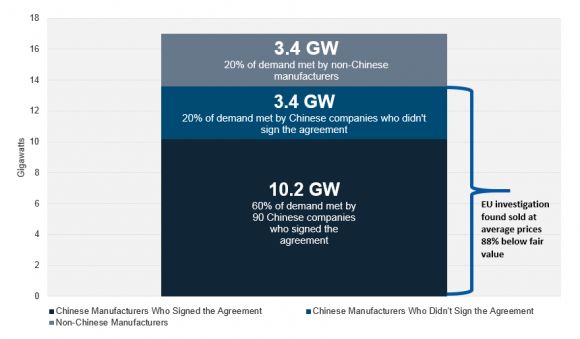

Last September, the European Union launched an investigation into 140 Chinese manufacturing companies that were accused of selling solar equipment below fair-value prices in Europe.

The dumping investigation found that government assistance enabled these companies to sell products at prices that were an average of 88 percent below fair value, resulting in an 80 percent market share in 2012.

In June, the EU imposed temporary duties of 11.8 percent on Chinese imports, which were set to rise to 47.6 percent on August 6. During this two-month period, the Chinese Chamber of Commerce negotiated a settlement with the EU on behalf of 90 Chinese companies, which taken together account for 60 percent of the 2012 European market.

The agreement between the EU and the Chinese Chamber of Commerce has two parts: a minimum price floor and a volume cap. While remarkably little has been disclosed about the deal by either party, the price floor is believed to be set at $0.74 per watt and the volume cap is reported at 7 gigawatts.

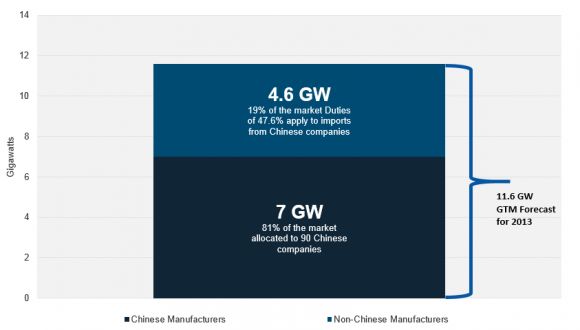

This means that the 90 Chinese companies covered by the agreement can export up to 7 gigawatts into Europe in 2013 at the minimum price of $0.74 per watt before invoking the 47.6 percent anti-dumping duties. The 50 companies that did not sign the agreement will be have to pay the 47.6 percent duties on all exports to Europe, although they are not obligated to meet the minimum price requirements.

Source: GTM Research

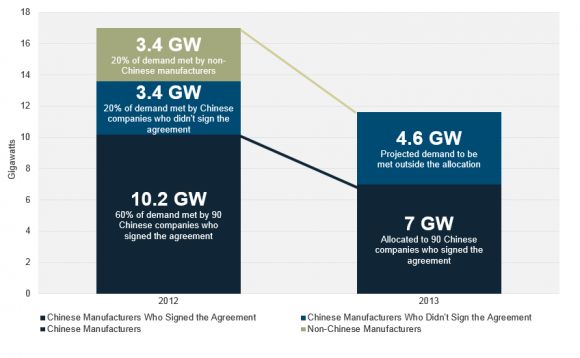

Although coming days may reveal more information, we can draw some interesting conclusions when we put these charts side by side:

- The 90 Chinese companies that signed the agreement can safely export 7 gigawatts without levying 47.6 percent duties on their products. However, this is a 3.2 gigawatt decrease from their 2012 export levels.

- If the 50 Chinese companies that did not sign the agreement want to provide the remaining 4.6 gigawatts of demand, their products will be subject to 47.6 percent anti-dumping duties. However, they are not obligated to meet the price floor.

- The fight over this remaining 4.6 gigawatts will be interesting to watch. Will the companies that did not sign the agreement be competitive against non-Chinese companies?

EU Trade Commissioner Karel De Gucht said that the volume cap would be well below the 80 percent market share previously held by Chinese companies. But as the second chart shows, a 7 gigawatt allocation would actually be right around 80 percent of the 2013 EU market.

This discrepancy indicates that the EU Trade Commission has a more ambitious forecast than GTM Research does for 2013. But it illuminates one of the key open questions about the deal: what happens if demand comes in above or below the projections -- and how will the allocation be changed and communicated?

***

Adam James is a Solar Analyst for GTM Research covering global downstream markets. Previously, Adam was a Research Assistant for Energy Policy at the Center for American Progress, where he specialized in clean energy and international climate policy. You can find him on Twitter at @Adam_S_James.