The Federal Energy Regulatory Commission has passed a rule that will open U.S. wholesale energy markets to energy storage on an equal footing with generators and other grid resources. But it hasn’t yet figured out how to address the same challenge for distributed energy resources.

On Thursday, FERC commissioners unanimously approved the final version of a rule, first proposed in November 2016, designed to “remove barriers to the participation of electric storage resources” in the wholesale energy markets that make up about three-quarters of the country’s electricity supply.

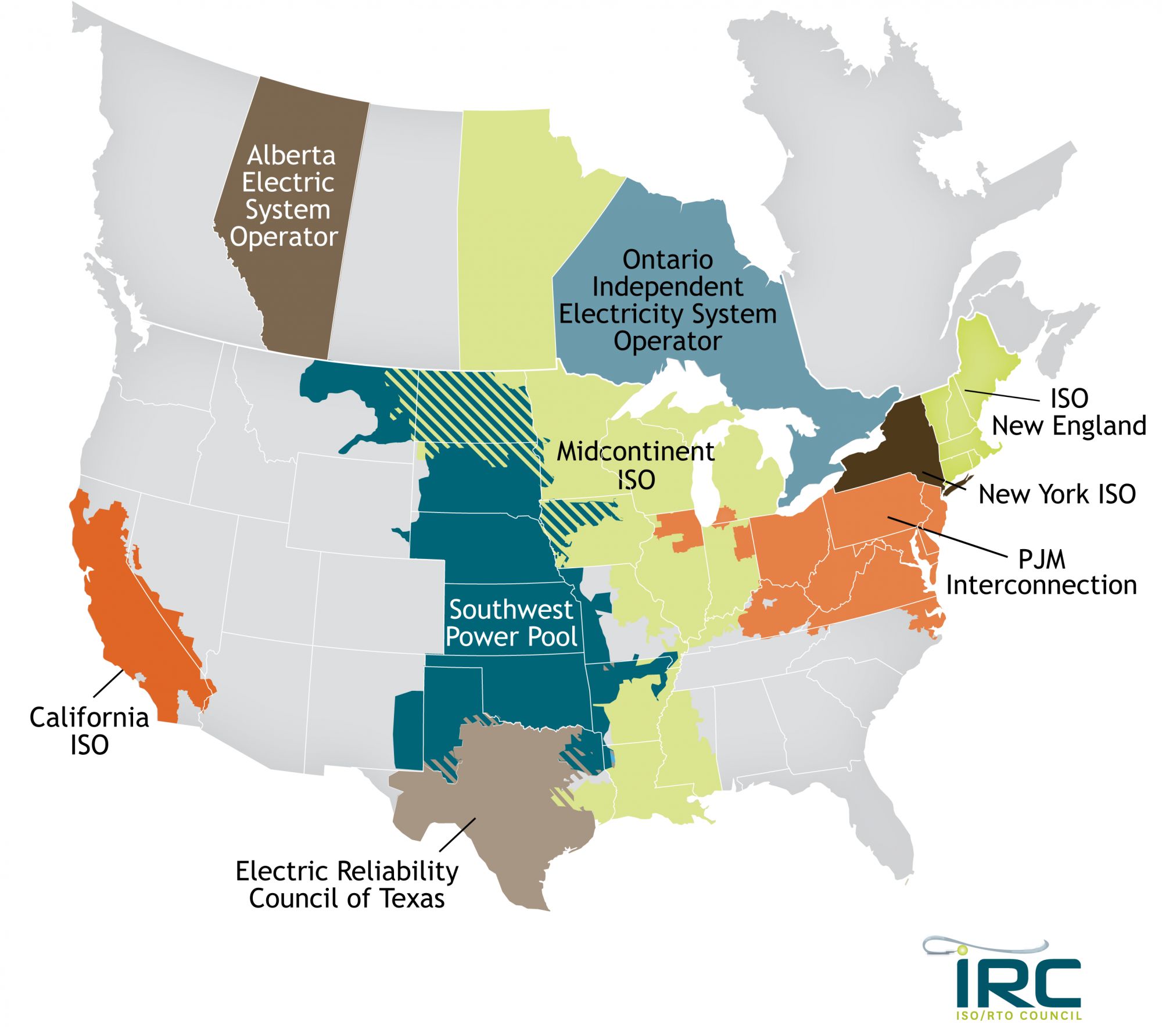

Within the next nine months, each of these regional transmission organizations (RTOs) and independent system operators (ISOs) will be required to come back with a plan for revising its tariffs to establish a participation mode for energy storage, “consisting of market rules that, recognizing the physical and operational characteristics of electric storage resources, facilitates their participation” across the range of markets that make up a regional transmission grid.

That’s a much broader set of opportunities than those currently available to large-scale batteries, pumped hydro systems, thermal energy storage and other types of energy storage now participating in ISO and RTO markets. To date, those have been limited in geography and in type, with the vast majority of storage playing in fast-responding frequency regulation markets, and with viable markets in only a handful of jurisdictions.

This biggest, mid-Atlantic grid operator PJM’s frequency regulation market, has also became the largest U.S. market for energy storage, with about 250 megawatts of cumulative deployments since 2013 -- although it’s largely tapped out at present and suffering from some of the side effects of its own success.

FERC’s new rule will expand the scope of energy storage’s participation beyond frequency regulation and into larger ancillary services and wholesale energy and capacity markets, and for all ISOs, not just the handful like PJM and California grid operator CAISO that have taken the lead on the matter.

ISOs and RTOs still have a year to implement these future energy storage market participation rules. But when they do, they will likely become one of the largest opportunities for energy storage in the country, noted GTM Research's Ravi Manghani. “This opens the floodgates for storage participation,” he said.

Energy storage and clean energy groups also praised the decision, noting the benefits that grid-scale batteries are already providing in the limited applications where they’re cost-effective, and hold promise for much broader applications as battery prices continue to fall in years to come.

FERC’s commissioners concurred in their written statements. Commissioner Cheryl LaFleur, a Democrat, called storage a “Swiss army knife” in its ability to provide energy alongside variable renewable generation, provide frequency regulation and other ancillary services, and help defer distribution and transmission needs.

Commissioner Richard Glick, a Democrat, noted that energy storage capacity is expected to grow more than sevenfold over the next five years, with performance that “is equal to or, in some cases, superior to conventional forms of generation.”

And Commissioner Rob Powelson, a Republican, tied the benefits of energy storage into FERC’s recent ruling overturning Rick Perry’s proposed rulemaking to bolster coal and nuclear plants, while also setting grid resilience planning as a priority. “The resilience of the grid depends in part on the ability to quickly respond to unforeseen events," he said. "Flexible resources that possess unique physical and operational characteristics that will assist us in accomplishing that goal should therefore be permitted to participate in the RTO and ISO markets.”

The challenge in adding storage to a grid run by generators serving load is that it doesn’t work quite like those resources. Electric storage -- batteries, flywheels, and other technologies that charge and discharge actual electrons -- can go in both directions, and react much more quickly than many other resources. But it’s also limited in duration, and of course is only as efficient or as clean as the electricity it stores, or the balance between its charging and discharging cycles over its lifespan.

To deal with these differences, the final rule sets up the following criteria for the participation models it’s asking the ISOs and RTOs to come up with:

- First, participating storage must be “eligible to provide all capacity, energy, and ancillary services that it is technically capable of providing.” In other words, energy storage should be valued on its technical merits.

- Second, the rules for storage should ensure that participating systems “can be dispatched and can set the wholesale market clearing price as both a wholesale seller and wholesale buyer consistent with rules that govern the conditions under which a resource can set the wholesale price.” In other words, storage can go both up and down, not just one way or the other.

- Third, the rules must “account for the physical and operational characteristics of electric storage resources through bidding parameters or other means.” In other words, market rules must take batteries’ limited duration and operating parameters, such as maximum discharge levels, into account.

- Fourth, the rule notes that the “sale of electric energy from the RTO or ISO market to an electric storage resource that the resource then resells back to those markets must be at the wholesale locational marginal price.” This clears up any confusion about whether behind-the-meter assets can buy wholesale and “sell” in the form of reduced retail consumption, or other such market maladjustments that could occur in mixed situations like these.

As for minimum size, FERC’s new rule sets it at 100 kilowatts, although it doesn’t specify duration. That’s a reasonable requirement for an asset that’s serving the transmission grid directly, adding up to the load of roughly 25 homes.

But rules for actually aggregating energy storage, or any other kind of distributed energy resource, on a home-by-home basis, are still being worked out. The original proposed rule on energy storage included a section on how to address aggregated distributed energy resources (DERs). But Thursday’s rule postponed a decision on this even more complicated issue, setting up a technical conference for April 10-11 to discuss “several concerns” raised by stakeholders.

“DERs continue to be viewed with apprehension, which is not surprising given the cross-jurisdictional challenges,” GTM’s Manghani noted. The overarching problem is that ISOs and RTOs don’t have oversight or visibility into the distribution grid, where the vast majority of DERs are connected. That's the responsibility of the distribution utility in question -- and utilities are busy tapping DERs for local grid needs.

What happens if a grid operator and a utility call for the same DERs at the same time? What if an ISO dispatch causes DERs to act in ways that disrupt local utility circuits? Or what if local circuits are having an outage, and can't deliver the DERs effects to the transmission system? These and similar conundrums need to be worked out before DERs can become a significant participant in wholesale markets.

Commissioner LaFleur laid out the two broad sets of issues to consider at the April technical conference. First, “since storage and other distributed resources are technically capable of providing many different services at both the wholesale and retail level, there needs to be a crisp understanding of who pays what to whom for what, which encompasses service definition, accounting, metering, and billing.” Second, “we need to figure out how the transmission and distribution control centers will coordinate so that there is appropriate visibility of the deployment of distributed resources to ensure reliability and safety at all levels.”

California is starting to see these kinds of issues emerge, she noted. State grid operator CAISO has started allowing DERs to play in wholesale markets, although the uptake has reportedly been rather light to date. The state’s Demand Response Auction Mechanism, meant to serve as a model for all future demand response in the state, is also built on aggregating distribution grid-connected assets for transmission grid needs. And utility Pacific Gas & Electric and CAISO recently unveiled a project that would allow DERs to stand in for transmission grid investments.