Determining the value of a Nest thermostat appears to be a straightforward process -- simply compare the costs of purchase and installation against the total energy cost savings.

However, this equation doesn’t account for an increasingly popular and potentially disruptive business model: the bundled energy efficiency/electricity supply contract.

About the Nest Thermostat

The Nest thermostat is the most publicized hardware to hit the residential energy efficiency market in recent memory.

Nest saves residential customers money on their heating and cooling costs through automatic optimization of HVAC scheduling. Nest estimates that a typical U.S. home (averaged across all ZIP codes) can save $173 per year in heating and cooling costs. With the Nest retailing for $249, customers stand to pay back their investment cost in less than two years, with all additional savings counting as positive investment returns.

Additionally, customers of more than a dozen utilities can reduce an already short payback time by receiving cash rebates of between $20 and $100 to subsidize the purchase of the Nest. Utility rebates and incentives for energy-efficient equipment are a well-established and widely deployed strategy; according to the U.S. Energy Information Administration (EIA), utilities invested $2.37 billion in energy efficiency rebates and incentives in 2011.

Utility rebates, like the ones offered for the Nest thermostat, are an important strategy in spurring adoption of energy-efficient products. However, customers choosing utility rebates are ultimately limited by their location, and as such, they cannot seek out the best rebate offered on the market.

The lack of choice that customers face in terms of energy-efficiency rebates is rapidly dissipating, and the energy efficiency industry is set to radically change.

Bundled Energy Efficiency/Electricity Supply Contracts

In thirteen states including Texas, New York, and Pennsylvania, as well as in Washington, D.C., electricity customers have the option to purchase electricity supply from a group of power marketers instead of from their utility. The utility still owns and operates the poles and wires delivering electricity from power plant to customer, but in a competitive market, customers can choose the power marketer from which they would like to purchase their electricity.

This increased choice enables customers to have many contract options: paying a guaranteed fixed price for several years, buying electricity based on monthly natural gas prices, purchasing 100% renewable energy, etc.

In the case of Reliant Energy and Green Mountain Energy, two major power marketers operating in Texas, customers can receive a Nest thermostat free of charge (effectively a $249 rebate) as part of an electricity supply contract.

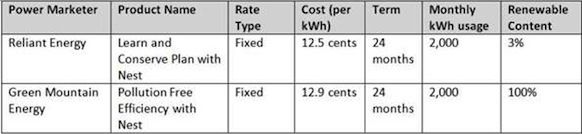

Residential customers using 2,000 kWh per month in Houston (CenterPoint Energy is the utility) can choose from the following options:*

*Pricing information was collected on May 28, 2013. Pricing includes 3.5 cents of transmission and distribution charges that are passed through by CenterPoint Energy.

CenterPoint Energy customers interested in receiving a free Nest thermostat have the ability to choose between these two electricity contracts to fit their preferences.

The story gets more nuanced when comparing the Nest supply contract options from Reliant and Green Mountain with the other electricity contracts offered by these power marketers.

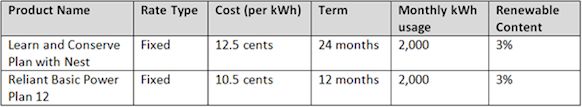

Customers choosing Reliant electricity pay a 19% premium for each kWh to upgrade from Reliant’s Basic Power Plan 12 contract to Reliant’s Learn and Conserve With Nest contract.

Comparison of Reliant Energy’s Electricity Products for Residential Customers in CenterPoint (Houston) transmission and distribution service area:

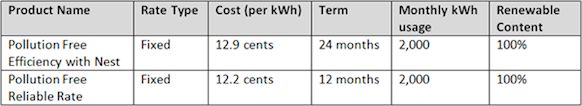

Customers choosing Green Mountain electricity pay a 5.7% premium for each kWh to upgrade from Green Mountain’s Pollution Free Reliable Rate contract to Green Mountain’s Pollution Free Efficiency with Nest contract.

Comparison of Green Mountain Energy’s Electricity Products for Residential Customers in CenterPoint (Houston) transmission and distribution service area:

What Is the Nest Thermostat Worth?

- For an electricity customer in Houston, the answer depends on her electricity supply preferences (Reliant’s 3% renewable energy or Green Mountain’s 100% renewable energy). A customer choosing Reliant’s electricity supply option with Nest must save more than three times as much energy with Nest to justify the added expense of the Nest thermostat, when compared to selecting Green Mountain’s electricity supply option with Nest. To be fair, in absolute terms, Reliant’s electricity supply contract with Nest is 0.4 cents per kWh cheaper than that of Green Mountain.

- For power marketers that will lose revenue with a customer to whom they sell an energy saving device, the answer depends on the value of the Nest in attracting additional customers, and the impact of the Nest on electricity sales. For Reliant, these deliberations have resulted in a 28.6% supply cost premium, while Green Mountain Energy has chosen a 8.0% supply cost premium. Supply cost premiums quoted here are higher than the price premiums paid by customers because the customer pays 3.5 cents per kWh to CenterPoint Energy; the power marketers pass through these charges and only collect revenue on the supply cost (9 cents/kWh for Reliant and 9.4 cents/kWh for Green Mountain).

Power marketers are increasingly offering energy efficiency bundled with their electricity supply in both the residential and commercial markets. The competitive nature of the power marketing business gives customers choice, and market influence, in selecting energy-efficient equipment that lowers their total operating cost.

The bundled energy efficiency/electricity supply contracts business model is reshaping not only the way we determine the value of an energy efficiency control device such as the Nest, but also the way we look at the value of energy efficiency.

So, how much is energy efficiency worth?

It depends on how you buy your electricity. Increasingly, the choice will be yours.

***

Corey Benson is a Business Development Analyst at Joule Assets, Inc., an energy market analysis tool and financing provider.

Editor's note: This article is reposted in its original form from Breaking Energy.