France's EDF, one of the biggest utilities in the world, is making its first major energy management play in America.

DK Energy US, a small American subsidiary of EDF's energy services arm, called Dalkia, announced this morning it acquired Groom Energy Solutions for an undisclosed sum.

Massachusetts-based Groom is a full-service energy services company serving customers with big portfolios of buildings in the commercial and industrial (C&I) space. It has 67 employees who help design, engineer and monitor projects across 20 states. The company services roughly 100 new customers each year, accounting for $43.8 million in revenue in 2015.

EDF's Dalkia has much bigger footprint. The global energy services company employs 12,000 people, brings in €3.3 billion in yearly revenue and manages 88,000 facilities in France alone.

DK Energy US is much more modest in size. Until this week, the subsidiary only had a couple of employees.

"This is our first operation [in America]. Our intention is to grow from the Groom platform," said Gregoire Ignasiak, the country manager for DK Energy US.

Since last year, DK Energy has been on the hunt for a delivery partner to help it build its American business and sell Dalkia's energy analytics software. It entered talks with Groom in early 2016, but eventually decided that buying the company was a better way to attack the fast-growing U.S. market.

"We surveyed a lot of energy services companies in the last 20 months. A lot of them had a very high cost of sales and a lack of focus. Groom was focused on the right verticals," said Ignasiak. Those verticals include grocery stores, industrial facilities, hotels and universities.

"It became clear we could be much more than a delivery partner to EDF," said Jon Guerster, Groom Energy's CEO.

DK is targeting three broad areas: building energy services, distributed energy and energy procurement for C&I clients. "By 2020, we want to be a player in these three lines of business across the U.S.," said Ignasiak.

The French company enters the American market during a period of intensifying competition among utility affiliates looking to serve customers in new ways.

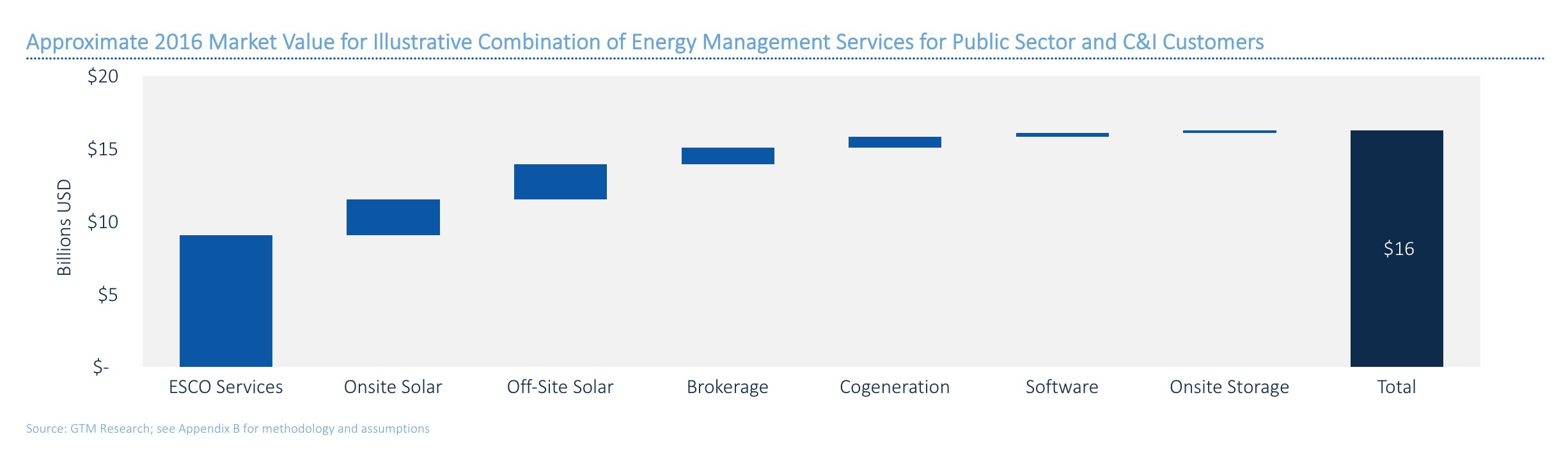

According to GTM Research's report on the C&I energy management landscape, there are now 22 utility affiliates offering energy efficiency or distributed energy services. The list of parent companies includes nearly all of the country's biggest power providers, all vying to get a piece of the $16 billion energy management market.

In the last couple of years, these utility affiliates have made a land grab, buying up or investing in solar developers, energy management firms and even storage companies.

EDF already has a strong presence in the U.S., mostly in its renewable energy division. Eyeing all the activity in the U.S., Dalkia realized it was time to enter in a meaningful way.

"We've been following a lot of moves carefully in the last years. It was all happening very quickly," said Ignasiak. "We're making an acquisition to bring growth."