The three major investor-owned utilities (IOUs) in California are well on their way to meeting their obligations to provide a third of their power from renewable sources by 2020. As a result, they and the California Public Utilities Commission (CPUC), their regulators, are no longer thinking only about the quantity of the renewables they want. They are starting to think more carefully about the quality of the renewables and how they will fit into utility portfolios.

As of May 2012, according to the CPUC, Pacific Gas and Electric (PG&E) had procured renewables capacity equal to 20.09 percent of its 2011 electricity. San Diego Gas and Electric (SDG&E) had procured 20.80 percent, and Southern California Edison (SCE) had 21.07 percent. At recent conferences in San Francisco, San Diego, and Phoenix, renewables investors repeated, off-the-record, that the IOUs may have as much as three-quarters of their 2020 obligations under contract.

To determine the best economic choices to fill out the remainder of the renewables portfolio, the CPUC is considering a new formula. In his April 5 Rulemaking, Commissioner Mark Ferron described a redefinition of the 2004 “least cost, best fit” formula for capturing the full range of costs and benefits of renewables selected to meet the RPS.

In it, the Net Market Value (R) of a generation source is defined as [Energy Value (E) + Capacity Value (C)] – [Post-Time-of-Delivery Adjusted Power Purchase Agreement Price (P) + Transmission Network Upgrade Costs (T) + Congestion Costs (G) + Integration Costs (I)].

For an Adjusted Net Market Value (A), the CPUC would sum that Net Market Value (R) and Ancillary Services Value (S).

There is not yet agreement on what these terms entail. Scientists and researchers at places like the National Renewable Energy Laboratory (NREL) and Lawrence Berkeley National Laboratory (LBNL) are still helping to better define and quantify the factors most useful in planners’ decision-making processes.

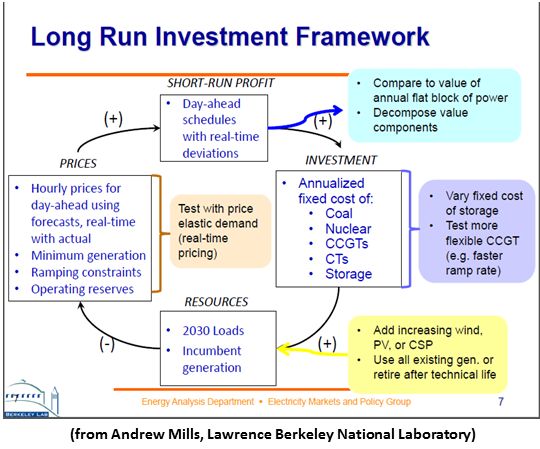

“What the CPUC might be trying to do there,” speculated LBNL’s Andrew Mills, is formalize the “least cost, best fit methodology used for procurement” and to “look at those individual components and make sure they’re using the best approach for quantifying them.” Those components, Mills said, include benefits like capacity value and energy value and costs like transmission upgrades and integration of variable renewables.

The term 'capacity value,' he explained, is an attempt “to quantify the ability of a resource to avoid the need to build other peaker plants.” A peaker plant, he said, is built to supplement generation at peak demand periods. It is “the resource you would build if you need something that just provides capacity [and] the ability to meet peak loads.”

Resources that reduce the need to build fossil-fueled peaker plants provide capacity benefit and therefore have capacity value, Mills said.

In explaining the value of BrightSource Energy’s concentrating solar power (CSP) plants with thermal energy storage (TES) capability, the company's Vice President for Government Affairs and Communications Joe Desmond described a 2006 California “heat storm” during which “the California ISO reached its all-time maximum demand” and had “about 3,000 megawatts of wind available,” but “the amount of wind delivering electricity into the system when it hit its peak demand was 1 percent.”

Desmond was attempting to characterize CSP with TES as valuable but some in wind thought he made wind’s contribution sound trivial, whereas, Mills pointed out, it was delivering 30 megawatts of capacity value at the time. Because a small peaker plant might be no more than 50 megawatts, that contribution from wind avoided 60 percent of the cost of building one.

Mills’ calculations would suggest to planners, however, that Desmond might have a point about CSP with TES being more likely to provide a higher capacity value.

“Energy value,” Mills said, “is thinking more broadly about the entire year.” It asks the value of the fuel saved when renewables generation allows the backing off of power plants.

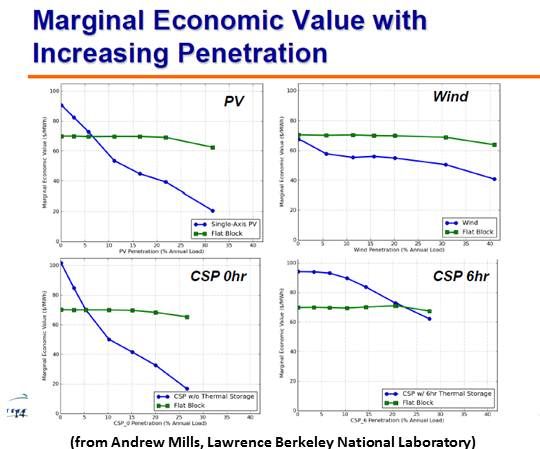

Mills’ work has focused not only on quantifying these values but also on understanding how they change with increasing penetrations into a transmission system’s overall portfolio.

The challenge, Mills said, is in making procurement decisions. That should include the benefit of renewable resources as defined in the least cost, best fit methodology. But it must also consider the levelized cost of electricity (LCOE) for those resources.

“There has been a tendency to compare only on an LCOE,” Mills said. “It’s the combination of those two that you can use.”

At zero percent penetration of PV with a hypothetical value of $90 per megawatt-hour and a cost of $100 per megawatt-hour, Mills said, “the renewable premium, or what the PUC is calling Net Market Value is in the range of $10 per megawatt-hour.”

A CSP plant might provide the same value of $90 per megawatt-hour, but a hypothetical cost might be more like $200 per megawatt-hour. Then, he said, “the renewable premium is $110 per megawatt-hour.”

Useful definitions and the relative importance of components in the procurement equation like energy value, capacity value and transmission costs are emerging, Mills noted. But much uncertainty remains.

“Rather than say that you should change your portfolio and only go with wind or solar, we’re trying to draw attention to these issues,” Mills said. “We’re a couple of levels back from saying you should adjust your procurement, at the level of saying you should adjust where you’re focusing your analysis.”