It is clear, from the talk at the American Wind Energy Association (AWEA) Offshore Windpower 2012 in Virginia Beach, Virginia, that an offshore wind energy revolution is in the offing.

Europe has over 4,000 megawatts of installed offshore wind capacity, 150 gigawatts in planning and is expected to build at least 1,000 megawatts per year through 2020. The U.S. has none built but has some fifteen pilot, research and utility-scale projects of about ten gigawatts planned.

AWEA Public Policy Senior Vice President Rob Gramlich summarized the many ways U.S. offshore wind is nearly ready to step up.

First, Cape Wind, the U.S. banner carrier, having passed all its regulatory hurdles, just announced the buy of a Falmouth, MA, O&M facility as it readies for planting Siemens (NYSE:SI) turbines in the Nantucket Sound seabed. It even, finally, got the approval of a Kennedy when Congressional candidate Joseph Kennedy III broke with the Hyannis Port elders and endorsed the 468-megawatt project off Cape Cod.

Fishermen’s Energy, a consortium of actual fishing industry veterans committed to the future of ocean commerce and a much bigger catch, got over its federal and state regulatory hurdles and began readying a pilot project for construction off Atlantic City.

Deepwater Wind is very near going into the water with its small Block Island Wind Farm off the coast of Rhode Island, a proof-of-product project for a company that is planning thousands of ocean-wind megawatts.

The U.S. Department of the Interior (DOI) issued Findings of No Significant Impact (FONSIs) for much of the Mid-Atlantic Wind Energy Area (WEA), opening the New Jersey, Delaware, Maryland, and Virginia coasts to streamlined permitting.

DOI also issued Determinations of No Competitive Interest (DONCIs) for the Google (NASDAQ:GOOG)-backed Atlantic Wind Connection (AWC) and the Deepwater Wind Block Island offshore transmission systems, streamlining the building of the infrastructure needed to deliver the power to population centers along the Eastern seaboard.

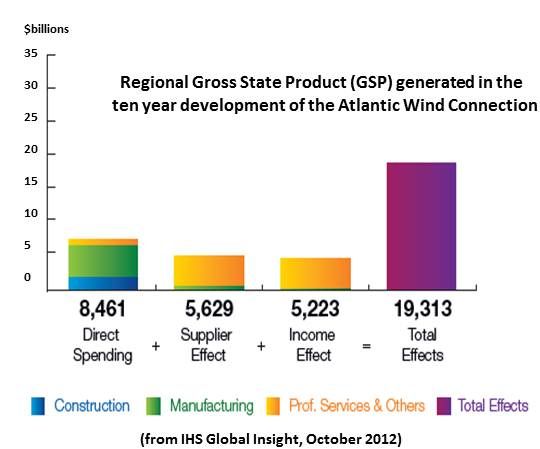

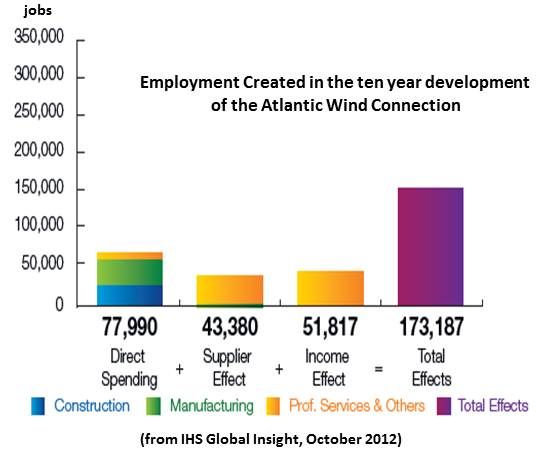

Consulting firm IHS Global Insight (NYSE:IHS) just released a study of the economic benefits that would accrue from the AWC, a 6,000-megawatt capacity backbone transmission system being built by Atlantic Wind Development, a partnership between Google, Inc., Bregal Energy, Marubeni Corporation (TYO:8002) and Elisa System Operator.

The AWC will run some 300 miles, from New Jersey to Virginia, twelve to fifteen miles off the Atlantic coast, and will connect projects capable of harvesting roughly 7,700 megawatts of the region’s University of Delaware-estimated 330 gigawatts of potential.

During AWC’s ten-year build-out, according to the report, the region can expect 173,000+ job years (77,000+ direct offshore wind industry job years, 44,000+ supply chain worker job years, and 51,000+ induced job years). It would create a $19-billion-plus increase in the region’s Gross State Products and increase federal, state, and local revenues by $4.6 billion.

U.S. Department of Energy (DOE) Wind and Water Power Program Manager Jose Zayas reported that DOE has committed $180 million to an Advanced Technology Demonstration Projects Initiative that will support the construction of the first generation of offshore projects.

Representatives for the Governors of Virginia and New Jersey described their states’ ocean wind resources, transmission systems, harbor infrastructures and eager blue-collar workforces, adding their bids to the one made last year by Maryland, when the conference was in Baltimore, to be the Eastern seaboard’s offshore wind development center.

Offshore Wind Development Coalition President Jim Lanard noted a poll done by Republican New Jersey Governor Chris Christie’s pollsters that found “landslide numbers” of support from both Democrats and Republicans for offshore wind. Construction of the first U.S. offshore projects is, Lanard predicted, “right around the corner.” The regulatory advances allowing leases to go forward in the Mid-Atlantic WEA “is the first step in driving down price,” Lanard said, “by opening development to competition.”

Price, he acknowledged, is a sticking point. Cape Wind’s power purchase agreement (PPA) price of almost 19 cents per kilowatt-hour would be acceptable in few other states and only got approved in Massachusetts because the Department of Public Utilities ruled the benefits of meeting peak demand and the state’s renewables mandate outweigh that high cost.

Economies of scale, Lanard said, will bring the cost of offshore wind down, just as it brought down the cost of computers, cell phones and solar panels. But, he added, that will take time and federal and state policy support. In Europe, he admitted, the price has gone up even as the sector has scaled because, he explained, demand for everything in the supply chain from cables to vessels has increased.

Both Gramlich and Lanard are hopeful that after November 6, when the politics of passion simmer down, an extenders bill like the one recently passed by the Senate Finance Committee that includes extension of onshore wind’s production tax credit and offshore wind’s investment tax credit will find its way through Congress.

Longer term, Lanard said, floating wind will bring aboard states on the Pacific coast, where the continental shelf is too deep to build into the seabed. California Governor Jerry Brown, Lanard added, is especially anxious to seize that economic opportunity.