Google’s Project Sunroof started out as a “20 percent project” -- a program that allows Google employees to work on side projects one day per week -- but quickly became regarded as a valuable marketing platform for rooftop solar, both as a customer education tool and as a lead generator for solar providers.

Project Sunroof offered leads to a certain partner companies from the time it launched in 2015. These companies viewed Project Sunroof as an important top-of-the-funnel marketing service. At one point, it seemed as though Google could eliminate virtually all other solar lead generation companies because of its ability to control the search process and reach potential customers. But as the solar market has evolved, the tech giant has re-evaluated its role in the space, and recently decided to end its lead generation business.

Earlier this month, Google quietly updated the Project Sunroof website by removing partner listings, and directing potential solar buyers to companies listed on Google's main search pages instead. The change was made so that Project Sunroof would be easier to manage for both solar providers and for Google, a spokesperson told GTM. Solar companies can now optimize their local listings for organic and paid customer traffic, all within Google Search.

The decision was made after receiving hundreds of requests from solar companies across the U.S. that were looking to be listed on Project Sunroof’s partner platform, the spokesperson said. Given how users typically search for solar providers on the web, both on and off of the Sunroof site, it made sense for the tech company to consolidate and guide users to Search pages with localized results.

The change means that Google is no longer offering leads to residential solar companies that joined the Project Sunroof platform -- a service that was provided at a cost. Companies had to pay to be Sunroof partners, and they had to bid to receive customer referrals, in addition to what they would spend to market themselves on Google’s search engine.

When the partner network launched in 2015, it was offered in three pilot cities: Boston, San Francisco and Fresno. Interested homeowners in those areas would scope out their solar potential using the Project Sunroof mapping tool, then have the option to provide more information and be connected with Google’s partner solar providers. These companies would pay for the lead once the information was received.

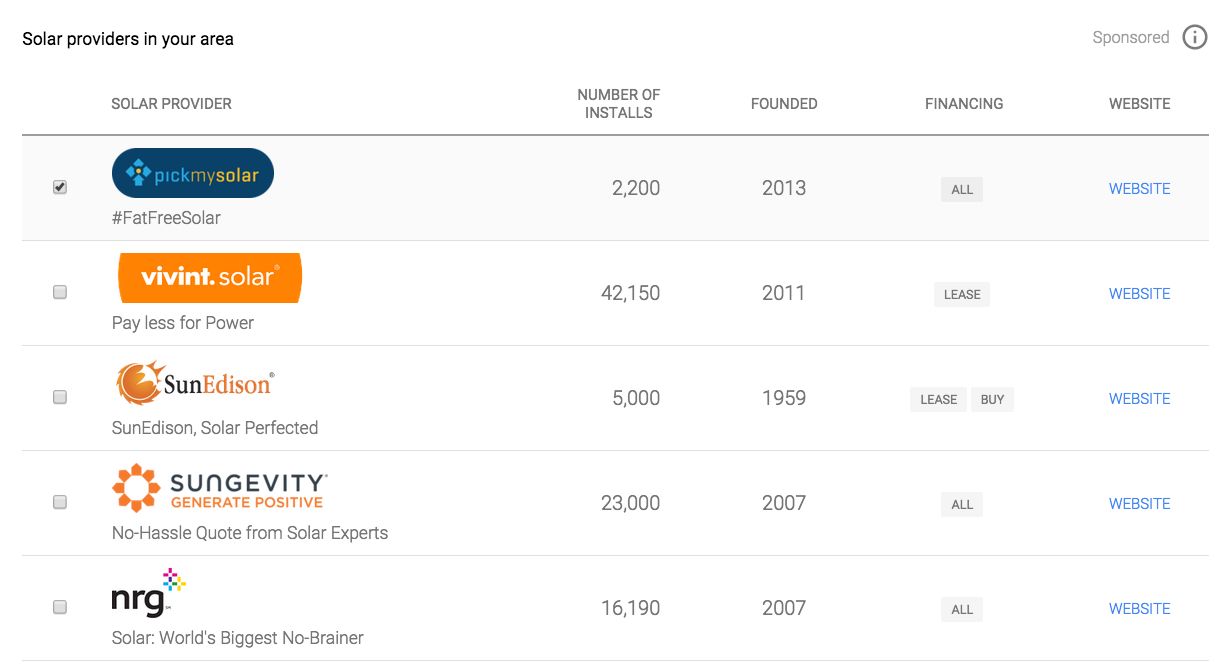

There were five national-scale companies on the platform at the outset: Pick My Solar, Vivint, SunEdison, Sungevity and NRG Home Solar. Notably, three of these companies (SunEdison, Sungevity and NRG Home Solar) are no longer in business.

