Since oil was first extracted commercially in Pennsylvania and southern Ontario in the late 1850s, its remarkable versatility has enabled it to become an integral part of dozens of different sectors worldwide, from transportation to manufacturing, and many now consider it indispensable to the functioning of the global economy.

And yet, like most new industries, oil had a slow start: from humble beginnings supplying a cheaper alternative to whale oil to light the world’s capitols, it took almost 50 years for oil to reach 5 percent of the global energy mix. It was only with the advent of oil-based transportation in the form of cars, trucks, trains, and ships that this share expanded rapidly, reaching approximately 45 percent in the mid-1970s, the height of our collective dependency on oil.

However, in a turnaround that has gone virtually unnoticed, the rate of oil consumption has declined in recent years in some parts of the world. Compounding this trend, in the past decade, biofuels, electric vehicles, and natural gas vehicles have all entered the scene, providing oil with its first genuine competition in the transportation sector in almost a century.

In an environment of sustained high prices and ongoing improvements in vehicle fuel efficiency, it is likely that within the next few years, global oil demand, in absolute terms, will start to decline.

Data on Demand

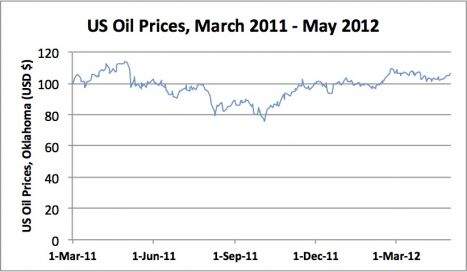

Global oil demand currently stands at a historic high of 89 million barrels per day, just over 70 percent of which is used for transportation. And despite considerable economic uncertainty in the Eurozone, oil prices have remained high, trading at between $80 and $120 per barrel since March 2011.

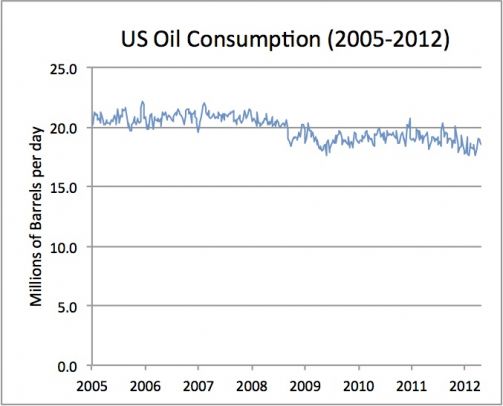

Data over the last fifteen years indicate that oil demand in dozens of countries has reached a plateau and begun to decline. U.S. oil demand peaked in 2005, France’s did so in 2001, while both Italy’s and Germany’s peaked in 1998.

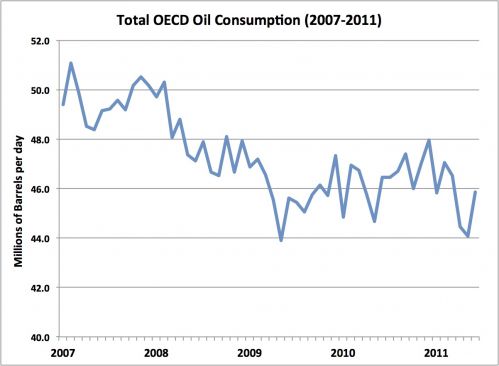

Perhaps more strikingly, oil demand in the 34 countries that make up the OECD (the Organization for Economic Cooperation and Development, a group of industrialized countries) has decreased by over 5 million barrels per day over the last five years.

In the face of this, the only factor that has kept global oil demand growing is the rapid growth in demand from the world’s emerging economies, most notably China. In a phase of rapid industrialization, China’s oil needs have grown from about 5 million barrels per day in 2000 to 10 million barrels per day in 2012. This means that China has almost singlehandedly taken up the slack in oil markets that would otherwise have been left with declining demand elsewhere in the industrialized world. Combined with other emerging economies, this has ensured that demand for oil has remained on the rise -- and it is this growth in demand that has kept supplies tight and prices high.

