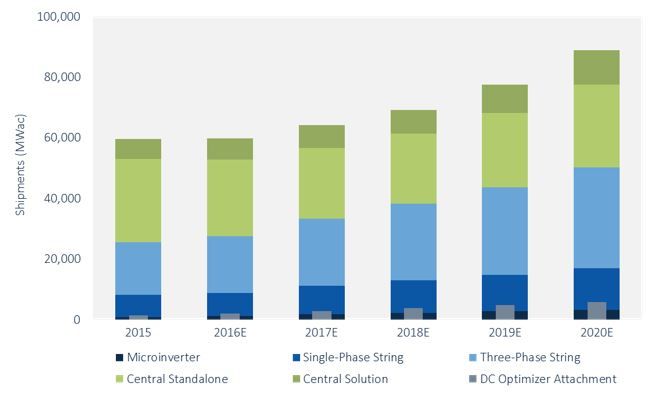

According to GTM Research’s latest report, The Global PV Inverter and MLPE Landscape 2016, global shipments of solar PV inverters will reach 90 gigawatts (AC) by 2020. This represents an average annual growth rate of 11 percent between 2016 and 2020.

Of the 59.7 gigawatts shipped in 2015, 66 percent were in the Asia-Pacific region, led by China and Japan. With the impending decline of the Japanese market, the report notes that demand will shift to other regions including Latin America, India, the Middle East and Africa. By 2020, GTM Research forecasts the Asia-Pacific region to account for less than half of all inverter shipments.

Despite the promising long-term outlook, growth will be flat in 2016. “Due to the U.S. utility solar ITC rush and strong demand in China, there was a buildup of shipments in 2015 to meet 2016 project demand” said report author and GTM Research analyst Scott Moskowitz. “Overall installation growth will slow in 2017, resulting in flat inverter shipments year-over-year.”

Figure: Global PV Inverter Shipments by Product Type, 2015-2020E

Source: GTM Research The Global PV Inverter and MLPE Landscape 2016

The report ranks and profiles leading PV inverter manufacturers. For the first time ever, Huawei took the top spot in terms of shipments according to 2015 figures. Sungrow, SMA, ABB and TMEIC rounded out the top five.

The report also highlights the fundamental shift in inverter technology preferences. In 2015, central inverters accounted for 57 percent of all inverter shipments, but with the continued rise of three-phase string inverters, central inverters' share will fall to 43 percent by 2020. Module-level power electronics will gain share as their prices fall and usage expands to commercial markets. Module-level power electronics (MLPE) are expected to account for 10 percent of all inverter shipments by 2020.

Inverter pricing continues to steadily decline as the market grows and technology advancements enable lower costs. The report points to 1,500-volt inverter technology, higher power density string inverters, and rapidly falling microinverter pricing as key drivers for the overall downward pricing trend. GTM Research forecasts inverter prices to decline 10 percent to 12 percent annually across most product segments through 2020.

By 2020, the global PV inverter market will be worth more than $7.1 billion.

***

For more information, visit the report page here or email [email protected].