According to researchers, the most cost-effective way for the U.S. grid power sector to meet greenhouse gas emissions targets through 2030 is by using natural gas. It would primarily displace coal-fired generation, while renewable energy would continue to grow. After 2030, wind would become a more cost-effective way to generate power than gas.

The findings, from the National Renewable Energy Laboratory (NREL) and the Joint Institute for Strategic Energy Analysis (JISEA), were published in the journal Energy Economics as part of a much larger JISEA study.

Co-author Morgan Bazilian, Deputy Director at JISEA, said the research was intended “to evaluate both the implications of shale gas development and use, and various policy and technology changes.” The research considered “power plant retirements, advances in generation technologies, federal policies to reduce greenhouse gas emissions, and variations in natural gas supply and demand.”

“We find that natural gas use for power generation grows strongly in most scenarios,” Bazilian said.

Three scenarios

The study analyzed three major scenarios:

1. A three-case “Reference scenario,” using two estimates of recoverable natural gas from the EIA's Annual Energy Outlook 2011. The EIA offered a range of “estimated ultimately recoverable” (EUR) gas volumes, which represent the country’s “total unproved technically recoverable shale gas resource.” As such, EURs only indicate how much gas might be recoverable using today’s technology, not whether prices will be high enough to make production commercially viable, or low enough for consumers to tolerate.

The Reference scenario included one case with standard demand growth and a Low EUR of 423 trillion cubic feet (Tcf); a case with standard growth and a Mid EUR of 827 Tcf; and a third case with the Mid EUR and low growth, perhaps due to economic stagnation, efficiency, and other demand-dampeners.

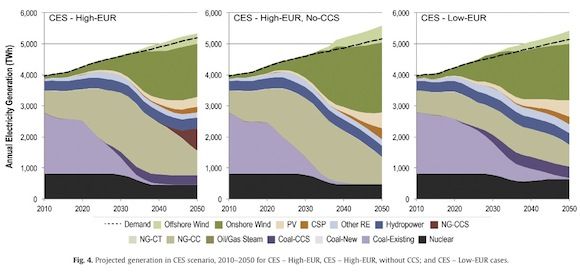

2. A three-case “CES scenario,” in which enough renewable power capacity is built under a clean energy standard (CES) to reduce emissions from the U.S. power generation sector to the level scientists believe is necessary to avert catastrophic climate change (60 percent to 80 percent below 2000 levels by 2050).

The CES used in the model is similar to that proposed in 2012 by then-Senator Jeff Bingaman, which would set clean energy generation targets and give each type of generation credits relative to standard coal-fired generation. Nuclear and renewable generators would get 100 percent crediting; natural gas combined cycle generators would get 50 percent, or 95 percent if equipped with carbon capture and sequestration (CCS) technology; and coal plants would get 90 percent if equipped with CCS.

The CES scenario included one case with a High EUR of 1230 Tcf where CCS becomes commercially viable around 2040; one case with the High EUR in which CCS does not become commercially viable; and one case with a Low EUR where CCS becomes commercially viable.

3. A two-case “Natural Gas Supply-Demand Variation scenario,” in which non-power sector gas use increases while meeting requirements for the safe and environmentally sound extraction of shale gas.

In the supply variation case of this scenario, a range of potential cost-of-compliance estimates were evaluated, which would increase gas costs by $0.50/MMBtu (million Btu) to $2.00/MMBtu over the 2010 baseline cost of gas. The baseline is the cost of gas to generators -- about $5.00/MMBtu -- which is roughly equivalent to $4.00/MMBtu at the wellhead (the usually cited Henry Hub price).

In the demand variation case, gas consumption for other uses than power generation (including new LNG exports, natural gas vehicles, industrial and chemical uses, and other sectors) rises to at least 12 billion cubic feet of gas per day by 2026.

The researchers made some reasonable assumptions: tax credit incentives for renewables will expire on schedule (or by 2030 for solar and geothermal tax credits) without renewal; some 30 GW of coal-fired capacity will be retired by 2025, which is consistent with NREL’s forecast but toward the low end of such estimates; in addition, the cost of building new electrical transmission infrastructure is included, but not the cost of building new natural gas pipelines.

Solar capacity growth was modest in the analysis. Assuming a capital cost of $4,067/kW in 2010, falling to $2,058 by 2050, utility-scale PV reaches roughly 10 GW by 2030 and 20 GW by 2050. New rooftop solar capacity was assumed to be 85 GW by 2050, per a previous NREL forecast.

Findings

The Reference scenario failed to meet the greenhouse gas emissions target. However, the researchers found that if the recent trend of low power demand were to continue into the future, it could lead to a more diverse power generation mix that is not overly dominated by natural gas, with lower emissions and price impacts, and less renewable power growth.

In the CES scenario, gas would be the most cost-effective way to generate power through 2030, after which wind would be. Renewable generation will meet at least half of total power demand by 2050 in all cases. CO2 emissions from power generation meet the target, declining to more than 80% below the baseline, and coal-fired power without CCS disappears.

Projected generation by fuel in the three CES scenarios.

Study co-author Jeffrey Logan said that if CCS becomes commercially viable over the forecast period, the model finds it would be deployed in order to meet reserve capacity margins and address other grid issues such as transmission constraints, even though wind would be cheaper.

