This year, the solar PV supply chain began to stabilize due to robust demand growth, capacity retirements and mothballing by uncompetitive firms, trade conflicts, and a general focus by suppliers on margins over sales growth. According to a new report by GTM Research, PV Pricing Outlook 2014: Value Chain Trends, Global Drivers and Regional Dynamics, global PV polysilicon prices will increase significantly next year, although module pricing will stay roughly constant.

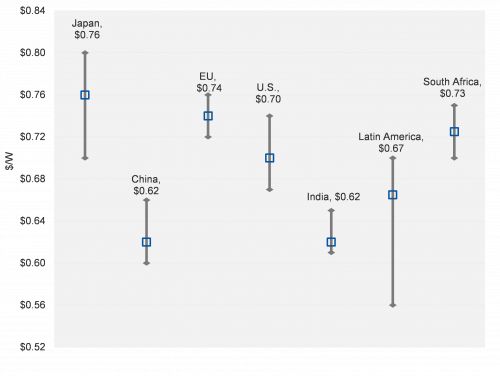

In the report, GTM Research breaks pricing down by both material and geography. Blended polysilicon prices will increase the most dramatically, at 25 percent next year. Wafer prices will increase 11 percent and cell prices 5 percent. Yet overall module prices will fall 1 percent, with pricing compression in Japan and South Africa offsetting increases in the rest of the world.

FIGURE: Delivered China Tier-1 Module Pricing by Region, Q4 2013

“Looking at a single module price to represent the global market no longer makes sense,” says report author and GTM Research Analyst Jade Jones. “Regional drivers such as import tariffs, incentive levels and technology preference are changing pricing dynamics. The difference in pricing between India and Japan, for example, is almost 30 percent at present, and we expect regional pricing spreads to persist through 2014.”

The 60-page report contains current, near-term and long-term pricing forecasts for PV polysilicon, wafers, cells and modules across multiple scenarios and market outcomes. Additionally, it identifies key pricing drivers such as supply-demand balance, supplier costs, and geopolitical factors and examines their influence on global and regional pricing trends.

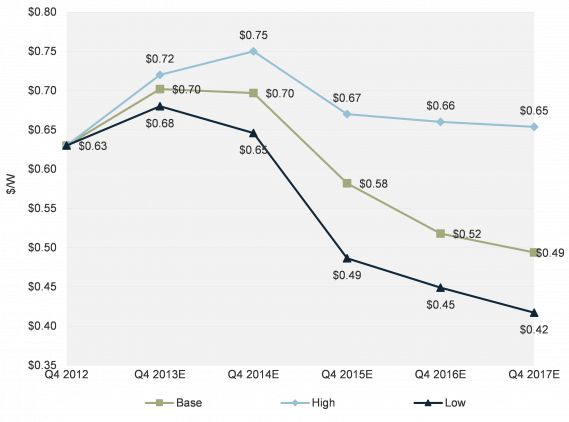

Looking to 2015 and beyond, GTM Research sees module pricing resuming its long downward trajectory, eventually dropping below 50 cents per watt for Tier 1 Chinese modules in GTM Research’s base forecast. “While we expect pricing to be stable to up in 2014, there are a number of factors at play which we believe will continue to exert downward pressure on pricing in 2015 and beyond, including manufacturing cost reductions, end-market underperformance, and a generally declining incentive environment that will place pressure on PV system economics,” says GTM Research Senior Analyst Shyam Mehta. “While there certainly is risk to our view in both directions, we are comfortable in our view that low-cost markets such as India, Chile and China will see module pricing of less than 50 cents per watt by 2017,” he added.

FIGURE: Delivered Global Blended Tier 1 China Module Price, Q4 2012-Q4 2017E

For more information on the PV Pricing Outlook 2014: Value Chain Trends, Global Drivers and Regional Dynamics report, please visit http://www.greentechmedia.com/research/report/pv-pricing-outlook-2014.

***

Pick the brains of report authors Jade Jones and Shyam Mehta at next month's Solar Market Insight Conference in San Diego.