It used to be that big-box stores were destination points for consumers. But increasingly, consumers' homes are a destination for retailers.

Over the last couple of years, Best Buy, Lowe's and Home Depot have unveiled partnerships or exclusive offerings for home energy management. These stores are jumping into a fluctuating market where security companies, telecoms, utilities and technology startups are jockeying for dominance in the connected home.

This morning, Staples unveiled its own product, called Staples Connect, which is designed to automate lighting, air conditioning, appliances and security systems. The company is partnering with big names in sector, including GE, Honeywell and Philips to integrate products with its communications hub.

The $99 wireless hub was designed by Linksys and supports Wi-Fi, Z-Wave and Lutron Clear Connect RF technology. Staples also plans to integrate ZigBee devices as more of them hit the shelves. The app was developed by Zonoff, the company that designed the software platform for the Marvell smart LED bulb.

When Staples officially launches the product in stores in November, it will be sold alongside several dozen products like smart thermostats and controllable LED light bulbs. By setting up a central location in stores where consumers can play with the connected devices, Staples hopes to make the choice easier for the uninitiated. (This is fitting, considering Staples' mascot is a red "easy" button.)

Best Buy has attempted something similar by setting up home energy learning centers where customers can learn more about efficient products and connected home offerings.

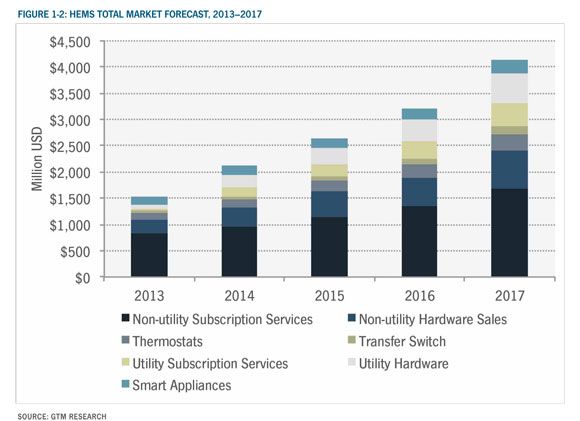

Staples is one of the largest retailers in the country, so its participation in the sector carries weight. The company's offering is yet more proof that home energy management services are being dominated by non-utility players. As the chart below from GTM Research's latest report on home energy management shows, utility hardware and subscription services will play a much smaller role than non-utility services in the coming years:

Staples enters the connected home market at a time when companies are still experimenting with how to engage consumers. Should home energy management be part of a cable subscription? Security services? Or an extension of technologies provided by big-box stores? Whatever the answer (which is probably all of the above), the key to customer engagement is finding a way to integrate the solution into existing services.

Since Staples is already selling security systems, thermostats and light bulbs, the company believes it can leverage those products to get deeper into the home. And considering the hub is only $99, it beats any other offering from big-box retailers on price so far.

For more on the home energy management landscape, check out GTM Research's latest report: Home Energy Management Systems: Vendors, Technologies and Opportunities, 2013-2017.