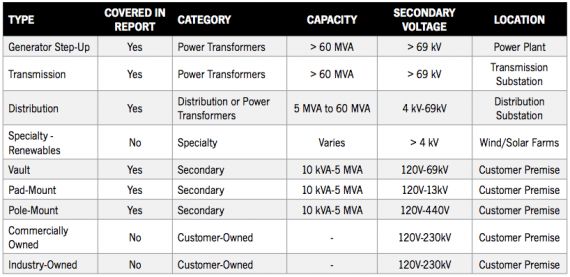

Following the release of GTM Research’s Transformer Monitoring Markets, 2013-2020: Technologies, Forecasts, and Leading Vendors report, a colleague and I hosted a webinar covering some of its key findings. The report covers a full range of sensors, communications and applications that utilities across the U.S. are installing alongside their transformer infrastructure. GTM Research classifies utility-owned, liquid-filled transformers into three categories, as shown in the following chart.

Source: Transformer Monitoring Markets, 2013-2020

By the end of the webinar, it had become clear that there was no way that we could address each of the 32 questions asked during the event's 10-minute Q&A session. To help address the questions that were left on the cutting-room floor that day, I have grouped them into three categories for the purposes of this article:

- Market Sizing and Growth Potential (covered in Part I of this article)

- Pricing

- Features and Functionality

Pricing

6. Where do you see the pricing going on secondary transformer sensing equipment?

We expect pricing in the secondary space to continue to decrease, at least for monitors for U.S. equipment. Right now, we have system costs coming to just under $750 including communications. That is expected to decrease consistently over the next eight years. However, it is worth noting that there is a market for more advanced sensors; it is just very small in the United States, limited mostly to areas with high penetrations of distributed energy resources. These advanced monitors, which cost upwards of $2,000 to $3,000, have no place on cheap pole-top transformers, but they can be used with larger secondary transformers in Europe, which have more extensive secondary networks that often serve more than 100 customers per transformer.

7. Can you clarify the costs involved in a $100,000 power transformer monitoring system?

A full hardware and software system to make a transformer “smart” consists of a variety of devices and applications. Listed below are some estimated costs for these devices when bought in bulk (i.e., more than 100 at a time):

- Comprehensive DGA monitor: $40,000 (could be spread over multiple transformers if located in the same substation)

- Advanced transformer monitor: $25,000

- Temperature sensing: $4,000 RTDs or up to $12,000 GaAs fiber temperature sensor

- Bushing monitor: $7,000

- Analysis software: Varies; fixed or service-based costs spread amongst the transformer fleet involved. This would include real-time data historian, comprehensive analysis solution and visualization software.

Features and Functionality

8. What are the communications technologies used for transformer monitoring?

Communications technologies are a question of:

- Type of transformer

- Security

- Cost

- Existing communications infrastructure

For power and distribution transformers, communications is a mixed bag of technologies. These technologies often create very little data compared to other equipment on the grid. For example, the output of a typical dissolved-gas analysis (DGA) monitor over one measurement cycle could be contained within an SMS text message. This opens up a wide variety of communications options, as latency is also a minor concern. So power and distribution transformers using the lowest-cost option with the required security is often the best policy.

For secondary transformers, market monitoring communication technologies are less varied. The availability of cheap network interface cards from advanced meter infrastructure (AMI) providers has drastically reduced the communications costs for applications that do not enable control. As for control-related applications such as volt/VAR control measurements, sensor providers and AMI companies are now partnering with cellular providers to provide radios for these locations to increase communications reliability, reduce latency and reach locations not covered by the network.

9. What level of importance is revenue protection capturing in the utility space?

Revenue protection is a key business driver for a variety of utilities across the world. It has not been as big a focus in the U.S. since there are far fewer non-technical losses than in other places around the world; however, that does not mean it is not a focus in North America. BC Hydro loses $100 million in revenue each year to theft. Protecting revenue can be tricky, however.

Statistics on high theft in northern Brazil, India, and Southeast Asia, along with much of Latin America, are often touted as automatic business cases for a variety of technologies, but the reality does not always work that way. Many electric utilities around the world are publicly owned, and if not owned by the public, they are regulated by political bodies. The intimate relationship with regulators or elected officials can lower the desire to identify and prosecute theft offenders depending on their political affiliation.

10. Where will processing and analytics be -- in the control center or distributed in the grid?

Arguments for both exist, but in the U.S., distributed processing will be important for utilities with limited communications capabilities or more advanced functionalities such as power quality monitoring at locations with concentrations of distributed energy resources.

Control center applications will be used to analyze certain value streams for which the IT infrastructure already exists, such as outage notification (through integration with OMS) and asset management (through integration with enterprise asset management, workforce management or a proprietary system secondary monitoring system).

Much more information pertaining to these issues can be found in GTM Research’s report, Transformer Monitoring Markets, 2013-2020: Technologies, Forecasts, and Leading Vendors.