Project Sunroof's initial group of solar partners

Financial troubles among national solar installers may have prompted Google to end its lead-gen practice. It’s likely the platform was manageable to run when the small Project Sunroof team (there were 10 employees working on the project as of last year) was only working with a handful of companies. But as the residential solar industry shifted and regional installers started to play a bigger role, Google may have decided that a partnership network with hundreds of members would be too unwieldy to manage.

Meanwhile, the two biggest national installers, Sunrun and Tesla (formerly SolarCity), never chose to join the Project Sunroof partner platform because they operate their own sophisticated customer acquisition processes internally.

Solar marketplace companies like Pick My Solar and EnergySage also have large internal teams dedicated to managing customer acquisition and prescreening hundreds of solar installers. These companies also offer roof-mapping services -- in Pick My Solar’s case, the map is actually powered by Google -- and they go much further than Project Sunroof in vetting potential solar customers.

Getting Project Sunroof to that level, where it could consistently produce valuable leads for a large and growing number of solar companies, would have required a meaningful investment with questionable benefits to the tech giant.

After all, search is what Google excels at, and where the company makes its money. Selling leads to solar companies at a large scale would only eat into those companies’ marketing budgets, making Project Sunroof competitive with Google’s own advertising business. The tool now directs users to installers located near them.

Project Sunroof now directs users to Google Search

At the same time, the customer-acquisition process has evolved. Solar companies are focused on tailoring the customer-acquisition experience, finding new ways to incorporate rebates and partnering with utilities to reach potential customers trough their trusted energy provider. Last month, for instance, Pick My Solar partnered with Enervee to offer utilities an integrated solar and energy-efficiency marketplace to millions of households across the U.S. The collaboration is now live with Con Edison New York and slated to launch on other utility websites.

“We know that our offer lives and dies with a great experience for every customer,” said Max Aram, CEO of Pick My Solar, in a statement. “That’s why we work hard to make the solar choice as easy and risk-free as possible -- from impartial assessments and vendor options, to installation and the flow of those solar electrons. It’s about providing the customer with the clearest opportunity to make the best choice.’’

Pick My Solar was one of Project Sunroof’s most prominent partners, and sometimes the only solar provider in certain areas. But it’s unclear how fruitful the lead-gen offering was for the solar marketplace, or for others.

A Google trends search reveals that interest in Project Sunroof tracks closely with press coverage, and has generally been low for the past year. Google representatives have acknowledged that they need to increase customer engagement with Project Sunroof in order to make the tool more effective.

According to EnergySage, which tracks keywords on Google, there are roughly 10,000 searches for “Project Sunroof” each month. Some portion of those searches presumably resulted in users testing out the Project Sunroof mapping tool, and some portion of those users would have progressed to filling out their customer data. It’s likely that only a small number of Sunroof users would prove to be viable solar customers, although GTM was unable to confirm with Project Sunroof partners how many leads were actually sold.

Residential solar companies that chose not to be Sunroof partners say the platform continues to play an important role as a residential solar education platform.

In 2016, Project Sunroof expanded to 42 states, with the ability to analyze roughly 43 million rooftops. Earlier this year, Google announced the residential solar tool is available in all 50 states, with coverage of approximately 60 million buildings. Over time, Google has also refined Project Sunroof with new data, machine learning, 3-D modeling, and imagery from Google Maps and Google Earth. Project Sunroof also offers a calculator for how much potential customers can expect to save by going solar.

Sunrun spokesperson Georgia Dempsey said Project Sunroof “is a great platform to help people understand the benefits of going solar and make it accessible to them.”

EnergySage, which offers a solar marketplace that would have been competitive with Google’s lead-gen business, was pleased that the service ended.

"The value of Project Sunroof is its solar calculator, and we are glad to see that it's still available for public use," said Luke Tarbi, vice president of marketing at EnergySage. "We also applaud that Google has exited the lead-gen business, as we believe that consumer-empowered online comparison-shopping and full transparency is the only way to drive the mainstream adoption of solar."

Solar installers will now have to compete with one another squarely on search engine optimization, tweaking phrases and buying keywords to make their company come to the top of the web page. In a world where door-to-door sales are starting to fall out of fashion and customer acquisition becomes increasingly internet-based, we’ll have to wait and see if and how Google’s role in residential solar evolves next.