The global credit crunch is hitting the solar energy market at a time when solar cell and panel makers have to place bets on new markets.

Germany has been the top solar energy market thanks to a reliable feed-in tariff program that requires utilities to pay high prices for solar energy. But it's a maturing market with about 1.5 gigawatts of solar power capacity by the end of 2008, and is likely to hit the limit at 3 gigawatts to 4 gigawatts, said Travis Bradford, president of the Prometheus Institute, at Greentech Media's Surviving the Shakeout conference in Phoenix on Tuesday.

Germany's program costs the ratepayers in Germany €300 to €500 per household per year, he added.

"That can't be left unchecked," Bradford said, noting that some German politicians had unsuccessfully pushed to significantly shrink the feed-in tariff program last year. The proposal was to slash the solar electricity rates by as much as 30 percent, which caused no small amount of fear among solar panel makers from Europe, the United States and Asia. Lawmakers ultimately lowered the rates to about 10 percent (see Solar Prices Set in Germany).

Spain also proved to be a gold mine – but that was in 2008. The country has dramatically cut its feed-in tariff program, leaving solar panels makers eyeing Greece, Italy and the United States as the next hot markets.

Bradford, along with GTM Research's senior analyst Shyam Mehta laid out the global solar market landscape and players at the conference. Here are the highlights:

- The United States "may be the greatest global hope for the PV industry," Bradford said. The series of federal tax breaks and grants, along with many state-centric incentive programs, have made the country a magnet for equipment makers in Europe and Asia.

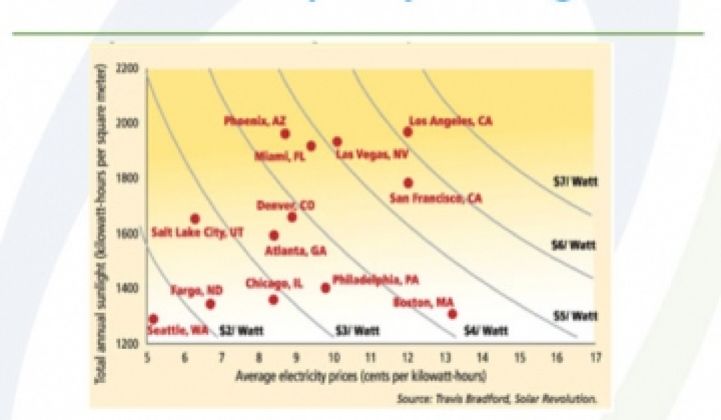

- Bradford cited a study by the National Renewable Energy Lab, which showed that nearly half of the 1,000 cities in the country could produce solar energy at the same cost as conventional power by 2015, if you factor in the 30 percent federal investment tax credit and the projected declines of solar panel prices.

- Companies that can make solar energy equipment cheaply will have a better chance to stay in the market, of course, Mehta said. Many thin-film solar producers make that low-cost claim, but only First Solar has delivered in volumes.

- Solar panel prices have declined around 5 percent per year. The average selling price for crystalline silicon panels, the most common panels found on the market today, are expected to reach a little over $2 per watt in 2010 $3.40 in 2008. The average selling price for thin-film panels, including all types of technologies, is expected to reach between $1.5 and $2 per watt in 2010 from $2.50 per watt in 2008.

- The costs of buying and installing the components that go into a solar energy system have come down quicker than the prices for the solar panels in the last four to five years, Bradford said. The growth of large-scale installations on the ground (as opposed to rooftop systems) has contributed to the decline.

- There are a growing number of companies that only recently began to produce amorphous-silicon panels. The challenges for this sector include the high upfront capital costs and low efficiencies – the rate at which the panels can convert sunlight into electricity, Mehta noted. Driving down the manufacturing costs will be key for these companies when their panels can't be as efficient as other types of thin-film or crystalline silicon panels.

- The polysilicon shortage is no longer a problem, Bradford said. There are no supply problems for companies making thin-film solar panels, which don't use a lot of silicon or alternative materials for converting sunlight into electricity.