General Electric today said that it has signed a broad technology licensing agreement with Rambus in an effort to create a flat LED light.

It's a big win for Rambus. The company emerged in the 1990s with a new type of high-speed memory. Intel championed Rambus-style memory but the industry gravitated toward DDR, which was based on industry standards. Rambus sued, arguing that DDR infringed its patents. Memory makers disagreed. After millions in legal fees and lots of acrimonious arguments, Rambus emerged largely victorious. (Disclosure: I covered the Rambus cases for a number of years and generally predicted Rambus would win; the memos unearthed during discovery tended to paint the chip makers in a negative light.)

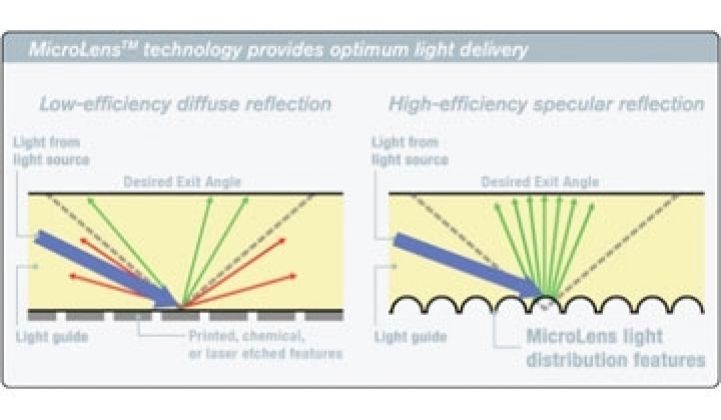

Last December, the company purchased advanced lighting and optoelectronic patents from Global Lighting Technologies for around $26 million. The patents are applicable to using LEDs as a light source for LCD screens as well as in the general lighting market. In all, Rambus acquired 84 patents in the deal. Generally, large companies are conservative to hostile when it comes to licensing intellectual property. They simply don't like it. Thus, to land a marquee customer in GE after only a few months is a big deal.

Still, you might see more. Envia, which makes cathodes, will try to license its technology to battery manufacturers. Simply put, small, innovative companies can't find the cash to build factories and often large companies need to bolster the R&D in their labs. GE's coming 40-watt equivalent LED bulb sports an LED from Osram, after all.

The deal covers both reference designs as well as manufacturing know-how. One more Rambus tidbit: former Rambus CEO Geoff Tate in March became CEO of Nanosolar. Is licensing in the cards for the CIGS manufacturer? Nanosolar has raised hundreds of millions of venture capital but has only shipped a token number of panels.

Meanwhile, the Building Operation Management Association's conference in Long Beach is underway and we checked in with executives from Johnson Controls. The mood, surprisingly, is a bit upbeat. The company provides engineering and construction services. It will retrofit buildings to lower utility consumption.

"Instead of paying the utility, you pay the financing company," said Leland Smith of Johnson.

The company has a stake in the Empire State Building retrofit. That retrofit costs $20 million and will save around $4.5 million a year in utility costs. Less elaborate projects generally have a 2.5 year to 3 year payback period. Johnson recently has begun to target commercial office buildings as well as owner-occupied (i.e., government buildings and schools) developments.

And speaking of energy efficiency, last week, Nayeem Sheikh, the global energy manager for Cisco, told us at the Silicon Valley Energy Summit that Cisco saved about $1 million a year by increasing the temperature in its labs a bit. Jerry Meek, who manages facilities for Genentech, says his company has also saved massive amounts of energy by tweaking the AC a bit.