There is a perception that the current lack of political action to put a cost on carbon emissions has resulted in a downturn of interest in CO2-related technologies from the investment community. But is this true? And is this warranted?

CO2 Separation Today Does Not Serve the Needs of Tomorrow

Amine-based solvents like those supplied by Dow, BASF, and others are broadly used today to separate CO2 in a range of applications. For example, large-scale separation is done within the natural gas production industry, with sales of amine solvents for this application topping $1 billion a year. Additionally, CO2 separation is critical in refinery processes and fertilizer production.

The solvents in use today have been customized for use in these industries, utilizing the high-pressure operation and the absence of oxygen in these processes. However, in order to separate CO2 from the flue gas of a coal-fired power plant, a longstanding aim that would help capture carbon and slow climate change, it would require improved operational flexibility, significant cost reductions, and scale-up -- scale-up in the magnitude of 10X over today’s largest systems. This should not be considered difficult given the already large-scale nature of these systems.

The challenge is to reduce the per-unit cost of CO2 separation while simultaneously scaling in size and improving operational flexibility. CO2 separation does not account for a significant portion of the cost of an MMBTU of natural gas ($0.10 to $0.20 per MMBTU), but it could significantly increase the cost of a kilowatt-hour of electricity coming from a coal-fired power plant. This means scaling today’s technologies results in an unacceptable increase in the cost of electricity.

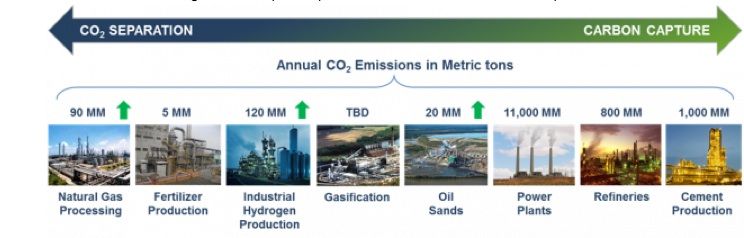

Companies such as St. Louis-based Akermin [Editor's note: the author is on the board of Akermin] are working on reducing the cost of CO2 separation both in today’s applications and the markets of the future. Akermin can reduce the energy required to separate CO2 by as much as 75 percent through a non-chemical approach that integrates an enzyme into a protective polymer structure, creating a “super catalyst” for solvent-based separation systems. As seen in the following diagram, Akermin’s technology applies to today’s natural gas sweetening and fertilizer production markets, as well as important, longer-term markets including coal-fired power plants, the oil sands, and cement production.

CO2 Separation Needs Are Increasing in Today’s Core Industries

As we move toward the extraction of more shale gas and heavier oil production, the need to separate CO2 increases daily. Infrastructure is being added by the largest natural gas producers and processors as a result of higher CO2 content in some shale gases that are being processed. For example, in British Columbia, a leading region for natural gas deposits, CO2 content in conventional natural gas fields has historically been between 2 percent and 4 percent, leading to the need to separate the CO2 in order to meet the pipeline specification of less than 2 percent. However, the new Horn River Basin resource in western Canada has a 12 percent CO2 content, requiring a substantial increase in CO2 separation needs at processing plants.

Legislation and Regulation Are Moving Ahead -- Slowly and With Broad Exclusions

The EPA has regulations in process that will substantially affect the emission of CO2 from coal-fired power plants and other large emitters. The survival of these regulations depends heavily on the upcoming U.S. presidential election. However, other jurisdictions also have carbon policies in place. Alberta and British Columbia both have minimal carbon taxes, while California is moving toward its own cap-and-trade structure. All of these and more are having a positive impact on corporate decisions regarding the adoption of carbon saving technologies.

Up-and-Coming Technologies That Convert CO2 to Valuable End Products Need Purified CO2 Streams

Thermochemical, biological, and electrochemical means of converting CO2 to chemicals and fuels are currently being developed in venture-backed companies. The high price of oil is providing a much-needed tailwind in these technological areas. The purity of the incoming CO2 is a key issue for many of these companies. Therefore, a cheap means of purifying CO2 will be vital to the success of many of these promising technologies.

Needless to say, economical CO2 separation will be a core requirement for the expansion of today’s natural gas reserves and for future technologies that deal with the planet’s CO2 emissions issues. That means investing in CO2 separation innovators like Akermin -- where it’s about reducing capital expense while providing greater operational flexibility -- makes sense.

Although there may not be a significant price on carbon emissions today, that doesn’t mean there should be an absence of investments in technologies that stand to provide national energy security and reduced global warming along with the significant financial returns that will be required when you’re staring at a process gas market exceeding $10 billion a year.

***

Mike Walkinshaw is Managing Director at Chrysalix Energy Venture Capital.