At GTM Research we profile the top vendors across the smart grid market in our annual report, The Networked Grid 150: The End-to-End Smart Grid Vendor Ecosystem Report and Rankings 2013, paying particular attention to product portfolios, market positioning and the likelihood of growth and sustainability. In 2013, having ranked top vendors according to our methodology and awarded innovation awards to vendor products across the energy value chain, we wanted to highlight a key trend that we are seeing emerge across vendors that compete in this market: diversification. As we look at where companies that we profile are operating, we see increased activity away from vendors' traditional core competencies into new market segments. This is an important trend to track, as very often vendors in this marketplace can be categorized as operating across a broad market with very different characteristics associated with each segment.

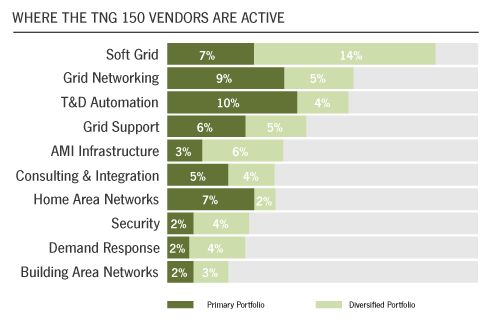

For example, vendors that have a primary product portfolio in transmission and distribution automation (e.g., transformers, circuit breakers and distribution equipment) will very often operate in the soft grid side of the smart grid value chain as well (e.g., energy management software, grid analytics and monitoring). The diagram below, from our analysis of the TNG 150 companies, shows where the vendors profiled in our report are active and the areas into which vendors most commonly diversify. The largest area of diversification by far is the software space -- for example, 14 percent of vendors that operate in the soft grid market have diversified into that segment from another smart grid segment.

Source: The Networked Grid 2013

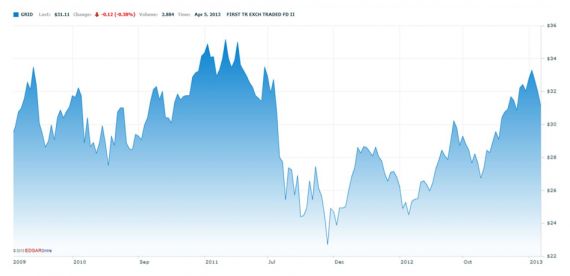

What all this points to is that companies that are successful in the smart grid market are increasingly operating across multiple segments and diversifying their products and services at a rapid clip. It also highlights that in order to maximize revenues in a difficult sales and economic environment, companies are having to rethink their traditional go-to-market strategies. To highlight these drivers toward product diversification, we need look no further than the financial performance of some of the larger publicly traded smart grid companies over the past four years. One way to do this is to examine the NASDAQ OMX® Smart Grid Infrastructure Index, which is an exchange-traded fund that provides a useful high-level benchmark for the smart grid sector.

FIGURE: NASDAQ OMX® Smart Grid Infrastructure Index

Note: Click on image above for link to larger version

Source: NASDAQ

The index includes over 30 companies ranging from smart grid "pure plays" to “diversified companies”, and tracks vendors such as ABB, Alstom, EnerNoc, Melrose, NGK Insulators, Siemens AG and Wasion Group Holdings LTD (all of which are included in the TNG 150). If we look at the performance of this index alone since 2009, we see that since November 2011 (when stock in this tracker fell to an all-time low), it has since been on a recovery path to earlier highs (+ $33.00 USD). While early performance of the tracker may be directly linked to the adoption of U.S. stimulus dollars and favorable regulatory programs, we are seeing diversification of product offerings, internationalization, and regulation as the key elements to helping companies carve out a more sustainable marketplace. Companies in this index and in the smart grid market at large acknowledge that moving beyond traditional smart grid growth in a rapidly changing sector is going to be critical for improved performance. Indeed, how smart grid companies capitalize on external innovation is going to be a competitive advantage not only for individual company growth but for the industry at large. With this in mind, we wanted to talk about some of the key diversification trends we are seeing in this year’s TNG 150 report.

Successful “grid giants” diversify across the value chain

At GTM Research, we classify Siemens, GE, Alstom and Schneider Electric as some of the “grid giants,” as they are often recognized as the key suppliers of transmission and grid modernization hardware products the world over. However, it is clear that these vendors and their competitors operate in a cyclical market segment that is often tied directly to economic growth and national GDP in particular. Given the recent economic uncertainty and the ever-present long sales cycles associated with large, capital-intensive infrastructure upgrades, focusing R&D dollars on IT infrastructure and purchasing companies in the software-related space is allowing these firms to compete effectively across the value chain and diversify their revenues. Indeed, that’s the key strategy behind GE’s “industrial internet” concept, Schneider Electric’s purchase of Telvent, and Siemens’ purchase of eMeter.

