This is the first piece in a two-part series from Cedric Brehaut on GTM Research's Global PV Monitoring: Technologies, Markets and Leading Players, 2012-2016 report. To learn more about the highly competitive PV monitoring market, click here.

It’s noon on a Friday and the sun is shining at nearly 1,000 watts per square meter. By all accounts, the local PV system should be cranking out kilowatt-hours, but is it? The monitoring system indicates that no data has been received from the solar plant for the past 30 minutes. Hopefully it's just another temporary network outage from the cellular provider -- it happens once in a while. It could also mean that the monitoring system itself is experiencing an issue…or a lot worse: AC power could be out at the facility. If the plant operator waits any longer to call a maintenance crew, it may be too late to dispatch someone onsite today. Weekend labor is expensive, so it may be best to wait until next week; after all, it may only be a cellular network outage. On the other hand, this could be a real outage and the system could end up sitting idle until 5 p.m. on Monday.

What would the impact of such an outage be on the total system performance or the project’s return on investment? How does it measure against the cost of sending a crew for nothing, or the extra expense of paying for weekend hours? Based on the system's performance so far, would an outage trigger penalties based on uptime or performance guarantees? Suddenly, the diagnostic and analysis functions offered by the monitoring system seem a lot more important than they did during project design when the solution was chosen.

Despite the importance of the monitoring function, it has historically received limited attention from the larger solar industry due to monitoring's relatively low impact on the overall cost of the system. The lack of comprehensive, global and independent market research has led to a situation where many vendors call themselves market leaders without anyone having the ability to confirm such claims with confidence. GTM Research and SoliChamba Consulting’s Global PV Monitoring report dives into the monitoring market and explores the competitive positioning of top PV monitoring suppliers, including their product offerings and shares in various regions and market segments.

Monitoring Systems: Software, Hardware, and Services

A solar PV monitoring solution is composed of a set of activities and tools allowing stakeholders to track the output and assess the performance of a solar PV system and to detect system issues as they arise. Some vendors also offer the ability to control the PV system, and most of them provide reporting functionality.

A typical monitoring system includes monitoring software as well as a number of hardware components:

- The gateway, or data logger, is a data collection device located on-site which connects to the various pieces of equipment to be monitored. More advanced gateways offer system control features as well.

- The meteorological kit, or weather station, allows measurement of weather conditions -- a critical factor for accurate assessment of the performance of a PV plant. Meteorological sensors include at a minimum a pyranometer (to measure the incoming sunlight) and often temperature sensors (ambient and at the back of a module), since the behavior of solar modules is impacted by heat. Pyranometers vary greatly in terms of accuracy and cost. It is typical for residential monitoring systems to include low-cost, low-accuracy sensors and, often times, no sensor at all, whereas utility monitoring systems include expensive, high-accuracy sensors. In utility environments, it is also common to measure other environmental factors such as wind speed and direction, air pressure, humidity and rainfall.

- The AC meter, or kilowatt-hour meter, is the official source of data for solar revenue generation. Most monitoring systems support interface with a meter, but the meter may or may not be sold by the monitoring vendor.

- The communications hardware varies depending on market applications: utility-scale PV systems often receive a dedicated data line for monitoring purposes; however, this would be cost-prohibitive for commercial and residential systems. Those types of plants are usually monitored either using a dedicated cellular data line (which requires a cellular modem on-site) or hooking up to an internet connection provided by the facility where the PV system is hosted.

- Optional ‘smart combiner’ devices allow monitoring systems to collect data at the combiner (sub-array) level or at the individual string level. In some cases, the data is funneled through the inverter; in others, the smart combiners are connected to the monitoring gateway. String monitoring is a standard practice for commercial and utility systems in Europe, whereas sub-array monitoring is more common in North America.

- Other optional hardware components include backup power supplies, on-site cameras and intrusion detection devices.

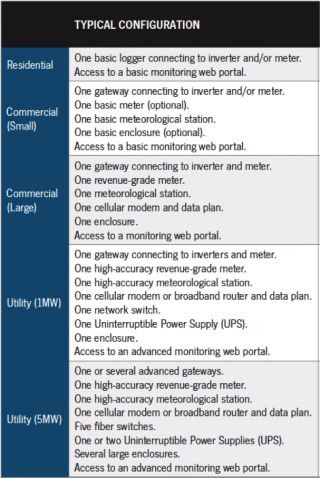

Figure: Common Monitoring Configurations by Segment

Source: Global PV Monitoring: Technologies, Markets and Leading Players, 2012-2016

The core value of most monitoring systems resides in their software, as differentiation on hardware is difficult to achieve due to a trend of commoditization for most of the physical components. Many monitoring PV vendors sell their software as a service, meaning that the software is hosted by the provider in its own network and sold on a subscription basis. This architecture facilitates deployment and eliminates the need for customers to manage servers, perform software upgrades, etc. However, some customers may still prefer to purchase the software, deploy it and manage it themselves in their own network and data centers. This is often the case with utilities that have strong regulatory and security constraints and already own a data infrastructure for the purpose of monitoring power generation assets.

Traditional monitoring solutions are limited to hardware and software tools provided to the plant’s owner or operator so they can manage it themselves. Many vendors now also offer a managed monitoring service: in this model, instead of the customer having to use the monitoring software in order to detect issues, diagnose them and make operational decisions, all of these activities are performed by the monitoring provider (or a partner) in its own operations center.

So who are these vendors offering PV monitoring software (as well as hardware solutions) and how do they stack up competitively against each other? We will explore that question next week in Part II of this article series.