“I just read that Google is ending its involvement in green energy projects,” a GTM commenter recently wrote. Nothing could be farther from the truth, it turns out. Google is more committed than ever to renewables and energy efficiency.

The company closed down a series of programs, largely unassociated with renewables, in 2011. “It’s a broader effort at Google to focus our engineering work,” said Google Clean Energy spokesperson Parag Chokshi, "and has nothing to do with energy.”

Among the programs closed down was RE<C, an engineering effort focused, Chokshi said, “on solar power tower technology research and development.” The group produced “eight or nine technical papers that are published now and available on our website detailing all the work they did,” he explained. “We just decided there are other organizations in a better position to take the research forward.”

As an example, Chokshi pointed out that the research had turned up specifics on materials used in the construction of solar power plant heliostats that the company believes can best be exploited by materials engineers or heliostat manufacturers.

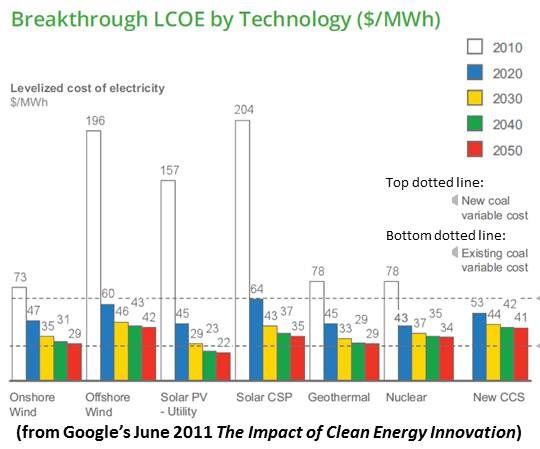

Google’s corporate commitment to renewables, however, is unwavering. In June, it released "The Impact of Clean Energy Innovation," a study that extolled the possibilities and benefits of energy innovation. “Our highest impact efforts in renewable energy are continuing unchanged. In fact, we’re really excited about expanding those efforts,” Chokshi said.

_540_449_80.jpg)

Google has worked at energy efficiency since its founding, Chokshi said, noting especially its efforts to streamline data center energy consumption. “And it’s not just the large data centers we build,” Chokshi said. “Smaller organizations can take advantage of these strategies.”

Google also wants to operate its data centers, whenever possible, on renewables. They have signed “two deals to procure wind energy for our operations and we’re actively looking for more to do there,” Chokshi said. “Our operations are now about 25 percent renewables-powered,” he said. “The ultimate goal is 100 percent, so we’re trying to work that percentage up. We’re hoping to be at 35 percent next year.”

Google is also completely carbon-neutral, thanks to purchases of “very high quality offsets that we think are additional, financially and environmentally,” Chokshi said. “But offsets are the least best option,” he added, which is why the company remains intent on renewables.

They just announced a new, $94-million, utility-scale solar PV investment in four Sacramento Municipal Utility District (SMUD) projects, once again opening up new dimensions in a renewables investment portfolio that now totals $915 million dollars.

The newest solar buy, 88 megawatts in total and scheduled to start service in 2012, is Google’s first U.S. utility-scale PV undertaking, its first participation in a feed-in tariff-based program, which also brings mega-investor Kohlberg Kravis Roberts & Co. (KKR) into that company’s first U.S. sun deal.

Google’s portfolio also includes:

-$75 million in a fund operated by Clean Power Finance (CPF) that will finance 3,000 rooftop solar home installations;

-$280 million in a fund operated by SolarCity that will extend that company’s lease program to some 8,000 new system owners;

-$168 million in BrightSource Energy’s Mojave Desert utility-scale CSP solar power tower facility that will supply 392 megawatts of electricity to California power suppliers SCE and PG&E (following an initial $10 million investment in the company itself);

-a 37.5 percent early equity stake in the Atlantic Wind Connection, a transmission backbone that will ultimately cost approximately $5 billion and deliver 7,000 megawatts of offshore wind-generated electricity from a 2,000-megawatt-capacity, high-voltage, direct-current, 250-mile transmission path between southern Virginia and northern New Jersey;

-$157 million in 270 megawatts of wind being built at the Alta Wind Center in Southern California’s Tehachapi Mountains;

-$100 million in the 845-megawatt Shepherd’s Flat project in Oregon, the biggest on-land wind farm in the world;

-$38.8 million in two North Dakota wind farms with a total capacity of 169.5 megawatts, the first production tax credit deal done after the 2008 economic crash;

-€3.5 million (~$5 million) for 49 percent of an 18.65-megawatt PV solar installation in Brandenburg, Germany.

It is a pretty standard portfolio approach. “We’re investing Google’s capital,” Chokshi said. “We want to make sure we are diversifying.” But “in a more general sense,” he added, “we think we need to invest in a wide range of technologies to get to the ultimate goal which is a clean energy future. That’s going to involve all the clean energy technologies.”

Though some opponents of renewables have tried to do so, there is simply no way to spin this kind of commitment of money and attention as some kind of wavering.

“We remain committed to the sector,” Chokshi said. “We see it both as a business opportunity and as an important sector to support, because as a company we think a long-term, cost-effective supply of renewable energy is critical to our business and to the world. We’ll continue to invest.”