The last few greentech IPOs and IPO aspirants have generated mostly disappointment.

BrightSource Energy, Luca Technology, and Enerkem filed but withdrew their public offerings. Enphase, the photovoltaic microinverter company, made it through the IPO window, but the company's stock is trading at $4.96 as of today -- well below its opening price of $6.00 per share.

Maybe a "sort-of-greentech" company like iWatt could breathe some life into this sector and the IPO market.

IWatt is a Campbell, Calif.-based provider of power management ICs that just filed for a $75 million IPO. Here's the link to S-1 registration document filed with the SEC.

Unlike many companies in the greentech sector, iWatt had actual net income in 2011 on substantial sales of a real product, non-dependent on government subsidies.

IWatt makes ICs and controllers for markets such as AC/DC power conversion, LED solid-state lighting, and LED display backlighting. The firm has shipped "more than one billion power management ICs since 2007, including more than 400 million ICs in 2011," according to the SEC filing.

The firm's technology allows it to play in the emerging LED lighting market -- a looming high-growth field -- and looks to expand into higher power applications such as household appliances. IWatt has devised a driver for LEDs that effectively lets a manufacturer eliminate another component called an opto-coupler. The thrust of the iWatt product line is to make devices such as lighting sources, tablets, and TVs consume less power -- and that certainly qualifies for the energy efficiency sector of greentech. Most of the firm's business to date has been in the AC/DC power conversion field rather than lighting.

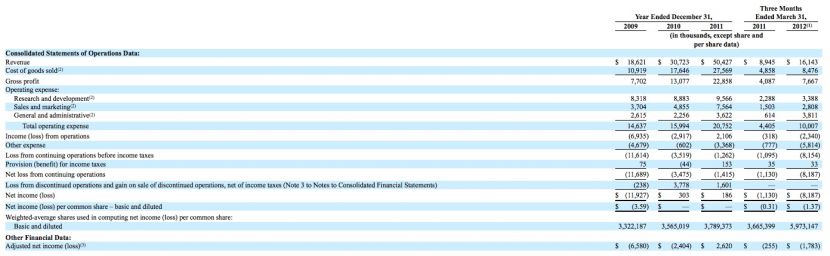

The company grew its revenue from $18.6 million in 2009 to $50.4 million in 2011 and generated revenue of $8.9 million and $16.1 million for the three months ended March 31, 2011 and 2012, respectively. The firm had a net loss of $11.9 million in 2009 and generated net income of $0.2 million in 2011 with a net loss of $1.1 million and $8.2 million for the three months ended March 31, 2011 and 2012, respectively.

IWatt's end customers include Apple, Philips, Cree, and Konka. A significant 18 percent of the company's revenue came from Apple in 2011.

Shareholders include VantagePoint Capital Partners (with a 39 percent stake before the IPO), Sigma Partners (30.7 percent), Horizon Ventures (8.7 percent) and 7 Capital (7.3 percent).

(Click to enlarge table)