What’s the difference between smart grid deployments in the United States and those going on in Europe? And how much is being spent on smart grid in Europe, anyway?

Anyone looking for an in-depth resource to answer these kinds of questions should turn to this report from the Joint Research Centre, the in-house science service of the European Commission. With an exhaustive list of smart grid projects underway as of September 2012, it’s about the most comprehensive snapshot of the continent’s progress on grid modernization out there.

All told, the report, “Smart Grid Projects in Europe: Lessons Learned and Current Developments,” collects 281 smart grid projects and about 90 smart metering projects, in the 27 European Union countries, plus Croatia, Switzerland and Norway. The list includes a wide range of information and communications technology (ICT)-enabled projects, from smart metering to virtual power plants. It also includes energy storage, electric vehicle charging, and the all-important integration of Europe’s growing share of intermittent wind and solar power into the grid.

Here are the key points from the report:

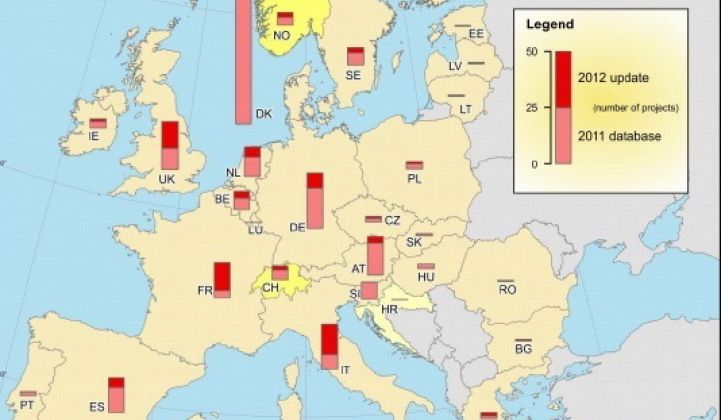

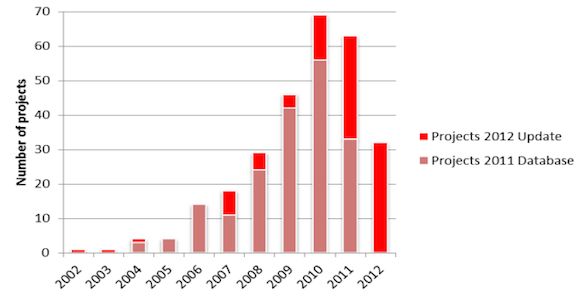

- Europe’s smart grid investments are on a growth path. The JRC’s first smart grid report, published in July 2011, included 219 smart grid and smart metering projects with an overall investment of more than €500 million ($670 million). The new update, which collected information through September 2012, brought that total to €1.8 billion ($2.4 billion) in collective investment, with about 80 percent of the projects starting between 2010 and 2012, as the following chart indicates.

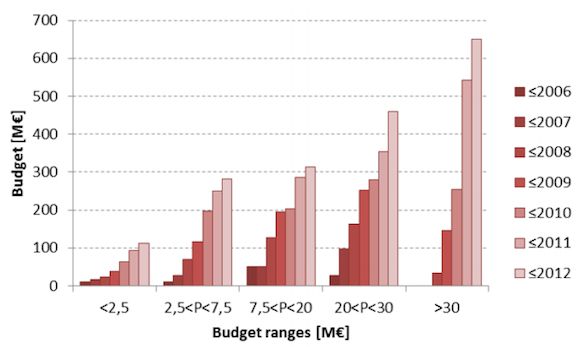

Beyond the sheer growth in number of projects, project scale and budgets have also been rising. The share of projects with budgets of over €20 million grew from 27 percent in 2006 to 61 percent in 2012.

It’s important to note that this tally does not include smart meter rollouts that aren’t connected to any broader smart grid goals -- those projects, which already amount to an estimated €5 billion ($6.7 billion) invested to date, are tracked separately (see more on that below). Nor does it include conventional grid-strengthening projects such as transmission lines, substations and power plant projects that use conventional designs.

- Public-sector funding is still critical. Much as U.S. smart grid projects have been driven by government grants and other support, Europe’s smart grid projects are largely reliant on public funding. About 55 percent of the total budget for the smart grid projects surveyed comes from non-private funding sources -- 42 percent from national or European Commission funding, and 13 percent from regulatory structures such as the U.K.’s Low Carbon Network Fund. And 87 percent of projects, accounting for 94 percent of the total investment, have gotten some sort of funding, indicating just how important that backing is to stimulate private investment.

