With a solar system installed every four minutes in the U.S., it shouldn't come as a surprise that the industry is adding a lot of new jobs in the process.

The Solar Foundation released top-level findings of its latest solar jobs census yesterday, finding that there are 142,698 jobs throughout the industry. That's a 20 percent increase since 2012 -- a jump driven both by growth in installations and new categories for academic and research jobs.

With 24,000 new jobs added last year alone, the industry is growing at roughly ten times the rate of the broader economy.

"This is very real and tangible growth," said Andrea Luecke, executive director of the Solar Foundation, on a press call. "The vast majority are new jobs."

Two-thirds of the jobs tracked were new, meaning they didn't come from companies shifting existing employees into the solar business. Solar firms were adding 56 new workers every day last year.

So much for that cleantech crash reported by 60 Minutes' Lesley Stahl, who concluded "there were not many jobs created" by clean energy promotion policies.

SolarCity's Lyndon Rive backed up the findings, reporting the addition of 2,000 jobs at his company in 2013 alone. That brings SolarCity's total employee count to just under 4,500 people in fourteen states, said Rive.

"Most of the jobs are in the field and are highly distributed. There's not any central hub," he said. Even in states where incentives are starting to disappear, "adoption has never been higher," said Rive.

As we've seen over the last three years since the census was first published, a large majority of jobs being created are downstream. There were 81,827 reported jobs in project development and installation, with the rest of the jobs spread across administration, sales, research and manufacturing.

None of those findings are unexpected. But the Solar Foundation dug deeper into demographic trends and buying habits this year to understand the forces behind those jobs figures. Here are five noteworthy trends.

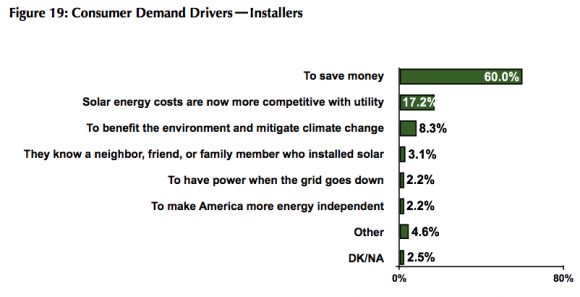

1. Companies say their customers are buying solar mostly to save money, not for environmental reasons

As the economics of solar improve, the industry is finally moving beyond early adopters who have historically bought solar for environmental or image reasons. When the Solar Foundation asked installers about customer motivation, it found that more than two-thirds of buyers are motivated by financial reasons.

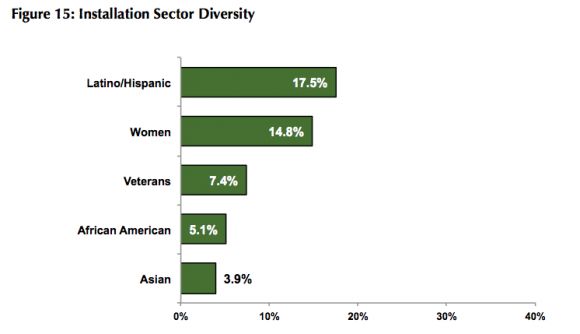

2. Solar installers employ more Latinos and Hispanics than any other solar sector

The diversity picture is mixed in downstream solar. Installation companies are employing more Latinos and Hispanics than the broader national workforce. However, while one in five solar jobs are held by women, only around 15 percent of these women are employed in installation. The number is much lower for African Americans and Asians, who together make up only 9 percent of installers.

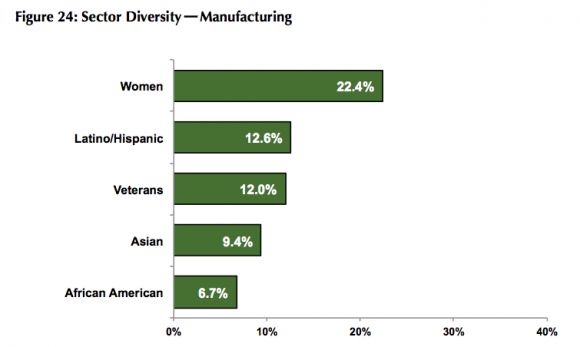

3. Manufacturers are the largest employers of women in the solar industry

Diversity improves slightly in the solar manufacturing sector. With a 22.4 percent share of the manufacturing workforce, women are employed more in that sector than anywhere else in the solar industry. Job placement for veterans is also higher in manufacturing than in the broader national workforce.

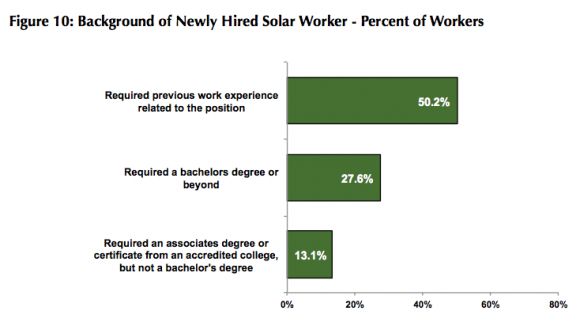

4. Workers finding jobs in the industry have related experience

The people making their way into the solar industry generally aren't entry-level workers. According to the Solar Foundation's survey, half of all new employees have direct experience in the solar industry, or are required to have a bachelor's degree in a related field. This means that two-thirds of workers are getting paid a decent living wage. But it also means there are significant barriers to entry for people who aren't in school, or who don't have access to training programs.

5. A majority of solar companies say cheap Chinese panels are a good thing

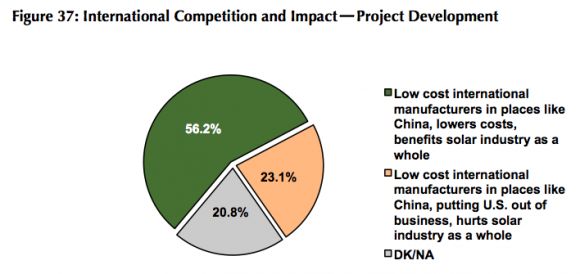

Because the solar jobs market is so heavily weighted toward downstream companies, it's natural that survey respondents would rank lower-cost equipment as being important to their business. The Solar Foundation found that 56 percent of project developers believe products from China are a good thing for the industry. Just under one-quarter of the surveyed companies said Chinese panels are a bad thing. This is an important factor to consider as the U.S. solar industry speculates about the consequences of another trade complaint from SolarWorld, which could significantly raise the price of foreign solar cells and modules.

"A comprehensive study of the broader U.S.-China solar trade conflict is needed to provide a deeper understanding of the conflict’s impact or potential impact on employment in both upstream and downstream labor markets," concluded the Solar Foundation report.

While the looming solar trade case casts a shadow over future job growth in the industry, the general consensus is that employment figures will continue moving in a positive direction. The Solar Foundation projects 15.6 percent growth in 2014.

"We are in fourteen states, and the growth is doubling in all the states," said SolarCity's Lyndon Rive. "The market in the next ten years is going to be very, very exciting."