The local unemployment rate has hit 37 percent in recent years. The mummified remains of a murder victim were found in the area in March. Crystal meth is a cottage industry.

But compared to Afghanistan or Bolivia, the Salton Sea just might prove to be an easier place to extract lithium for car batteries and consumer applications. And it's only two-and-a-half hours from San Diego.

Simbol Mining in approximately 18 months will open its first commercial plant and is in the process of trying to demonstrate that its technique for extracting lithium from geothermal wells can provide the metal to battery makers at a lower cost than conventional techniques.

"Lithium from Chile costs around $1,400 per metric ton now," says Josh Green, a partner at Mohr Davidow Ventures, the lead investor in Simbol. "We will be meaningfully below that."

Chile obtains lithium through evaporation in salt pans. Mineral lithium obtained through mining costs around $4,500 a metric ton.

If it works, Simbol could rocket to prominence. The company has discussed its technology before, but only in terms of prototypes and prospective plans. If all goes well, Simbol will come to market at around the same time that major manufacturers and battery suppliers will be laying out plans for a broader expansion of plants to meet demand for electric cars.

Lithium is only one component of a lithium-ion battery pack and the raw material is not necessarily the most expensive ingredient. Battery manufacturers have to invest billions into factories and electronics for controlling battery cells and power consumption.

Lithium, however, is the most volatile ingredient when it comes to pricing. Soaring demand has prompted some to claim that lithium shortages may emerge. While others have countered that -- as the third element on the periodic table -- lithium supplies are adequate, others note that lithium generally gets mined overseas. That means shortages, embargoes and price fluctuations are real concerns.

Relatively recent discoveries of the element in Afghanistan and Bolivia have in some ways made matters worse. The new strikes mean that supplies exist. But the chronic political instability of both nations creates fears that attempts to extract it will raise prices or put pressures on mines in safe nations.

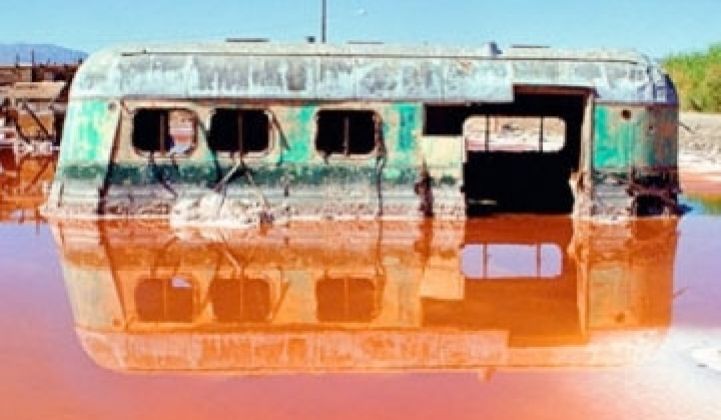

Simbol sucks lithium carbonate out of the flow of water in geothermal wells. Water plunged into the geothermal wells comes back to the surface with 1) heat to create steam for a turbine and 2) traces of lithium from beneath the surface. Zinc, manganese and other elements can also be extracted (picture credit: Extreme Media Studies).

The concept is actually part of a larger greentech trend called resource recovery. Ostara Nutrient Recovery Technologies, one of the early leaders, has created a system that extracts phosphorous and ammonia from human sewage and converts it to a high-grade fertilizer it calls Crystal Green, which should not be confused with Crystal Light powdered drink mix. Companies like 212 Resources and Altela, meanwhile, mine oil from refinery sludge (see also: Eleven Great Things to Do With Sewage).

Five geothermal wells exist in the Salton Sea and there is potential for 50 more wells in the area. The first Simbol plant could be capable of generating millions of dollars' worth of lithium a year, Green said. The region as a whole could ultimately produce billions of dollars' worth of minerals.

The downside? Simbol's mining technique, developed at Lawrence Livermore National Labs, may only be applicable at the Salton Sea. The region has a lithium concentration of 200 parts per million or greater, he added. Although the complete extraction technique may not be transferable to other regions, some of the technology is applicable to lithium operations in Chile, Green noted.

Simbol is one of two subterranean investments at MDV. It also put money into Laurus Energy, which has refined a technique developed in the old USSR to convert coal to gas underground. The technique drastically reduces particulate matter and greenhouse gas emissions by burning the coal in place: only natural gas comes to the surface.

"It's the champagne of fossil fuels," says MDV partner Erik Straser of natural gas.

Earlier this year, Laurus signed a deal with the Cook Inlet Region Inc., a Native American-owned corporation, to build a plant in Alaska.