“Gut-wrenching times” is how Tom Carnahan, the CEO of Wind Rose Energy and the incoming Chair of the American Wind Energy Association (AWEA) described what the industry is now living through in his speech at WINDPOWER 2012, the industry’s annual conclave.

The convention’s two biggest concerns were the failure of Congress to extend the industry’s 2.2 cents per kilowatt-hour production tax credit (PTC) and the intimidating competition from logic-defyingly low natural gas prices.

Carnahan's discouraging words brought worried expressions to the larger-than-usual number of youthful faces exploring the future of power generation, but did not darken the spirit of industry veterans and leaders who transformed wind over the last decade from an alternative energy to a mainstream source of power that has provided the U.S. with a third of all new generation capacity installed annually for the last five years. Industry stalwarts like GE and ABB and rising stars like Suzlon and Goldwind USA continued to announce new technologies and newer deals.

_540_449_80.jpg)

It was impossible to keep up with the remarkable range of innovations and opportunities the industry offered at the Atlanta convention, even as it faced the loss of the PTC, its most important incentive, and the emergence of enmormous new supplies of natural gas that are driving its price down and creating fierce competition for all sources of electricity generation.

Several panels were about the implications of the hydrofracking-facilitated ascendance of natural gas. As long as natural gas remains below $3 per MMBTU, it was broadly concluded, wind cannot compete. But, most also agreed, market pressures -- including the demand for liquefied natural gas for export -- are bound to drive the price above that threshold and facilitate the development of a new supply partnership between gas and renewables, especially wind.

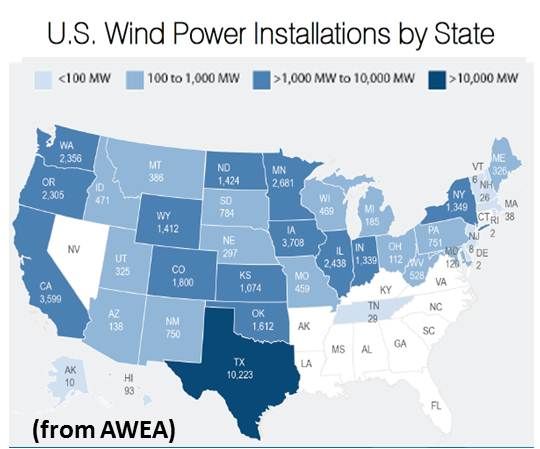

The wind industry’s transmission engineers, who a few years ago were working on the implications of a national power grid, are now obsessed with the challenges of integrating wind and other renewables into local transmission and distribution systems. California is preparing to get a third of its power from renewables by 2020. South Dakota and Iowa have sporadically obtained 20 percent of their power from wind, and, in Colorado, Xcel is at times getting up to half its supply from wind.

Much of the chatter at the Atlanta convention, the first southeastern WINDPOWER ever held, was of U.S. wind makers preparing to pioneer the nation’s last under-developed region. Newly designed, taller, longer-bladed, more powerful turbines will harvest the moderate winds said to be a potential economic boon for the South.

China’s wind makers are moving into Latin American, African and Central Asian markets, while the Chinese government is boosting the domestic industry by building the world’s longest and largest high-voltage direct current (HVDC) capability.

China is also preparing to move to offshore wind in big numbers. And Cape Wind, the controversial first U.S. offshore project, completed what may be its last significant public challenge when hearings on the NSTAR PPA, which covers the bulk of Cape Wind’s remaining uncommitted output, recently concluded.