The aim of stabilizing global temperatures will require enormous investments in renewable energy and energy efficiency in the near term, but these investments are economically feasible and will save society billions in the coming decades, according to a new report from Citigroup.

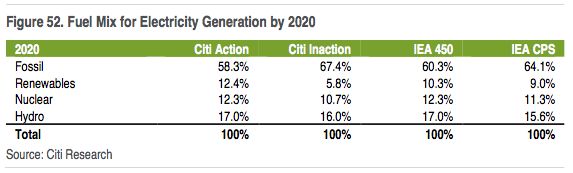

Under an “Inaction” scenario, Citi analysts assumed that in 2040 the electricity sector would remain weighted toward fossil fuels -- roughly 40 percent coal, 22 percent natural gas and 6 percent renewables. Under an “Action” scenario, the share of fossil fuels would decline from today’s 64 percent to 28 percent. At the same time, power consumption would grow at a slower rate thanks to efficiency measures, while solar and onshore wind grow to 22 percent of the electricity mix.

Renewables play a notably larger role in Citi’s view of a lower carbon future than in the International Energy Agency’s 450 Scenario, which sets out an energy pathway consistent with limiting the global increase in temperature to 2 degrees Celsius.

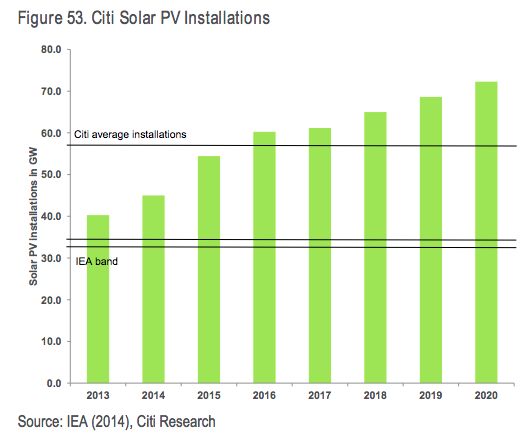

Analysts at Citibank predict global growth in solar could be at least 65 percent higher on average than what the International Energy Agency predicts through 2020. Citi's solar PV forecast shows an average global installation rate of 53 gigawatts per year between 2013 and 2020. The IEA, by comparison, forecasts an average global installation rate of 33 gigawatts to 34 gigawatts per year over the same period.

GTM Research's global PV forecast is significantly higher than both Citi's and the IEA’s, coming in at an average of 75.5 gigawatts per year between 2013 and 2020.

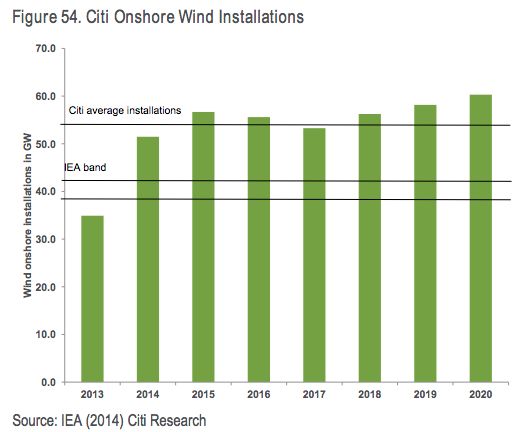

Citi and the IEA also differ in their wind installation projections. Citi estimates that installations between 2013 and 2020 will average roughly 54 gigawatts per year, versus the IEA’s annual average of 38 gigawatts to 42 gigawatts.

The IEA and the United States’ Energy Information Administration are notorious for low-balling renewable energy deployment figures. A recent EIA report projected that all non-hydro renewables will account for only 18 percent of the country’s electricity generation supply by 2040, up from 13 percent in 2013.

Experts at these organizations have been accused of relying upon ill-considered assumptions, and even of being biased toward fossil-fuel interests. This has troubling implications for policymaking, argue Eric Gimon and Sonia Aggarwal of America’s Power Plan. When deployment and cost assumptions are systematically underestimated, it undermines the ability to create smart laws and regulations for the future.

According to Citigroup, decarbonizing the world’s energy mix will involve not only creating new policies, but also innovation in financial markets. That includes new vehicles such as securitized energy-efficiency fixed interest instruments, as well as YieldCos and green bonds.

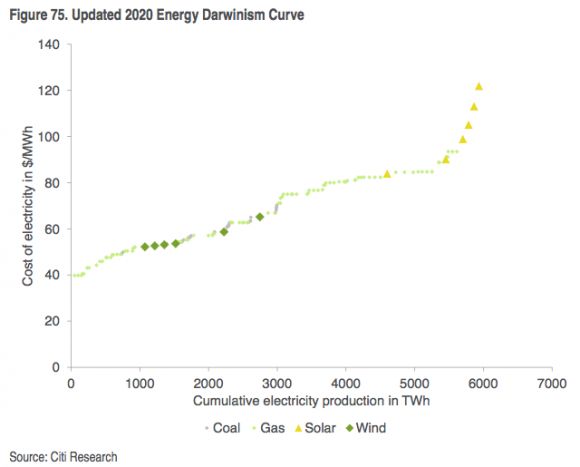

These innovations will help drive down the cost of capital for renewables, making them more competitive. By Citi’s calculations, wind is expected to be fully competitive with conventional fuels by 2020. Better financing conditions are expected to make the cost of solar electricity generation more competitive by 2020; however, global solar prices are still expected to be above $80 per megawatt-hour, according to the report.

Analysts note that adding a carbon price of $50 per ton would quickly bring solar up the cost curve, and coal would be largely priced out. However, a global price on carbon is unlikely to be approved at the United Nations’ upcoming climate negotiations in Paris.

While it will take a concerted effort, transitioning to a carbon-light energy mix doesn’t have to break the bank. Citi analysts determined that their Action scenario would only require spending an additional 0.1 percent of global GDP on energy each year through 2040, compared to the Inaction scenario. The cumulative effect of the extra investment -- to come from both emerging and established economies -- amounts to around 1 percent of current GDP.

The total cost to society would be an additional $1.1 trillion between now and 2040. But while there would be greater spending on renewables and energy efficiency in the early years of the Action scenario, the savings in fuel costs would ultimately offset earlier investments in later years.

Overall, the needed level of investment in energy in the coming decades is staggering, no matter what resources take priority. Citi estimates that between 2015 and 2040, its Action and Inaction scenarios will require spending $190.2 trillion and $192.0 trillion, respectively.

The low-carbon pathway, while more expensive in the near term, will ultimately save $1.8 trillion from greater efficiency and the lack of fuel use from wind and solar.

On an annual spend basis, the returns from incremental avoided costs “are not spectacular,” the analysts write. However, they continue, “in today’s context of low yields, and certainly in the context of potential implications of climate change inaction on society and global GDP, and with the additional benefit of cleaner air, the ‘why would you not’ argument comes to the fore, an argument that becomes progressively harder to ignore over time.”