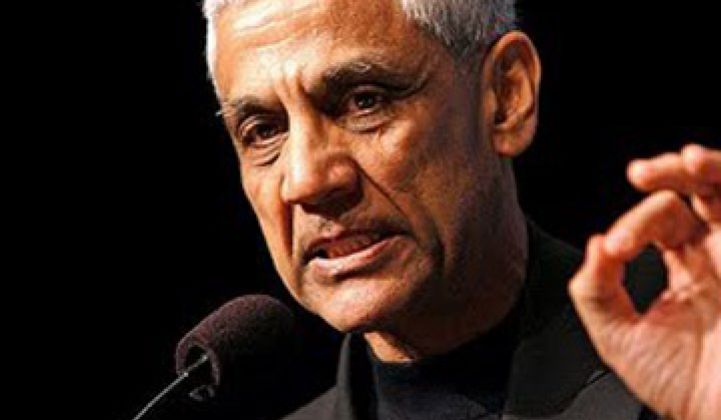

[Editor's note - this contributed piece from Mr. Khosla is essentially an executive summary of the larger primer which we will publish in two installments in the coming days.]

Given the likely continued dominance of the internal combustion engine, cellulosic and sugar-derived fuels offer one of the lowest risk advances to quickly and affordably achieve low-carbon transportation. Furthermore, substituting higher value bio-chemicals for petro-chemicals, will promote enhanced sustainability across a wealth of industries and offer a critical step along the path to weaning the world off of oil. There are also measurable economic and national security benefits to drastically reducing the reliance on global oil.

Amyris was a signature IPO in this space. In addition to Amyris, several biofuels companies are actually starting their businesses with high value chemicals, a lower-risk pathway to profitably move down the cost and efficiency learning curve to fuels. The value of chemicals produced by biological processes can be up to 2 to 10 times higher than biofuels, while commanding billion dollar markets. I believe the medium term (five year) “safe from oil price volatility” price target for biofuels is to be under $60 to $70/bbl crude oil equivalent, unsubsidized for global competitiveness.

In the U.S., subsidies and the RFS II mandate make significantly higher prices viable. Of course, if oil prices soar as many expect, (e.g. to $150 to $200/bbl by 2015 to 2020), or even stay at current levels ($90/bbl), higher cost biofuels will be viable. About 12 billion gallons of corn-based biofuel (i.e. ethanol) per year are already being produced in the United States and selling for $1.50 to $2.50/gal (with a roughly equivalent amount of sugar-cane based ethanol in Brazil, selling for $1.00 to $2.25/gal)[1], representing a $30 billion and growing market for new fuels to play in.

In fact the mandated renewable fuels market in the US alone is $90 billion at these prices by 2022. I predict that long before 2022, half a dozen technologies within and outside our portfolio will be market competitive and will blow away the cost structure of corn ethanol.

However, I consider corn (and sugarcane in the longer run) ethanol to be transitional technologies. To achieve the U.S. renewable fuels target of 36 billion gallons in 2022 and beyond, biofuels will need to be produced largely from high yield non-food biomass sources. I also envision advanced biofuels moving well beyond ethanol and diesel to hydrocarbon fuels: renewable crude oil, drop-in diesel, gasoline, jet fuel and other petrochemicals. Through a combination of diverse feedstock and diverse end products, bio-derived hydrocarbons and alcohols have the potential to replace an entire industry.

The old fashioned bias among traditionalists, mostly Luddites unfamiliar with the vibrant new research especially in startups, is that Fischer-Tropsch synthesis (FT) of liquid hydrocarbons from gasified coal and biomass is the only path to producing enough fuel to replace conventional crude oil. Frankly, this is nonsense. Many also assert that biofuels cannot scale to the quantity needed without impacting food availability, but the data suggest otherwise and I briefly discuss this below.

Common production technologies for fuels or fuels precursors are sugar fermentation, synthesis gas (syngas) fermentation, gas-phase thermochemical conversion (such as Fischer-Tropsch or syngas to methanol/ethanol chemical catalysis), direct to liquid thermochemical conversion, transesterification of oils, and solar to fuel precursors such as algae.

In my opinion solar fuels like algae, Fischer-Tropsch, syngas to methanol/ethanol chemical catalysis, plant oil based biodiesel (like soya bean/canola) and even enzymatic hydrolysis of cellulose are unlikely to be economic in the near to mid-term. Even newly fashionable plant oil based methods (like jatropha or camelina) will not scale adequately due to their low yield per acre (200 to 300 gallons per acre). Meanwhile, palm oil based biodiesel is an environmental disaster. Chemical catalytic processes like Virent are also less promising. Some new efforts, like Synthetic Genomics, could be promising in the long term (ten years or more) if they can overcome genetic engineering environmental risks in large-scale systems. Other processes based on waste fat and organic matter from animal husbandry operations or used restaurant grease, may be economic but are too unscalable to be material.

