In 2009, after Spain's market collapsed and the world faced a crippling financial crisis, GTM Research predicted a shake-out in the manufacturing sector. But unexpected growth in global demand, particularly in European markets, helped keep many producers afloat.

Then, in 2010 and 2011, we saw a surge of new manufacturing capacity -- much of it driven by China -- that created the structural oversupply faced by the industry today. As illustrated by the growing list of deceased solar companies and acquisitions, the delayed shake-out in the industry is now well underway.

This morning at the GTM Solar Summit, Shayle Kann, vice president of research, shared his outlook on consolidation, module prices, and the shifting global demand through 2016. Here are four charts from his presentation that provide a glimpse of what the world may look like in the next three years.

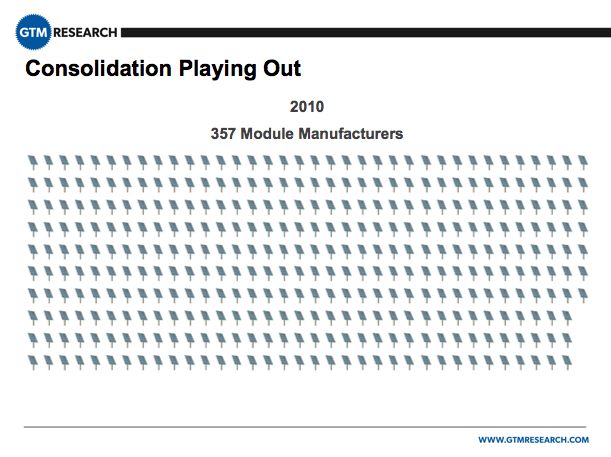

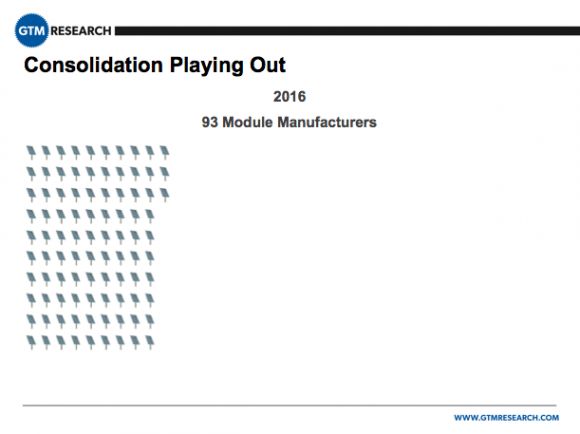

In 2010, when the period of irrational growth began in solar manufacturing, there were 357 active module producers.

By the end of this year, that number will be down to 145. And in 2016, it will drop below 100. (So if you're at a conference talking to a person involved in manufacturing, there's a good chance he or she might be out of a job or working for a different firm the next time you see them.)

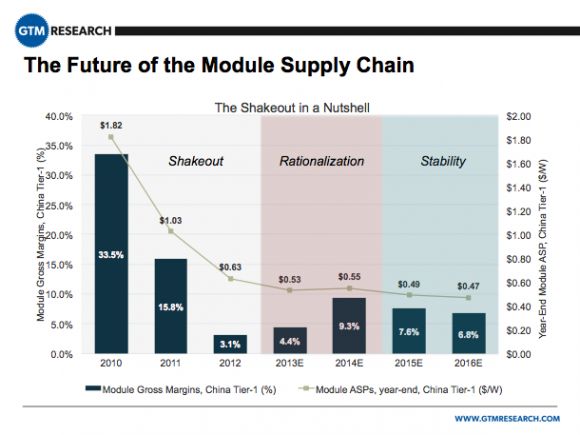

But global demand continues to grow as new markets open up and installation costs drop. Already, panel prices have begun to level out as the Chinese and Japanese markets speed up. At the end of 2013 and into 2014, the market will begin to rationalize and prices actually may start to rise, allowing the remaining manufacturers to catch their collective breath. But the days of gross margins of over 30 percent for solar producers are long gone. (Notice that the average sales price in a "stable" market for a Tier-1 Chinese module is still $0.47 per watt.)

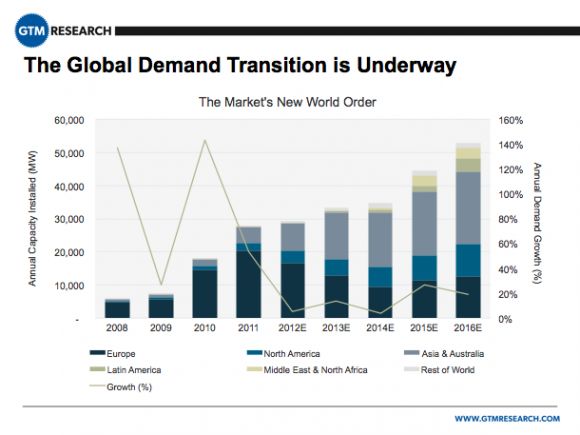

So what does the "new world order" look like on the demand side after 2016? After a long period of dominance, Europe finally cedes its leadership to Asia in 2013 and 2014. The U.S. also becomes a major player, representing 18 percent of total global installations. The Latin American, Middle Eastern and North African markets also start to show great promise in 2014 through 2016.

While the annual growth may not be as strong, the global market will still total more than 50 gigawatts in 2016 -- a massive jump from the 6.4 gigawatts installed in 2009 when GTM Research first predicted the shake-out would occur.

You might have missed out on Shayle Kann's presentation, but you can watch it below and also find many of our sessions streaming here throughout the rest of the conference.