The energy storage market is booming, and that means the companies with the software to make energy storage work need funding to match that growth.

Greensmith, one of the leading U.S. energy storage management software vendors, has raised $4.9 million of a planned $9.9 million investment round, according to a Tuesday filing with the U.S. Securities and Exchange Commission.

The full $9.9 million round is expected to “close imminently,” Greensmith CEO John Jung said in a Tuesday interview. It will also include some strategic investors, as well as some of the as-yet-unnamed investors who have bankrolled the company to date, he said. While he wouldn’t name those strategic partners, “we may be able to make some announcements down the road."

Greensmith had raised $6 million in angel and early-stage financing as of 2012, and brought in some “planned injections of capital” over the past year or so, he said. Those include $4 million in May 2014, and $1 million in February, according to SEC filings.

But the new round is “the major growth funding,” he said. Greensmith is providing its software for about 45 projects with 20 different customers, and has nearly 500 megawatts of projects in a pipeline that “is growing on a weekly basis,”Jung said.

The Rockville, Maryland-based company’s software is managing more than one-third of the 61.9 megawatts of energy storage projects deployed in the United States last year. Those range from a 20-megawatt system providing frequency regulation services for grid operator PJM, to 30-kilowatt behind-the-meter batteries in California, and newer projects balancing intermittent solar power in Hawaii and Puerto Rico. Its most recent partner is Duke Energy, which announced last week that it’s tapping Greensmith for a 2-megawatt storage project, featuring lithium-ion batteries from LG Chem.

Greensmith has incorporated a dozen different types of batteries, including multiple lithium-ion chemistries, as well as Aquion Energy's sodium-ion battery and ViZn Energy’s zinc redox flow batteries, into its software suite. About two-thirds of its customers are electric utilities, including San Diego Gas & Electric and Sacramento Municipal Utility District, he said.

But it’s also done several behind-the-meter projects, including two 1-megawatt battery systems, one in Puerto Rico and another in Ohio, according to Jung. These are much bigger projects than the typical behind-the-meter battery systems being installed in buildings by companies like Stem, Green Charge Networks and Coda Energy, Tesla and SolarCity.

They’re also not aimed at providing demand-charge reduction for customers’ utility bills, as the aforementioned companies are doing, he noted. Instead, “some of these customer-sited systems are participating in frequency regulation” he said, while the Puerto Rico project is specifically aimed at meeting the smoothing and ramp-control requirements for new solar and wind projects being built on the island.

Greensmith’s funding doesn’t match that of key competitor Younicos, the German company that has reportedly raised about $200 million from backers including Samsung and German-Japanese flow battery maker Gildemeister/DMG Mori Seiki, and which bought bankrupt battery startup Xtreme Power last year. Nor does it put the company at the same scale as AES Energy Storage, the world’s leading grid-scale battery project developer, or NEC Energy Solutions, which bought the grid-scale battery business of formerly bankrupt A123 from Chinese owner Wanxiang.

But then, as a software provider, “we’re not having to raise money to do no-money-down” deals, Jung said, like those being offered by a host of behind-the-meter storage providers. Nor has it chosen to build its own battery test center, as Younicos has done.

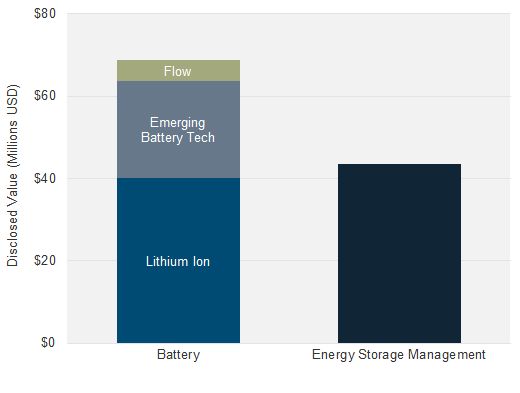

GTM Research predicts the U.S. will deploy 220 megawatts of energy storage in 2015, with the market on a path to reach 861 megawatts of annual installations and a value of $1.5 billion in 2019, about 11 times its 2014 size. Meanwhile, energy storage companies have garnered about $112 million in investment so far this year, with about $40 million going to energy storage management providers Greensmith, Advanced Microgrid Solutions and Stem. Other key energy storage management software providers include GELI and 1Energy.