International Battery builds large-format rechargeable lithium-ion cells, batteries, and systems, and recently marked the first closing of its $35 million Round C financing led by Digital Power Capital, an affiliate of Wexford Capital.

I spoke with International Battery President and CEO Dr. Ake Almgren. In his words, "What makes us different is that we develop and manufacture large-format prismatic lithium ion cells using a water-based manufacturing process. We work with lithium-iron phosphate and lithium cobalt manganese, but we are chemistry agnostic -- we are not an inventor of lithium chemistries."

International Battery (IB) has reached the commercial stage at their manufacturing facility in Allentown, Pa. where they build the prismatic cells. According to Almgren, "There are compelling benefits from the company’s unique, truly large-cell technology.” The IB batteries are not your standard flashlight-sized battery -- they are construction-brick-sized, and that confers some advantages in battery management and control, according to the CEO.

In the CEO's opinion, "Tesla didn't have access to prismatic [technology], but if they were to design their battery system today -- they would use prismatic cells." (In fact, Tesla is looking at prismatics for their current designs from Panasonic and others.)

Almgren further states, "Our large prismatic cells are, depending on size, the equivalent of 20 to 80 of the small wound cells. We don't need to connect and wire these together and we don't lose energy density from needless wires and connectors," also adding: "Fewer connectors equals less thermal issues and reduces the need for forced cooling," and, "We can control and monitor the voltage, current and temperature of each cell to constantly balance the system."

IB's products fall in the 5-kilowatt-hour-to-several-megawatt-hour range, although most are in the 25-kilowatt-hour-to-100-kilowatt-hour size and not suitable for hybrid-parallel passenger cars. IB is going after stationary power, military and transportation applications -- specifically, all-electric buses.

Today's utility-scale energy storage typically uses sodium sulfur (NaS) batteries, with some trials using Li-ion and flow batteries. Algren said that, "at the utility scale, we need 'all-of-the-above technologies,' as well as pumped hydro and compressed air energy storage."

There is a range where Li-ion fits, according to the CEO -- up to about five megawatt-hours. Above that, NaS works best, especially if six-hour charge and discharge rates are acceptable. At the other end of the spectrum, where fast charge and discharge rates are required, e.g., for grid regulation, lithium titanate from Altair Nano is a suitable choice.

Another distinguishing feature for IB is that they build their pioneering large-format prismatic cells with a water-based process, as opposed to an organic solvent. That's a "big deal," according to Almgren. The water-based process is greener, easier to permit, and results in a capex that's cheaper by half and offers a 10 percent to 20 percent reduction in product cost. It is a more difficult process, but the CEO claims that they have "mastered it, although it took substantially longer than expected."

International Battery has built systems for NASA and for the U.S. military, and were selected by utility AEP for its Ohio gridSMART project. They expect to begin the installation in July.

When it comes to lithium-based battery chemistries, there is always talk of a lithium shortage or the U.S. being beholden to China or Bolivia for lithium the same way we are beholden to OPEC for oil. In Almgren's view, "Even in the most aggressive growth scenario -- lithium supplies will not be a problem. It's the more exotic materials like cobalt, nickel and manganese that might be a problem." Access to NMP, a key ingredient in the solvent-based process, might also become a challenge. Simbol Mining is a startup focused on developing lower-cost lithium and extracting other elements from geothermal brines.

"Lithium-ion is getting to megawatt scale," according to Dan Rastler of the Electric Power Research Institute, citing a 1-megawatt, 15-minute Li-ion system. He adds, "There are as many different Li-ion chemistries as there are California wines." There are currently early field trials by Altair Nano and A123 using Li-ion at utility scale.

According to Rastler, "We need to get below $300 per kilowatt-hour installed, all in." He said that the current cost of Li-ion ranges from $400 per kilowatt-hour to $1,200 per kilowatt-hour.

Haresh Kamath of EPRI's Technology Innovation Group said, "Storage is a great idea -- except for the cost." Kamath expects the cost of large-format lithium-ion (for electric vehicles and utility-scale storage) to drop to $250 per kilowatt-hour.

China's BYD is building utility-scale battery-based grid storage from their LiFe batteries. They are deploying 4-megawatt energy storage batteries for ancillary services and energy arbitrage. According to a spokesperson, the battery cost was in the $500-per-kilowatt-hour range, which is within striking distance of many experts' competitive target of $250 per kilowatt-hour.

On a very closely related topic, my colleague Michael Kanellos wrote an article recently (A Survival Strategy for Battery Startups) in which he makes the following point:

"To break into the battery business, startups have focused on designing, manufacturing and selling their own lithium-ion or rechargeable zinc batteries. Unfortunately, it's a high-risk, capital-intensive endeavor that requires scientific creativity and engineering breakthroughs. Most companies fail in the early stages.

And the ones that succeed face even a more daunting task: competing against giants like LG and Toshiba that have extensive R&D teams, worldwide sales channels, strong links with government officials, friends at car companies (they sell chips to automakers already), and factory capacity that could cover several football fields. Plus, they've got the financial resources to allow them to lose billions during temporary downturns."

Other venture-funded battery firms include Lion Cells, Enovix fka MicroAzure (Li-ion), Atraverda (bipolar lead acid), Revolt, PowerGenix, Anzode (zinc chemistries), and other battery technologies: Nanoexa, Infinite Power Solutions, Thin Battery, Carbon Micro Battery, Enfucell. Here's an article on available energy storage technologies.

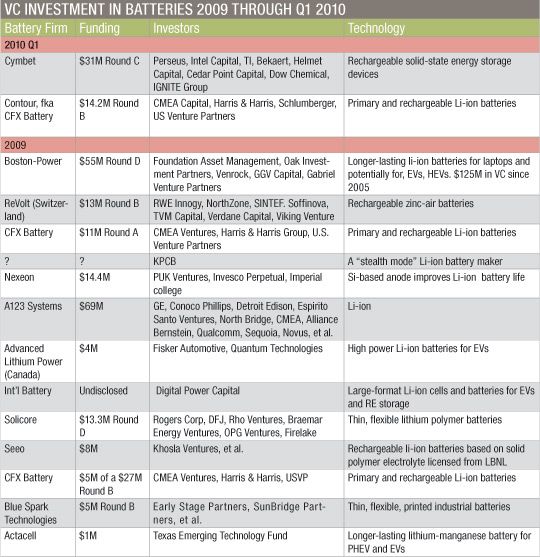

And here's a table listing VC-funded battery firms 2009 through Q1 2010: