Imagine a utility-scale photovoltaic solar farm with tens of thousands of panels covering thousands of acres of land.

Now, picture a squadron of tiny flying robots buzzing up and down the endless strings of solar panels like bees in a clover field.

They’re hunting not for nectar, but for data. Perhaps they're looking at how much dust has collected on any particular panel, or identifying areas where fast-growing trees and grasses have begun to cast shade over certain strings in late afternoons.

Or maybe they’re swarming to investigate a problem the control room has found, but can’t explain.

Unmanned aerial vehicles -- also known as drones -- could someday serve these tasks for multi-megawatt solar farms. And they could do it much more cheaply than people in trucks or helicopters.

They’re so comparatively cheap, in fact, that they could theoretically support an entirely new, data-driven approach to preventative maintenance and enhanced operations on solar farms -- or finding the best rooftops for solar, for that matter.

These are the potential payoffs that have led companies like First Solar and SolarCity to start testing unmanned aircraft systems (UAS) as a business tool over the past few years, according to a new report from the Electric Power Research Institute (EPRI). But to become a commercial-scale tool, UAVs will have to deal with uncertain federal and state regulations on where, when and how high you can fly robots around private and public land -- and a key restriction that forbids flying them out of sight of their operators.

EPRI’s report is based on interviews with PV asset owners, operations and maintenance service providers, and providers of UAS -- the federally approved term that includes base stations, communications systems, and other support equipment, along with the flying robots themselves.

Today’s UAS “can currently perform a variety of PV-related tasks, including visual imaging (of modules, wiring, and other plant components), infrared thermography, and vegetation monitoring,” EPRI writes. And they can do so at quite a low cost, compared to the alternative.

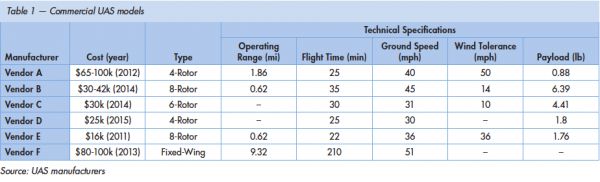

According to EPRI’s report, the cost of hiring a UAS vendor for a year ranges from as high as $100,000 to as low as $25,000, based on data from the past few years.

Drones would be replacing truck rolls -- the employee-hours, fuel costs, and other soft costs involved with sending people out in trucks to inspect sites. GTM Research estimates the cost of a single truck roll at between $300 to $600, depending on fuel costs and distances traveled.

This is a variable cost, compared to the relatively fixed costs of flying battery-powered robots around. Each truck roll is a separate expense, which puts pressure on O&M providers to limit their attention to problems that are worth the cost.

"Conventional preventative maintenance approaches, which entail periodic inspections to proactively prevent major breakdowns, tend to be both tedious and costly, making frequent and comprehensive inspections of large systems infeasible," concludes the EPRI report.

That forces solar farm O&M providers to “balance the degree to which expensive ‘truck rolls’ are dispatched to facilitate on-site inspections with the risks of potential plant failure,” EPRI writes. In other words, every solar farm is weighing the risk of something bad happening, or some undetected problem eroding performance, against the cost of trying to look for it. Drones could radically alter that approach by reducing the cost of data collection.

Low-flying rotor-based flyers are quite sophisticated in terms of how much they can find wrong with panels, the report notes. “Errors such as micro-cracks, snail trails, potential-induced degradation, and ribbon solder bond failures, among others, can be identified” by hovering UAVs, not to mention easy-to-spot problems like dirt and leaves.

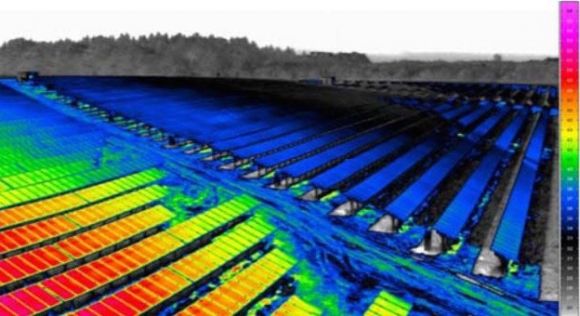

They’re also able to perform thermal imaging to see where excess heat is degrading PV performance, at a granularity and frequency that would be cost-prohibitive for hired airplane or helicopter over-flights (which is how it's done today).

Drones can also check combiner boxes, junction boxes, inverters, and other electrical equipment for heat, which can be a sign of impending failure.

Another thing UAVs can do is take lots of different kinds of data at once, knowing exactly where it is at every moment, geospatially speaking. This multi-data collection capability can support GPS tagging, visual and LIDAR pulsed-laser imaging, as well as detect light wavelengths humans can’t see.

As this type of interwoven data starts flowing in, it has “the potential to update largely manual conventional processes and more efficiently identify and diagnose PV system performance issues,” EPRI writes. “Future UAS capabilities, such as data analytics through pattern recognition and change detection, offer greater potential economic upside by introducing predictive methods for gauging plant health and optimizing strategic O&M responses.”

SolarCity is one of the big PV fleet owners EPRI cites in its research. “Based on perceived worker safety and economic benefits, the company is particularly interested in leveraging UAS as a front-end sales tool, utilizing the device to perform rooftop assessments and help build 3-D point clouds that simulate production performance models.”

SolarCity, which has been testing drones from startup Skycatch since last year, told EPRI that it estimates it could double its pace of rooftop inspections per day with UAVs, with increased accuracy over manual methods.

Amidst all these potential benefits, there are a number of cost factors that have limited UAS deployment in the solar and utility fields to date.

The first, and most obvious, is regulation. Today, anyone who wants to fly drones as a business has to get a special exemption from the Federal Aviation Administration (FAA), which is done on a case-by-case basis.

That was initially a very slow process. Of the 684 applications submitted from September 2014 to March 2015, only 48 -- or 7 percent -- were approved, EPRI notes. But it skyrocketed after two new streamlining rules were approved in March and April, with more than 1,400 applications approved since then. Bigger changes are on the way, with the FAA working on a universal regulatory framework for UAS that’s set to be put in place in late 2016 or early 2017.

That could help resolve a pressing problem for UAS commercial viability: autonomous flight. Under today’s FAA exemptions, UAVs have to be flown within line of sight of their operators, which drastically reduces their range and usefulness.

Two new technologies will be needed to make autonomous flight possible, EPRI says. The first is sense-and-avoid technology, which makes sure the UAV doesn’t crash into anything, even if it’s disconnected from central control. It’s a complex enough technical challenge that NASA has gotten involved, providing proof-of-concept collision avoidance and “self-separation” demonstrations the FAA will use in developing its regulations.

The core question of flying drones beyond visual line of sight is a much thornier one, with concerns about “potential loss of communications between the operator and the aircraft, and the possible malfunction of navigation equipment/sensors which could lead to property damage or personal injury,” the report notes. “To date, FAA research and demonstration of [beyond visual line of sight technologies] are in the early stages.”

Drones are being tested by utilities including San Diego Gas & Electric and Commonwealth Edison for use in inspecting transmission lines, though they’re also limited to line-of-sight operation at present.

These uncertainties led EPRI to conclude that it can’t project the costs and benefits of UAS for solar customers, or utilities at large for that matter.