I expect that the much touted enzymatic hydrolysis cellulosic ethanol technologies using enzymes from companies like Novazymes and Danisco will also fail to be economic, and companies like Mascoma that use that approach will likely need to switch to cellulosic sugars from companies like HCL Cleantech.

So what will work? The early best answers in my opinion, based on operating costs, flexibility and scalability are sugar and gas-phase fermentation for specialty molecules, and direct-to-liquid thermochemical conversion for fuels. The fermentation pathways are excellent for producing specific chemicals and custom-designed hydrocarbons (sugars: Gevo, Amyris, LS9, Solazyme; gas-phase: LanzaTech, Coskata), and can thrive in high value markets that offer tens of multi-billion dollar markets. Some generic fermentation technologies that go after fuels directly will struggle with costs. The sugar fermentation pathways will have to wait for low cost cellulosic sugar technologies like the one HCL Cleantech is developing and a few years of experience with yield and cost optimization to go after the larger scale fuels markets.

Direct-to-liquid thermochemical conversion that yields a crude oil or diesel and gasoline blendstock, represented by the novel approach of Kior, are nearer term candidates for economic viability and appear to be much lower risk technologies that can globally (read unsubsidized) compete near term with oil at today’s $90/bbl price and in the mid-term at prices as low as $60/bbl.

Cellulosic ethanol and chemicals technologies like Coskata and LanzaTech can out-compete corn ethanol if they can finance their first commercial facility to prove their economics. These syngas-based gasification technologies will be substantially superior and higher yielding than traditional Fischer-Tropsch technologies and have the advantage of pursuing multiple high-value chemical markets in addition to the fuel ethanol market.

They will suffer from high capital costs (if they must build the front-end gasifier) but will have low operating costs and good rates of return on the capital if they can be built. Technologies like Range that started with chemical catalysis will need to switch over to these newer fermentation technologies.

Though sugar fermentation is a powerful production method, I personally don’t believe that food-based sugar fermentation technologies can scale adequately to meet fuel demands. However, the sugars need not be food-based; there are several competing enabling technologies that take cellulosic biomass and convert it via hydrolysis to sugars that are pure enough for fermentation. HCL Cleantech hopes to be able to deliver $0.08 to 0.12/lbs sugar, quite competitive given the price range of mostly 10 cents to 25 cents per pound for the last five years.[2]

This type of technology unshackles sugar fermentation processes from the negative perception of the food vs. fuel-debate, and delivers more diverse, lower cost, and scalable feedstock sources, with lower price volatility. Regardless of the technology, feedstock costs will be critical. For instance, I believe prices for woody biomass and agricultural waste, which are in the $50-65/ton range in the U.S., will drop within a decade as the biomass crops, agronomy and logistics ecosystem evolves, more competition develops and yields improve. Substantially lower prices are available internationally.

The key issues to focus on in determining a good biofuels technology are the upfront capital costs, ongoing operating costs, and environmental impact (mostly based on feedstock and location). Looking at any individual company, beyond the technology, it is additionally important to consider the proposed business model, the tactics for “boot-up” or getting the first commercial facility going, and the regulations and incentives in place. A company must find economic markets for its first commercial facility, be they in fuels or specialty chemicals, to get down the learning curve and start reducing its costs. This critical step is often difficult in an otherwise promising story. Non-oil related markets (such as nutraceuticals for algae) are unlikely to lead to economics that work in the fuel market. In order to avoid abuse of the terms “renewable and sustainable” to a minimum, we need to institute a comprehensive carbon, land, air and water impact assessment metric (one I call a CLAW Rating upon which I’ve written previously) for each biofuel. Not all biofuels are good biofuels.

In the current market, it can be difficult to secure capital in any sector. Therefore, biofuel companies able to deploy a commercial, cash flow positive plant for under ~$100 million have a distinct advantage. Some companies can achieve this with greenfield plants (e.g., Kior), but others are employing clever business models; LanzaTech’s first few projects use the waste gases of a steel mill in place of a capital intensive gasifier, to feed their fermentation.

Gevo is retrofitting existing corn ethanol facilities for high efficiency butanol production for chemicals markets. Amyris and LS9 are bolting their technology onto working sugar mills in Brazil. In contrast, a commercial FT facility would be on the order of several hundred million.

Once you’ve got a plant up and running, the operating costs are dependent on feedstock costs, energy, chemicals, water handling and personnel. Given the importance of feedstock costs, yield is a critical parameter. Of course, to enter the high value chemicals market, a higher cost per barrel of oil equivalent is acceptable; but to expand markets the key is to have a path to much lower costs. Keep in mind that if the process hasn’t been demonstrated at 100,000 gallon/year scale, the accuracy of the cost estimate, be they capital or operating costs, is, at best, a guess.

Meanwhile, licensing models are unlikely to be profitable. A licensing deal creates structures that often lead to long delays due to the risk averse partner, with fewer technology iterations and lower financial upside even if they succeed. Frankly only the weaker companies will enter these. In our portfolio, only Verenium, in my view the weakest of our cellulosic companies, entered a licensing agreement. Shell actually offered a relationship to LS9, which we declined because they asked for a license for the technology.

