Johnson Controls released its fifth annual survey, 2011 Energy Efficiency Indicator: Global Results, which takes a birds eye view of the international state of energy efficiency.

This year, there were more than 3,800 respondents from around the world -- a mix of C-level execs, building owners, vice presidents and facility managers. Over half of the participants were in the commercial sector, along with industrial and institutional organizations represented.

Many of the responses weren’t that different than last year, with just a moderate increase in awareness and action on energy efficiency topics. There is an increased emphasis on managing energy, but there are also challenges.

- Not surprisingly, China and India still rated the importance of energy management highest, with 88 percent of Indian respondents saying it was extremely or very important, compared to 66 percent for the U.S. and Canada. In every region, however, the importance continued to grow.

- The drivers for energy efficiency are still cost savings, although rebates and incentives played a more important this year than last year. However, for the first time, energy security, especially in the eyes of the Chinese, Indians and Europeans -- was listed as one of the top three reasons. Here in the U.S., public image held the number three spot -- an interesting diversion from other regions since we saw the return of $100 barrels of oil and Obama has called for an end to our cycles of shock and trance on energy security.

- Last year, most respondents thought energy prices would creep up. That holds true for 2011, with more than 80 percent of participants in every region saying prices will rise. The average guess at how much was about 11 percent, compared to 9 percent for last year.

- Incentives gained market traction this year, especially the influence of government incentives.

- One of the biggest areas of changing perceptions was green building certification. The figure of respondents with at least one green-certified building jumped from 19 to 37 percent, with another 32 percent saying they’ve incorporated green building elements without formal certification. In Europe there has been energy benchmarking for years, something that’s just starting in the U.S. -- which is likely to keep this figure rise in coming years.

- Lighting and HVAC improvements continue to lead the pack, but with behavioral improvements (we’re assuming that’s having people turn off their computers) and peak demand management just behind.

- Only 1 percent of building mangers over 500,000 sq. feet said that they had taken no energy efficiency measures in the past 12 months.

- Occupancy or photo sensors were second only to switching out lighting as the most popular measure to achieve energy efficiency. Close behind were adjusted HVAC controls, increasing awareness amongst occupants and replacing inefficient equipment before the end of its lifecycle.

- In the U.S., respondents were bullish on the future of lighting technologies, with nearly 60 percent saying it would have the great increase in market adoption in the next decades. Nearly every other region had about 35 percent of respondents pick lighting.

- China and the U.S. saw smart building technologies getting a lot of take-up in markets in the next 10 years, although only about a quarter of Europeans felt the same way.

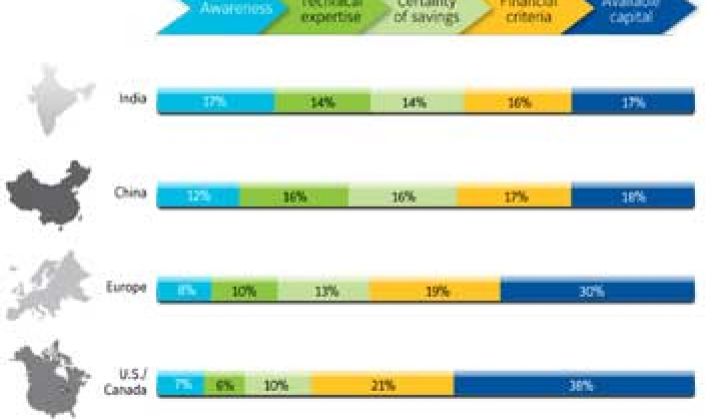

- No surprise, lack of money topped the list as the top barrier to pursuing energy efficiency, with insufficient ROI coming in second with 19 percent saying it was a constraint. Capital costs were less of an issue in Indian and Chinese markets than they were in North America and Europe.

- Technical expertise was surprisingly seen as a bigger setback for China and India than Europe or the U.S.

- On a positive note, 76 percent of respondents have either an energy or carbon reduction goal. Just last year, about 30 percent did not know or had not prioritized their carbon strategy, and a 2010 survey of just North American businesses by Johnson Controls found that figure was closer to 40 percent.

- Almost half of the companies measure and record their energy usage at least weekly. However, that figure looks less rosy when the follow up reveals that only 15 percent review and analyze that information on a weekly basis. However, nearly half of the companies look at the data monthly.

- 84 percent of Chinese companies polled added personnel as part of their energy efficiency programs, compared to just 45 percent of the U.S.

- Internal capital continues to be the source of funds for upgrades, with three-quarters of respondents saying they will use internal budgets in the next two years.