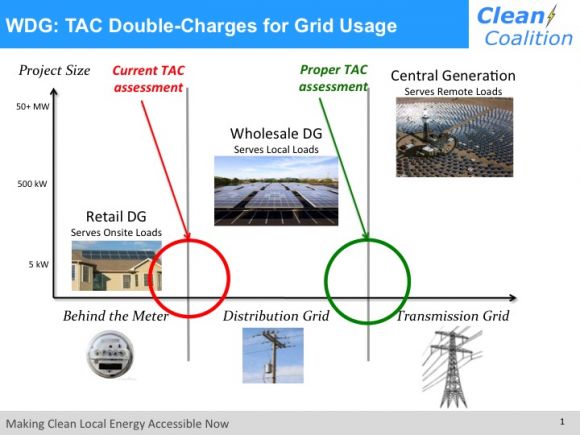

One of the benefits of distributed energy resources like rooftop solar is that they generate power where it’s consumed, and don’t need to use high-voltage transmission lines to transmit power. So why are distributed energy resources (DERs) in California paying for access to a transmission grid they don’t use?

According to the Clean Coalition, it’s because of the state’s outmoded transmission access charge (TAC) regime. TAC adds a charge of about 3 cents per kilowatt-hour to the 20-year levelized cost of energy in the state, or nearly one-third of its typical wholesale power costs, to pay for transmission projects.

But the state’s big investor-owned utilities base their TAC charges on the total amount of power consumed at their customers’ meters -- which means they’re not measuring how much distributed energy is reducing the need for new transmission investments.

This week, the San Francisco-based nonprofit is asking state grid operator CAISO to consider a new approach: simply meter electricity at the point where utilities connect to the transmission grid, instead of each customer, to calculate their TAC costs.

That quick fix, Clean Coalition executive director Craig Lewis said, could help eliminate a “market distortion” that disadvantages distribution-grid-connected solar and other DERs. That’s a big deal for distributed energy projects competing against transmission-connected power for power-purchase agreements and other long-term contracts, he said.

It could also serve as an important counterweight to the changes coming to the state’s net metering regime, Lewis said in a Monday interview. Right now, California’s investor-owned utilities are asking regulators to reduce how much money net-metered customers get for their solar power, from the current retail rate to much lower rates based on how much energy they export to the grid.

But none of them are proposing to credit net-metered solar for their effects on reducing transmission costs, he said. In that context, “3 cents is something between a 50 percent and 30 percent adder to what utilities are saying local renewables are worth to them. That’s huge.”

TAC-ing on the benefits of distributed solar

The Clean Coalition’s proposal will be filed this week as part of a CAISO proceeding to expand its energy imbalance market to out-of-state utility-grid operators including PacifiCorp, NV Energy and Arizona Public Service. Friday is CAISO's deadline for taking comments on different options for reconfiguring its TAC regime.

“The first thing we have to get CAISO to do is to agree that they’re going to address this,” he said. The Clean Coalition already filed a brief with CAISO in September (PDF), laying out the problems with today's TAC regime and how it could be fixed. This week’s filing will take the next step of formally asking CAISO to alter its tariff language to assess TAC on a utility’s transmission load.

“If it’s going to be addressed in the near term, it’s going to have to be in this energy imbalance market proceeding,” he said.

CAISO only calculates TAC costs at the customer meter level for California’s big three investor-owned utilities -- Pacific Gas & Electric Southern California Edison, and San Diego Gas & Electric -- because they own part of the state’s transmission grid, he said. That makes them “participating transmission owners,” or PTOs, in contrast to municipal utilities, which now pay TAC charges based on their draw from the transmission system.

That means these non-PTO utilities, such as Palo Alto’s municipal utility, have an incentive to encourage distributed energy as a way to lower their TAC costs, he said. Clean Coalition’s proposal will essentially create the same situation for the state’s IOUs, he said.

If that happens, new wholesale distributed energy projects will be able to demand that utilities calculate their reduced TAC charges as part of their value, under their “least-cost, best-fit” rules for bringing new renewable energy to the grid. “You just calculate what that TAC charge will be, and it becomes another valuation in that local renewables calculation.”

On a broader policy front, the change Clean Coalition wants will help reveal a clearer picture of the cost of new transmission projects in the state. That’s because taking locally generated energy out of the equation will force CAISO to increase the per kilowatt-hour rates it charges whatever energy remains.

“The existing transmission costs will still be spread around. The overall revenue requirement will still be the same,” he said. “What will change is that the cost of transmission will be divided by a smaller denominator,” which means “that transmission access charge will be higher than it is right now.”

That sounds like a bad thing. But Lewis says it should actually make the additional costs of transmission infrastructure a lot clearer, and help reduce the number and costs of new projects in the future. Because TAC costs are paying for both existing and future projects, that should eventually lead to lower TAC costs over the years, he said.

Of course, transmission grid investments are a big capital cost for utilities -- and utilities like capital costs, because they earn a fixed rate of return on them. Likewise, adding a value to net-metered solar might work counter to utilities' desire to reduce how much they pay customers for the energy they self-generate.

These are some of the reasons Lewis expects utilities will resist the TAC changes the Clean Coalition is proposing. “Transmission is a cash cow for utilities, and we’re putting transparency, fairness and consistency into place," he said.