The Impact of Alternatives

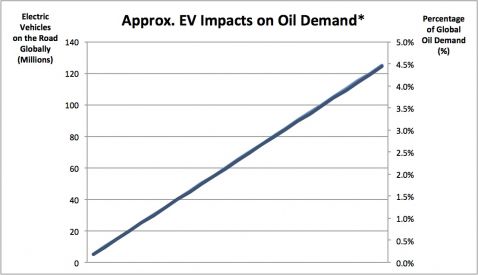

While it is impossible to accurately predict the rate of uptake in electric and natural gas vehicles, it is clear that as such vehicles begin to reach wider adoption, they will begin to displace a growing share of global oil consumption. Indeed, replacing 25 million light vehicles with alternatives would cut global oil demand by roughly 1 million barrels per day, all else being equal; by some estimates, electric vehicle sales could reach that amount per year by 2025. Even under more modest estimates, there is little doubt that electric vehicles are going to take a substantial bite out of global oil demand in the years ahead.

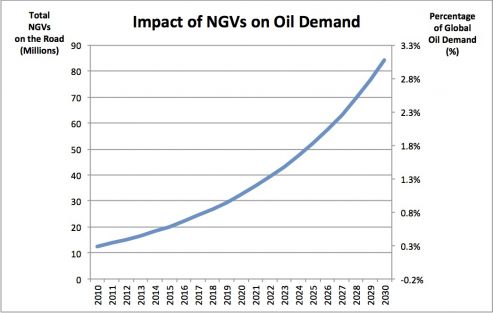

A similar story plays out in natural gas vehicles (NGVs). In jurisdictions throughout the U.S. and Canada, orders for natural gas transit buses and commercial vehicles are surging, as businesses respond to the availability of a cheaper fuel option. Automakers are responding too: popular models such as Honda’s Civic are now available in markets like California in a natural-gas-powered version. Significantly, natural gas offers a substantial discount over oil-based transport options, with average prices in the U.S. at or below $2 per gallon-equivalent. With this kind of competitive edge, firms like Pike Research estimate that global use of NGVs could reach 20 million vehicles by 2016.

When the impacts of electric and natural gas vehicles are combined with the rise of biofuels, in an environment of high prices, all against a backdrop of rising efficiency standards, it becomes clear that oil is facing significant pressures in its core market.

How oil producers will react to an eventual decrease in oil demand remains to be seen. Given how deeply many oil-producing countries rely on oil revenues to balance their books, there is little doubt that any sustained reduction in oil demand will have significant social, political and economic implications. While some may consider this a controversial thesis, the basic functioning of the market all but ensures that when substitutes emerge that can provide the same service at lower cost, consumers will respond. As energy thinker Amory Lovins is fond of pointing out, if these trends continue, oil will likely become uncompetitive even at low prices well before it becomes unavailable even at high prices.

This notwithstanding, the decline of oil is likely to be gradual, a process more like phasing one instrument out of the symphony than disbanding the orchestra altogether.

Oil will always have customers, for the simple reason that it can be refined into thousands of different products; still, it is likely that the 65 percent of it that is devoted to ground transportation will be gradually priced out of the market by the basic functioning of market competition in the decades ahead.

On a positive note (and there are many), with oil becoming less and less competitive as a transportation fuel, a greater share of it will gradually be devoted to higher-value, less-easily-substitutable uses like advanced petrochemicals and jet fuel.

Not only will this prolong its life, it will also increase the total economic value extracted from each barrel, and perhaps even leave some in the ground for future generations.

If this view is correct, burning oil to power cars and trucks may one day become as antiquated as hunting whales to light our homes.

•••

Toby D. Couture is Energy & Financial Markets Analyst at E3 Analytics, an energy consultancy based jointly in the London, U.K. and Fredericton, Canada. He works in a wide range of areas including policy, strategy, finance, and sustainability.

(Sources: The U.S. data are both from the EIA 2012, the OECD data are from the OECD 2011, and the NGV and EV calculation assumptions are as follows: This depiction assumes each displaced vehicle travels 25,000km per year, at 13.5km/L (32 mpg) fuel efficiency, and that the baseline oil demand is 90 million barrels per day.)