The first natural-gas-fired turbine for U.S. power generation and one of today’s state-of-the-art designs currently live a couple hundred yards apart on GE’s massive 413-acre Greenville, South Carolina campus. The fact that both machines convert natural gas into electricity is where the similarities end.

The first gas turbine used for electric utility power generation in the U.S. was manufactured by GE and shipped to Oklahoma Gas & Electric in 1949. It represented the transformation from early aviation turbines that rarely ran for more than ten consecutive hours to long-life power generation applications. The unit operated at OG&E’s Belle Isle power station from 1949 to 1980 and helped prove the technology.

National Historic Mechanical Engineering Landmark: First gas turbine for U.S. utility power generation. Photo credit: Breaking Energy/Jared Anderson

Fast-forward more than 50 years and natural gas-fired generation has grown to account for roughly 30 percent of U.S. power generation capacity. GE’s Power & Water division has invested heavily in its next generation of combined-cycle natural-gas-fired turbines, the 9HA/7HA series. According to the company, the “H Class” is the world’s most efficient gas turbine, which is helping it quickly gain market share.

The H class turbines have an efficiency rating of over 61 percent, meaning 61 percent of the energy contained in the natural gas used as fuel is converted to electricity.

“It’s a good machine they put together,” according to Richard Dennis, Technology Manager for the National Energy Technology Lab. The NETL is an organizing national lab within the DOE’s Office of Fossil Energy. “Quick startup and good load following are some of its hallmarks,” he added.

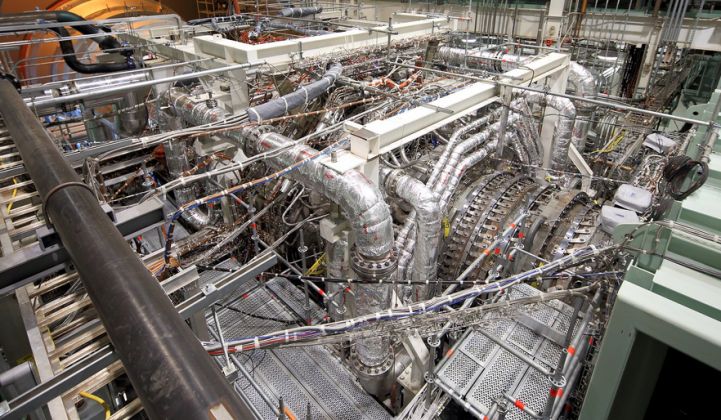

9HA gas turbine going into test stand. Photo credit: GE

“There are other companies that also have very highly efficient machines in the 61 percent target range,” said Dennis, who cited Siemens and Mitsubishi Heavy Industries -- now in partnership with Hitachi -- as examples.

Turbine efficiency depends on numerous exogenous factors including altitude, temperature and humidity levels. “The parameter people look to is turbine firing temperature or turbine intake temperature. […] To get ultra-high efficiencies, it takes a coordinated approach to pursue several parameters including firing temperature, optimal pressure ratios, advanced cooling technology and new components,” said Dennis. All these parameters need to be incorporated into a new design in order to increase total efficiency.

“Our target is 65 percent, and the commercial developers are all pursuing similar goals. It’s a very technology-intensive endeavor to reach these higher firing temperatures, particularly with such mature technology,” Dennis added.

And GE is working hard at finding the innovations needed to move the dial toward even more efficient gas-fired turbines. Part of this effort is directed at advanced coatings for turbine blades, which allow the metals to reliably operate at higher temperatures. “Coating processing is probably one of the biggest problems [turbine manufacturers] have. […] The coating business is very competitive, very secretive and very profitable,” said Bruce Pint, a research staff member at the DOE’s Oak Ridge National Laboratory.

In addition to coating technology, GE is focusing on fuel and combustion advancements that allow its machines to run on fuels ranging from crude oil to natural gas liquids.

Gas turbine markets and environmental regulations

There is strong appetite for natural gas generating capacity as pressure to reduce greenhouse gas emissions increases. Power plant operators in regions of the world with access to comparatively inexpensive natural gas supplies are also motivated by economic incentives.

GE’s biggest markets for its gas turbines are the U.S., Middle East and Asia. “One thing we know for sure is that in 10 years, people will want cheaper and more reliable power,” Guy DeLeonardo, GE Power & Water’s Power Generation Products Manager, told reporters during a recent media tour of the company’s Greenville operations.