In fact, GE’s new strategy as a back-end IT services player with its Grid IQ suite is also coupled with the announcement earlier in 2012 that the company sought diversification of its Grid IQ Respond platform, and as a result, its smart grid customer base. Beyond the grid, this diversification from hardware to software is also apparent in the metering space, where market leader Itron is taking time to rebrand itself as much more than just a metering company; it aspires to be a global technology company. This corporate mission is certainly a push to become market leaders and expand revenues in the automation software and meter data management space. In an industry dominated by the rhetoric of big data and where a plethora of new intelligent hardware and software applications are coming on-stream, expanding revenue streams at this stage of the market is going to be a key success factor for large players -- and that is a trend that is playing out.

Successful smart grid startups diversify their customer bases

Looking outside the larger publicly traded smart grid vendors, it is worth mentioning that a great deal of innovation and activity is still apparent in the smart grid startup arena. Take, for example, the distributed generation market, where energy storage is often seen as the holy grail, and vendors such as Xtreme Power are shifting their business models to focus on core competencies, indicating a sophistication of the value chain in that space. By letting go of the most capital-intensive part of its business -- building, selling and financially backing its batteries -- and focusing on the software side of the market, Xtreme will be able to maintain a competitive position in the marketplace and perhaps even find a quicker route to profit. Indeed, this strategy may allow Xtreme to diversify into non-battery-related storage areas and focus on distributed generation management at large. In 2012, more than 80 percent of all dollars invested in the smart grid market went to companies that by and large operate outside of the regulated utility industry.

The three sectors that saw the most dollars were energy efficiency, transportation, and energy storage, while the more clearly defined smart grid segments, including communications, distribution automation, transmission, energy management and software, received $200 million. This trend clearly indicates that startups in the smart grid space need to diversify their customer bases early so that they play in both a regulated and unregulated market. In 2013 and beyond, expect to see opportunity for startups in the analytics space. Indeed, the $14 million investment in situational awareness and analytics solutions provider Space-Time Insight in late 2012 is a great indicator of where opportunities for startups exist across the value chain. Companies that are hardware-agnostic, focus on software and analytics solutions capable of providing real-time intelligence, and diversify their customer base outside of utilities are proving to be most successful in this space.

Successful smart grid vendors consolidate their positions by diversifying internationally

Of course, as in any industry, expanding internationally is a key source of new revenues; however, this is particularly pertinent in the smart grid industry. For the companies that we track in the TNG 150, we noted that 2012 saw the biggest year of M&A on record for the industry, with three key deals. Eaton bought Cooper Industries for $11.8 billion, U.K. investment company Melrose PLC bought Elster for $2.3 billion, and Blackstone bought Vivint for $2 billion. Outside of these deals, however, we saw a whole host of international-expansion-focused investment. In Japan, we have seen firms access a $100 billion national program to encourage private sector firms to exchange yen funds for foreign currencies. Toshiba accessed this facility for its $2.3 billion acquisition of Landis+Gyr.

Indeed, as margins diminish in European and North American markets, expect to see vendors look to Asian and Latin American markets for growth, where some of the biggest global opportunities are now emerging. These factors are undoubtedly going to continue to contribute to increased partnerships, acquisitions and alliances in the industry. Furthermore, this focus on international markets as a source of sustainable advantage is not just confined to smart grid vendors, but also to power providers. For example, last month, Spanish power giant Iberdrola’s Chairman Ignacio Galan announced, "Despite the difficult environment, Iberdrola has succeeded in becoming one of the few European companies in its sector to have maintained earnings and shareholder remuneration for five years now." The key to this success? A strategy of international diversification which in 2012 saw 70 percent of net earnings obtained outside Iberdrola’s home nation of Spain.

As we are at the early stages of the smart grid market, and as market segments and technologies mature at different speeds globally, we are going to see vendors and power companies compete on a range of factors. This is made even more apparent by the slower sales cycles associated with the utility industry. The smart grid landscape is diverse, vendors are moving horizontally and vertically on the value chain, and the opportunities are large. Of the 155 vendors profiled in the report, 60 percent are private companies and 40 percent are public companies, with 74 percent based in the U.S. and 26 percent internationally based. To see a complete list of the top 150 smart grid vendors that are included in our latest report, and the theme of market diversification among vendors bought to life, please download the report's summary brochure by clicking here.

To learn more about the report and to purchase today, please contact Tate Ishimuro at [email protected], or visit: http://www.greentechmedia.com/research/report/the-networked-grid-150-report-and-rankings-2013.