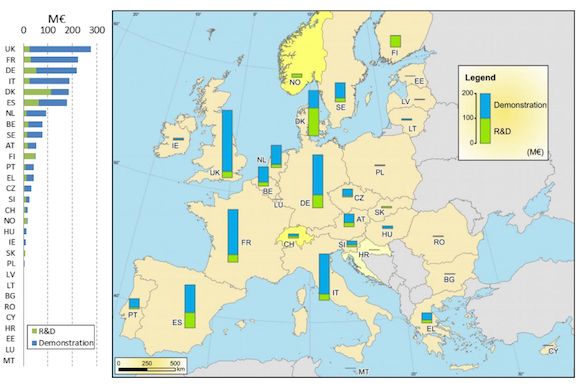

- Western Europe leads, Eastern Europe lags. Not surprisingly, the richest European countries also make up the leading smart grid investors, with the U.K., Italy, Germany and France topping the list on a total investment basis, while Eastern European countries (the EU12) are lagging behind significantly.

On a per-capita basis, Denmark leads the investment race, and also hosts the most research and development work, much of it aimed at integrating its leading share of wind power into its electricity grid.

- Smart metering is still king. While the JRC’s report treats standalone smart meter projects as separate from its count of smart grid projects, it does conclude that the EU directive to member states to have 80 percent of their meters replaced with “smart” devices by 2020 will drive major growth in that sector. Already, Europe has invested at least €5 billion in smart meters, including €2.1 billion ($2.8 billion) for Italy’s rollout of 36 million smart meters from 2001 to 2008; €1.5 billion ($2 billion) for Sweden’s 5.2-million-smart-meter deployment from 2003 to 2009; and €600 million to €900 million ($800 million to $1.07 billion) for Finland’s 5.1-million-meter rollout expected to be complete this year.

Beyond that, we’ve got promises from the U.K. to install 56 million smart meters by 2019, from France to install 35 million meters by 2017, and from Spain to install 28 million meters by 2018. Adding commitments made by other EU member nations, the report projects smart metering investments will reach at least €30 billion ($40.2 billion) by 2020, with 170 million to 180 million smart meters installed.

- Integrating and managing renewable energy at large and small scale is a European specialty. Amongst the smart grid projects that JRC tallied, “Projects focusing on distributed ICT architectures for coordinating distributed resources and providing demand and supply flexibility are probably in the majority,” it found. That’s not surprising, given that Europe is leading the world in bringing wind and solar power on-line.

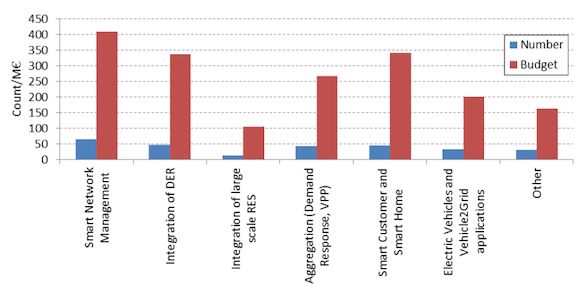

That focus applies both the distributed energy resources (DER) and large-scale renewable energy sources (RES), as well as the systems needed to aggregate them at the grid scale, via demand response and virtual power plant (VPP) technologies, and at the consumer scale in terms of “smart customer” and “smart home” applications, as shown in the following chart.

Technically speaking, the past five years have seen a lot of work done to take these technologies from the laboratory to real-world demonstration. “Recently, a few large-scale demonstrators have been launched to test VPP coordination with market signals and grid constraints,” the report finds.

These range from working projects, such as the VPP created by utility RWE and Siemens, now actively trading electricity on the German grid, to those just now getting underway, such as the partnership between ABB/Ventyx and utility E.ON aimed at integrating transmission-scale systems with distributed resources in Sweden.

Other projects of note include Germany’s eTelligence project, which linked about 650 homes and a long list of distributed energy resources via demand response and variable power pricing, or Denmark’s Cell Controller project, which laid out a system for using grid technology to control variable and unpredictable wind power.

“Project results show that technical solutions for the integration of DERs are becoming quite consolidated,” the report found. “However, project results also show clearly that the integration of DERs requires much more than just technical solutions,” with key regulatory and economic barriers to be overcome at the edges of the smart grid.