There are those who question the availability of sufficient land for fuels. Indeed, using extrapolations based on corn ethanol, there clearly isn’t enough land. However, if we apply some creativity, and consider other processes and sources of land, a very different picture emerges. Forest waste and currently dormant paper mills in the U.S. can produce enough woody material to meet our goal of 22 billion gallons of advanced biofuels by 2022 without any material land impact. Abandoned lands alone (385 to 472 million hectares, or 950 million to 1.2 billion acres globally)[3] could yield (at current acreage yield averaging only 5 tons/acre) over 30% of world oil demand according to a recent paper[2].

Per another study, which includes grassland, savanna and shrubland suitable for low-input high-diversity mixtures of native perennials, total land availability jumps to over 1.1-1.4 Billion hectares, with the potential to address up to 55 percent of our liquid fuel demands if suitable current generation energy crops are planted.[4]

Yields of much of this land could easily be improved by many multiples (700 percent increase in productivity has happened in corn in the last fifty years) with specialty energy crops, though that will take time to engineer. In fact, the development of high yield polycultures, most non-food perennials and winter cover crops is essentially unexplored. There is a lot of room to improve yields, while decreasing environmental impact by minimizing/eliminating fertilizer and water use, tilling and other agronomic practices.

Many biofuels technologies have made significant progress over the last few years; there have been some surprises, some partnerships and some clear winners and losers. Some have failed for genuine technology reasons, but many others for business reasons, market/investor or regulatory biases. Many technologies are as yet unclear and some seem to be promising. There are many positive surprises to come. However, we believe that cellulosic feedstock, regardless of the processing technology and end-product, is the likely winner at scale in the fuels market. Sugars will work in the chemicals market. I would bet on technology where the first instantiation is somewhat competitive in at least one market (like many of the new sugar fermentation hydrocarbon or new molecule technologies and the direct to liquid technologies) that gives the base technology an opportunity to improve from a production platform. I would bet against technologies like Fischer-Tropsch that have been optimized for a long time and have little additional room for progress in yields or costs.

Over the last few years the industry has seen a tremendous number of strategic and technical iterations coupled with new discoveries. Novel business plans have been developed, to exploit capital-light opportunities, as well as to branch out into high-value specialty chemicals sector. It is critical to continue nurturing the next generation biofuel landscape; there is enough “there” there to warrant continued investment. The winners will be big winners, and some of “losers” in the fuels market will still be able to find reasonable sized niche markets such as billion dollar specialty solvent markets – the so called Wall Street “bear case” for a company. We should also expect new developments currently unanticipated by me, which will surprise many of us in both positive and negative ways.

Four years ago I would have expected a 70 to 90 percent failure rate in our biofuels portfolio. Today I expect more than 50 percent of our technology bets will be successful.

Within five to ten years at least half a dozen technologies will be competitive even with $60/bbl oil, with some more profitable than others. The critical point is that for the next ten years at least, there will be unbounded demand for biofuels and biochemicals. The quantities required by the current regulatory mandate in the U.S. will be an achievable stretch with all the technological innovation. U.S. and worldwide demand of oil will be such that biofuels will not compete with each other, they all compete directly with oil. Each technology is suited to specific local conditions, and with the expected demand, there is ample opportunity for all these and even more technologies.

By 2022, advanced biofuels will become material in the oil supply equation, and will be a significant market force within twenty years. I firmly believe that in 30 years, the price of oil will be more dependent on the marginal cost of non-food land than anything to do with exploration, drilling, OPEC, or Middle East instability. If my expectations on technology come true and financing and regulatory support is made available for the infancy stage of biofuels, I expect biofuels will drive the real price of oil to $30 to $50/bbl in 2010 dollars by 2030!

Editor's note: Khosla Ventures has positions in Gevo, LanzaTech, Coskata, Range, HCL Cleantech, Mascoma, Kior, LS9 and Gevo.

[1] UNICA, rough estimate due to volatility of Brazilian currency

[3] The Global Potential of Bioenergy on Abandoned Agriculture Lands, J. Campbell et all Enviro Sci Tech, 2008

[4] Land Availability for Biofuel Production; X. Cai et al, Enviro Sci Tech 2011

***

Khosla Ventures offers venture assistance, strategic advice and capital to entrepreneurs. The firm helps entrepreneurs extend the potential of their ideas in breakthrough scientific work in clean technology areas such as solar, battery, high-efficiency engines, lighting, greener materials like cement, glass and bio-refineries for energy and bioplastics, and other environmentally friendly technologies, as well as traditional venture areas like the Internet, computing, mobile and silicon technology arenas. Vinod Khosla founded the firm in 2004 and was formerly a General Partner at Kleiner Perkins and founder of Sun Microsystems. Khosla Ventures is based in Menlo Park, California