The great thing about fault location isolation and service restoration, commonly known as FLISR, is that when an outage does happen, the technology can cut a 45- to 75-minute outage down to one to five minutes for most affected customers.

The problem, according to Ben Kellison, author of GTM Research’s latest report, Distribution Automation: 2012-2016: Technologies and Strategies for Grid Optimization, is that although automatic line switching technology can pay for itself quickly, utilities are never sure when they’ll need it.

“FLISR can hedge the risk of lost of revenue and man-hours needed to restore power when outages occur and can be one of the handful of technologies that are useful during or after a major weather event,” said Kellison. “The problem with forecasting the payback on FLISR software is that it is difficult to predict when you will need to use it.”

But that’s not stopping many utilities from investing in the technology. Just the FLISR software market alone is expected to be worth $406 million to $1.22 billion from now through 2016.

The market for FLISR is currently stronger than that for volt/VAR optimization, with large-scale implementations underway at NSTAR, EPB Chattanooga, and San Diego Gas & Electric and planned projects in the works at Pacific Gas & Electric and Southern California Edison.

At EPB, S&C Electric is working to install more than 1,200 pulse reclosers. SDG&E has been installing automated switching since 2008 and expects to have its entire distribution network completed in 2016.

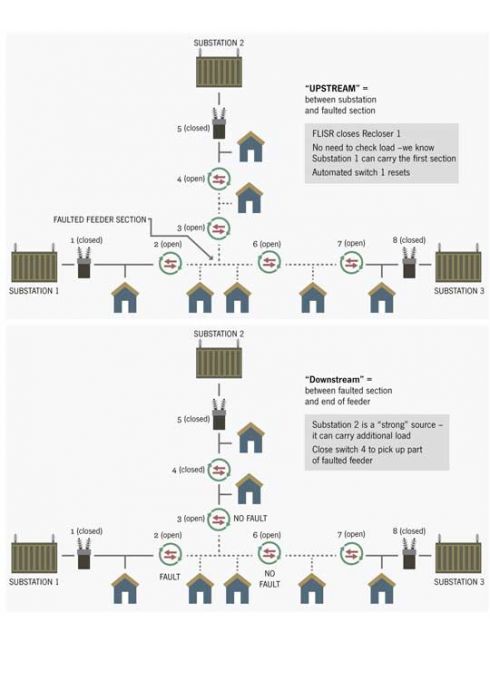

For each utility, the FLISR implementation process will look a little different, depending on its unique needs. Kellison noted in an earlier story that FLISR applications can use either decentralized, substation, or control-center intelligence and that each has advantages and drawbacks. For utilities with performance-based rates, Kellison noted that FLISR software should be an attractive option.

Although the cost can be high, the cost of not having smart switching in place can be even higher. Connecticut Light & Power incurred nearly $163 million in reported costs after an October nor'easter devastated the state. By early November, some customers had filed lawsuits, and CL&P has set aside a $30 million fund for rebates to customers who went without power for more than a week.

Not only can an FLISR application be a savior during a major outage -- it can also be a selling point for C&I customers, said Kellison.

If regular-flavored FLISR doesn’t get you excited, keep an eye on S&C Electric and Alstom Grid for their work in using software so utilities can offer commercial and industrial customers sub-second reliability coupled with the dynamic optimization of service -- for a premium price.