proposal at $1.4 million. The annual revenue is $14 million.