If CCS is not viable, renewable energy takes roughly an 80 percent market share and gas consumption for power generation falls back to 2010 levels by 2050. However, the power generation mix becomes less diverse, and more transmission capacity (six times more than the Baseline – Mid-EUR case) must be built to accommodate the additional wind generation.

In the CES – Low-EUR case, natural gas usage remains about the same as it was in 2010, while renewables grow more and nuclear declines less. Average electricity prices would be 6–12 percent higher by 2050 than they were in 2010.

In the Natural Gas Supply–Demand Variation scenario, increasing demand for gas from other sectors pushes prices up by a maximum of 29% above the Reference scenario in 2026, then stabilizes. Gas power generation would not quite double and remain below the baseline by 2050. Alternatively, if compliance costs add a maximum of $2/MMBtu above the baseline cost in the early 2020s, it would drive off non-power sector gas usage and prices would return to the baseline level in 2050. More robust environmental protection in the production process would not have a significant impact. If those measures increased gas costs by $1/MMBtu, for example, the long-range evolution of the U.S. power sector would not change significantly.

More research needed

The findings may be startling to renewable energy proponents, particularly given the emerging consensus that by 2020 renewable power may be cheaper than fossil-fueled power. As Bazilian commented, the future of power generation is a “highly topical and divisive” subject which begs for the kind of “robust analytical work” his organization conducts.

“Very few people saw the dramatic changes coming that are being witnessed in the U.S. natural gas sector,” Bazilian observed. “The critical role of unconventional gas—and specifically, shale gas—has been dramatic. The changes taking place in the U.S. natural gas sector go well beyond the boundaries of traditional energy-sector analysis. They touch on areas as diverse as foreign policy and industrial competitiveness.”

The key question is the future price of natural gas. The authors caution against a major shift to natural gas generation, noting that gas prices could rise substantially if demand for gas were to rise due to power generation, gas exports and other uses, particularly if current estimates of recoverable gas are incorrect.

“More research is needed to better understand how much gas will ultimately be recovered from unconventional plays, and at what price,” the researchers said. The long life of combined cycle natural gas generators -- 55 years -- could result in major misallocations of capital or unfortunate technology lock-in if prices go too high or gas is less abundant than believed.

My take

Because the researchers restricted their analysis of natural gas prices to costs that may arise from state and federal regulations, environmental compliance, and increased uses in other domestic sectors, I believe the future cost of natural gas is underestimated, particularly in a future as distant as 2050. Other factors, like the threshold of profitable gas production and the reliability of EUR estimates, may have far greater impact on price.

As I detailed in 2011, how much shale gas may be technically and economically recoverable is still very much an open question, but we can say with confidence that we do not have 100 years of proved reserves, no matter how often that claim is repeated. I think the Mid EUR estimate is probably in the right ballpark, but might be toward the high end, and that the High EUR estimate is unlikely.

Gas prices are clearly an important factor in this analysis. As I explained in 2012, U.S. shale gas endured a long period of loss-making production, which stanched its growth trajectory. Gas prices only recently recovered to what I would consider the actual profitable floor of around $4/MMBtu, but have fallen below that threshold again. In my latest gas price forecast, I saw gas prices rising slightly through the end of the year to maintain profitability, but the wave of consolidation through mergers and acquisitions that is (predictably) now sweeping through the industry may engender further volatility.

The researchers have effectively modeled a Henry Hub gas price of $4-6/MMBtu. If EURs have been significantly overstated, as some analysts I respect believe, then actual prices could go far higher than than that. For example, if the “shale gale” puffs out by 2025 (a not inconceivable scenario) then gas prices could jump back to $10/MMBtu (or much higher) by 2050, in which case more renewable power would come into play than the model suggests.

I also have serious doubts that CCS will ever become economically viable. It can only hope to reach that point if governments are willing to spend many billions of dollars to prove the technology and bring down its cost, and by that point I think there’s a good chance that renewable power will be cheaper. If that is true, then this research suggests that 80 percent of grid power from renewables is the most likely outcome.

Finally, I suspect that the potential of solar PV was too tightly restricted in this model. The capital cost of utility-scale solar in the U.S. is already at $2,140/kW, and Greentech Media’s proprietary cost model through 2017 suggests it will go significantly lower still. Utility-scale solar could reach $2,058 in the next four years, whereas the researchers don’t anticipate that cost being achieved until 2050.

Even so, this research is a useful contribution to the debate about the future of grid power, and adds further weight to the notion that whatever the specific mix of power generation is in 2050, it will be utterly dominated by renewables and natural gas, while nuclear’s role declines and coal is phased out completely.

***

Chris Nelder is an energy analyst and consultant who has written about energy and investing for more than a decade. He is the author of two books (Profit from the Peak and Investing in Renewable Energy) and hundreds of articles, and has been published by Nature, The Atlantic, Scientific American, Slate, Quartz, Financial Times Alphaville, The Economist Intelligence Unit, and many other publications. He has appeared more than 50 times as an energy expert on television, radio and podcast. He is a public speaker, a regular columnist for SmartPlanet and Greentech Media, and he blogs at GetREALList.com