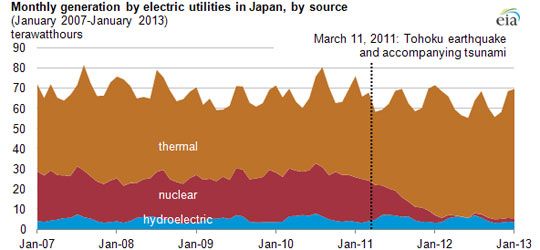

Japan may have one of the world’s largest residential solar markets, but the majority of its power is coming from fossil fuels after the country shut down most of its nuclear fleet in the wake of the Fukushima disaster two years ago this month.

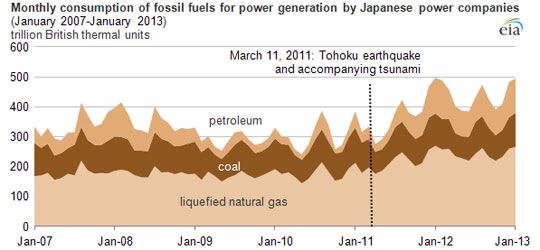

In 2012, Japan’s use of fossil-fueled generation was up 21 percent, according to the U.S. Energy Information Administration. The additional capacity was needed as the country shut down all but two of its nuclear power plants after an earthquake and subsequent tsunami destroyed TEPCO’s Fukushima nuclear power plant. Japan’s nuclear regulatory agency is expected to issue final nuclear safety regulations in July, according to EIA.

To combat the energy shortages with nuclear -- which had made up about 30 percent of Japan’s electricity fleet -- the country largely turned to liquefied natural gas, rather than coal. Japan is already the world’s largest importer of LNG. Natural gas used for electricity was up 15 percent through 2012. Crude and heavy oil imports also more than doubled to meet electricity demand.

When the nuclear regulatory agency releases the new safety rules in July, it is unclear how quickly fossil fuel use will drop back down. Some estimates have put the cost of upgrading nuclear plants to meet the new regulations at more than $11 billion, according to EIA.

Nuclear is being sidelined in Japan's national policy as smart grid and renewables see increased investment. Already, investments in home and building energy management systems are growing at a rapid clip, according to GTM Research. The country has also turned to energy efficiency and smart grid to curb supply-side demand.

Japan has also incentivized renewables with a feed-in tariff and opened up some of its national parks to geothermal exploration, but it is still too early to predict the degree to which renewables will replace nuclear -- especially as red tape and politics come into play once the new rules for nuclear are set.