The high efficiency H Class turbines offer decreased emissions and increased reliability. Over the past 20 years, fuel combustion technology has decreased power plant emissions 90 percent, said Combustion Engineering Manager Joseph Citeno.

“What GE seems to be bringing to the table is very fast startup and low NOx emissions,” NETL's Dennis said.

And this presents an interesting engineering challenge because higher-temperature hydrocarbon combustion generates higher levels of nitrogen oxide emissions, but decreases carbon dioxide emissions. So now there is a push toward what’s known as “lean combustion,” which requires additional air to be injected into the reaction.

Fuel costs and the need for reliability

“The driving need here is lower cost of electricity to serve a growing world,” DeLeonardo said. The company estimates $5 trillion will be spent on new power plants globally over the next 10 years. And whenever those capital-intensive plants are down for maintenance or service, the owner is usually losing money. That’s why “there is a huge focus on reliability,” said DeLeonardo.

And modern gas-fired turbines are increasingly durable, with intervals between scheduled service growing larger as technology advances. It’s like driving a car 1.2 million miles before servicing, Citeno explained. GE’s latest F class turbines currently operate for 24,000 hours before combustion system inspections are necessary, he added. And the goal for the H class is to reach 25,000 hours.

With regard to power generation installed costs, GE’s new turbines are within the $500 to $700 per kilowatt range, said DeLeonardo, while renewables are around $1,500 per kilowatt and nuclear can be $5,000 per kilowatt. Indeed, according to the 2013 Wind Technologies Market Report published last year by the DOE’s Lawrence Berkley National Lab, the capacity-weighted average installed project cost was $1,630/kilowatt in 2013.

Of course, once wind turbines or solar systems are constructed and connected to the grid, the fuel is free. Fuel for gas-fired power generation is anywhere from two-thirds to 80 percent of the cost of producing electricity.

GE’s gas turbine manufacturing plant in Greenville, South Carolina, which is reportedly the world’s largest. Photo credit: Breaking Energy/Jared Anderson

At current natural gas prices, the fuel cost component of generation in the U.S. is about two-thirds, while Asian markets that rely on imported LNG face fuel costs that account for roughly 80 percent of the capital spent by a utility to produce power, DeLeonardo explained.

GE has already been technically selected for 45 HA units globally, with 19 of these coming from U.S. customers, seven each from buyers in Japan and the U.K., and six in Brazil. Power producers in South Korea, Russia, France, Germany and Turkey have also placed orders for the new machines.

Traveling a dangerous path?

Natural gas is a clear winner today given its commodity price advantage in the U.S. and its emissions advantages over coal. But are we making our infrastructure too reliant on the resource?

Some contend that piling too heavily into natural gas as a power generation source exposes consumers to disproportionate risk if commodity prices increase as a result of demand growth. Utilities are some of the first to bemoan over-reliance on any single power generation source and always seek balanced feedstock portfolios. However, given public and political resistance to coal, natural gas has a leg up in the current environment.

“It’s a dangerous path we are going down,” said Oak Ridge Lab’s Bruce Pint. “I see the benefit and I see the reason why we are doing it, but the fact is not investing in nuclear, not investing as much in coal is probably going to come back to bite us at some point,” he said.

Should the EPA’s Clean Power Plan move forward with resultant coal plant closures, it will be difficult to replace that lost power generation capacity with anything but gas in the short term. Renewable sources can help, but they will still need baseload backup until utility-scale storage options can be economically and reliably integrated. This is why natural gas is often referred to as a bridge.

“To me, [natural gas is] more like a crutch. What I worry about is that it’s not just going to be a bridge. It’s going to be full force with everyone going natural gas,” Pint said.

There is substantial evidence that indicates how historically low natural gas prices -- coupled with emissions benefits -- are motivating numerous businesses to switch fuel sources. Foreign and domestic gas-intensive manufacturers have been expanding operations in the U.S.; shipping companies are looking at LNG instead of bunker fuel; railroads are considering using LNG over diesel; and fleet vehicle operators like UPS have already adopted natural gas to varying degrees.

“In general, I think that metaphor needs to be carefully considered. […] If you are going to look at any bridge to the future, you need to consider the whole life cycle for GHG emissions for any power source,” Dennis said.

***

Jared Anderson is the managing editor of Breaking Energy. Pete Danko contributed to this article. This piece was originally published at Breaking Energy and was reprinted with permission.